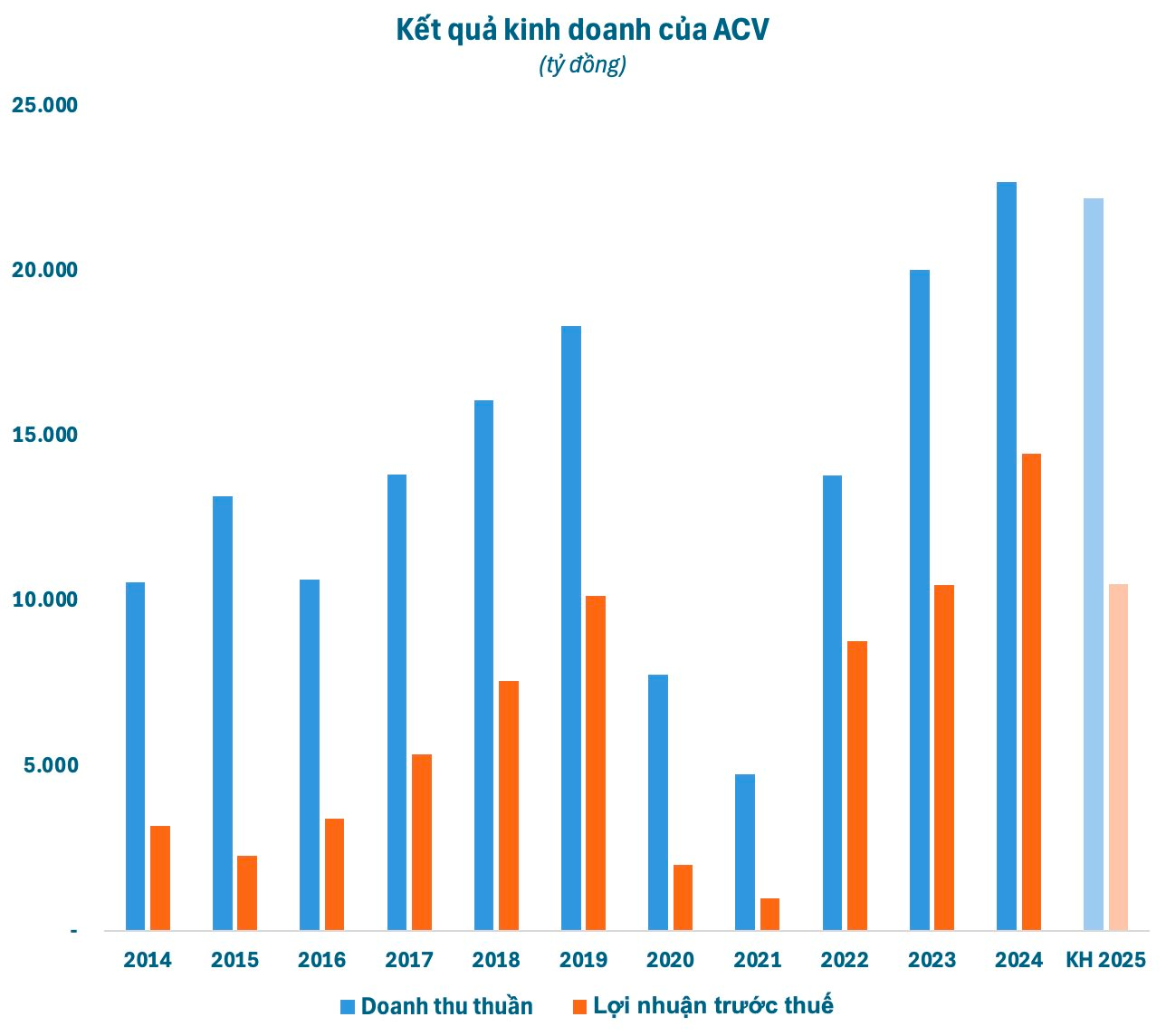

Vietcap has released an updