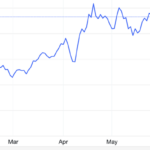

With a lack of short-term supportive factors and seasonal trading lethargy, many analysts believe gold prices could hover below the $3,300 per ounce mark this week, despite positive long-term prospects.

At 8 a.m. Vietnam time, the spot gold price in the Asian market fell by $9 per ounce compared to the previous week’s close in New York, equivalent to a decrease of nearly 0.3%, trading at $3,265.8 per ounce, according to data from the Kitco exchange. Converted at Vietcombank’s selling rate, this price is equivalent to about VND 103.4 million per tael, a decrease of VND 200,000 per tael from the previous week.

At the same time, Vietcombank quoted the USD at VND 25,880 (buying) and VND 26,270 (selling).

Gold prices fell by 2.8% last week, marking the second consecutive weekly decline. The downward pressure on gold came from the easing of geopolitical tensions in the Middle East due to the Israel-Iran ceasefire agreement and some positive news on trade negotiations between the US and its major partners, especially China.

So far, the ceasefire agreement between Israel and Iran has held despite being described as fragile. Last week, US officials announced that they had finalized a framework trade agreement with China and were close to reaching deals with dozens of other countries, as the deadline of July 8 – the last day of the 90-day tariff truce – looms.

The weakening US dollar did not seem to provide much support for gold prices. For the week, the Dollar Index fell by nearly 1.5%, bringing the year-to-date decline to over 10%.

This morning, the US dollar continued its downward trend. At 8 a.m. Vietnam time, the Dollar Index fell by more than 0.1%, trading below 97.3 points, according to data from MarketWatch.

The global gold market is entering a traditionally quiet trading period during the summer months. This period usually begins with the US Independence Day holiday on July 4th.

In a conversation with Kitco News, independent precious metals analyst Jesse Colombo predicted that gold prices could decline this week as traders go on holiday and no short-term catalysts appear evident. He also noted that gold prices are likely to be range-bound between $3,200 and $3,500 per ounce during the summer months.

Echoing this sentiment, Lukman Otunuga, a senior market analyst at FXTM, stated that the risk-on sentiment among investors is putting downward pressure on gold prices.

“With the US and China finalizing a trade framework and Israel-Iran honoring the ceasefire, investors are flocking back into risk assets, leaving safe-haven assets like gold at a disadvantage. Such an improvement in market sentiment may not bode well for gold prices,” he told Kitco News.

According to this expert, a weekly close below the $3,300 per ounce level could lead to a further decline towards the $3,250 per ounce level and possibly the psychological level of $3,200 per ounce. Conversely, “if prices reclaim $3,300 per ounce, this could trigger a recovery towards $3,330 and $3,360 per ounce,” he said.

However, Mr. Colombo argued that gold prices are supported by several long-term factors. He opined that, in addition to safe-haven demand amid global geopolitical uncertainties, the unsustainable growth in public debt and the resurgence in global M2 money supply growth would provide solid support for gold prices throughout the summer.

“We may see gold face further selling pressure, but I am not worried about this correction,” he said.

Naeem Aslam, chief investment officer at Zaye Capital Markets, shared his optimism about gold prices based on the expectation of a continued weak US dollar.

“Most investors expect the US dollar to continue weakening and anticipate that the Federal Reserve will have to cut interest rates. Therefore, any dip in gold prices is seen as a buying opportunity. However, the return of risk appetite could limit gold’s upside potential, especially if geopolitical tensions do not escalate,” Mr. Aslam told Kitco News.

Gold Prices Stall, SPDR Gold Trust Maintains Outflow

The recent inability of gold prices to rally amidst escalating geopolitical tensions in the Middle East is indicative of a precious metal that has run out of steam in the short term.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)