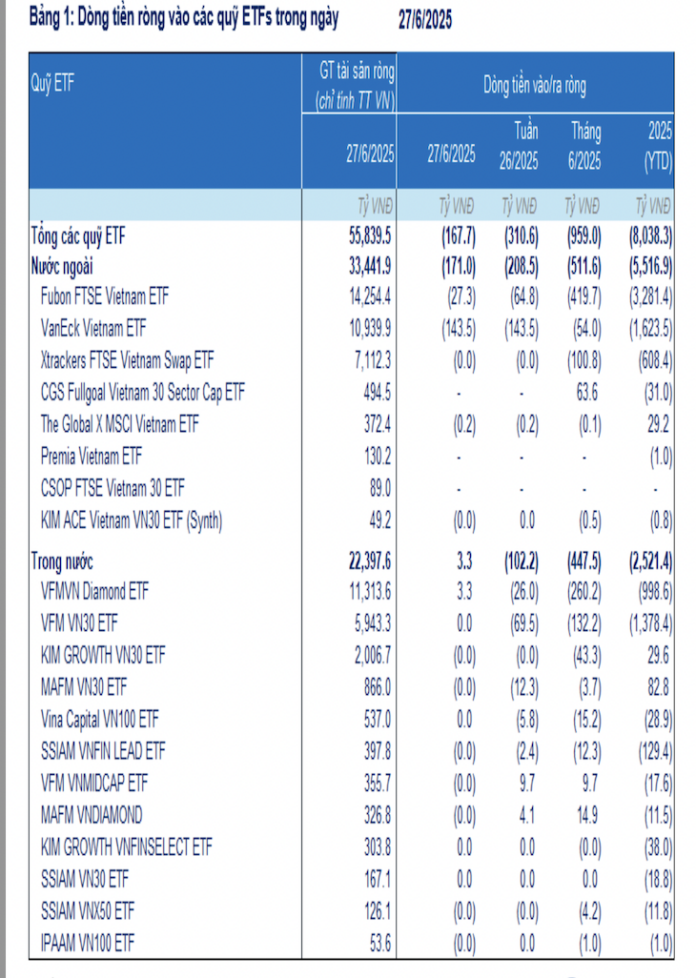

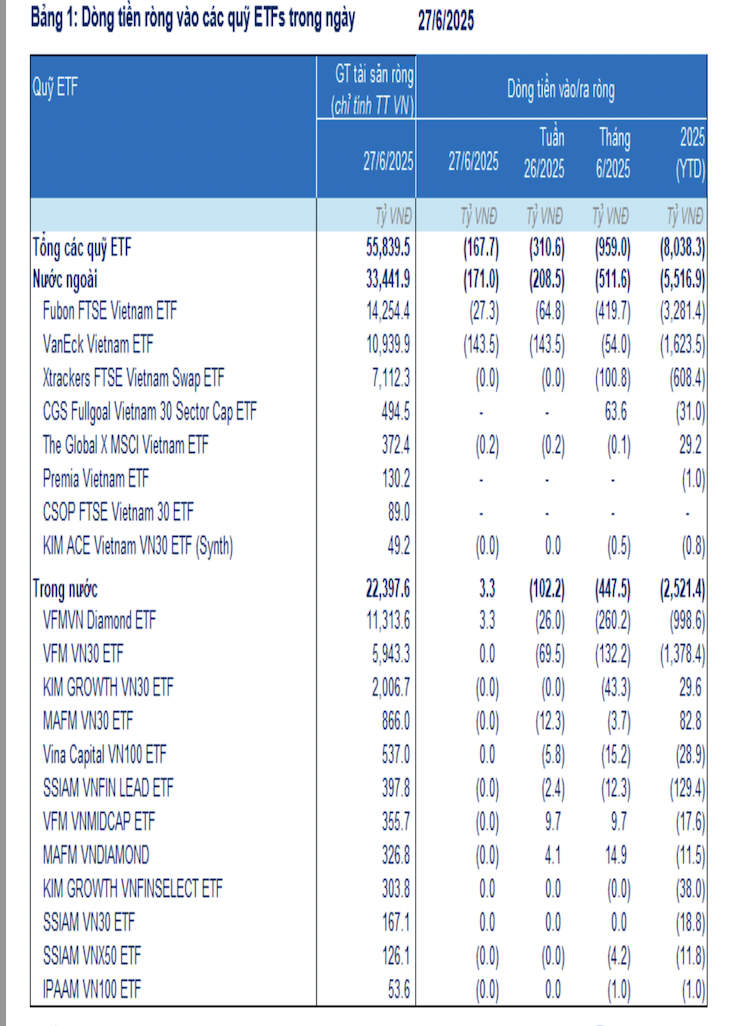

For the week of June 23-27, 2025, ETFs investing in the Vietnamese stock market experienced net outflows of over VND 360 billion, a 55% increase compared to the previous week.

Out of the 20 funds, 11 witnessed outflows, predominantly from the foreign VanEck Vietnam ETF. Foreign ETFs saw net outflows of more than VND 208 billion, with VanEck Vietnam ETF accounting for VND 143 billion. Similarly, the Fubon FTSE Vietnam ETF faced outflows of nearly VND 65 billion. There were no significant changes in cash flow for the remaining domestic ETFs.

Domestic ETFs, on the other hand, recorded outflows of over VND 102 billion, mainly from the VFM VN30 ETF (VND 69.5 billion). Additionally, the VFM VNDiamond ETF experienced outflows of VND 26 billion.

Thai investors sold a net of 1.4 million certificates of deposit (DRs) in the VFM VNDiamond ETF (FUEVFVND01), amounting to VND 45.4 billion. They also sold 1.9 million DRs in the VFM VN30 ETF (FUEVFVND01), equivalent to VND 482 billion.

In the previous week, Thai investors had sold 1.1 million DRs in the VFM VNDiamond ETF (FUEVFVND01), totaling VND 37.2 billion. They also sold 800,000 DRs in the VFM VN30 ETF (FUEVFVND01), valued at nearly VND 199 billion.

By the end of June 2025, ETFs had experienced net outflows of VND 959 billion for the month, bringing the total net outflows since the beginning of 2025 to over VND 8 trillion, a decrease compared to 2024’s figure of VND 21.8 trillion.

As of June 27, 2025, the total net asset value of ETFs (considering only allocations to the Vietnamese market) stood at nearly VND 55.8 trillion, a 2.6% decline from the end of 2024. The top stocks sold by ETFs during June 23-27 were VIC, TCB, VHM, ACB, FPT, and VCB.

On June 30, 2025, the Fubon FTSE Vietnam ETF faced additional net outflows of over VND 33 billion, bringing the year-to-date net outflows to more than VND 3.3 trillion. The fund continued to sell stocks, totaling over VND 28 billion. The top sold stocks were HPG (-115,000 shares, -VND 3.6 billion), SSI (-59,000 shares, -VND 1.5 billion), SHB (-53,000 shares, -VND 700 million), VHM (-47,000 shares, -VND 3.6 billion), and VIC (-42,000 shares, -VND 4 billion).

Meanwhile, the VFM VNDiamond ETF experienced outflows of over VND 16 billion, while the VFM VN30 ETF saw no significant changes in cash flow.

Investing in a Metal That Outshines Gold

“A Precious Metal Outshines Gold: Unveiling the Rise of the New Reserve Asset.

The world of finance is witnessing an intriguing shift as a particular precious metal emerges, outperforming gold in the realm of exchange-traded funds (ETFs). This unexpected trend has caught the attention of investors and market enthusiasts alike, sparking curiosity about the driving forces behind this newfound hoarding phenomenon.

[Continue reading the article to uncover the fascinating insights and uncover the identity of this rising star in the world of investment assets].”

Is the VN-Index at Risk as Political Tensions Rise and Trade Negotiations Near an End?

With strong performance improvements over the past week and month, and indications of divergence in the Vn-Index, a short-term correction could bring the VN-Index back to the support region of 1300 – 1308 points. In a scenario of unfavorable tariff adjustments or heightened Middle East tensions, the market’s support region could lie between 1270 and 1280 points.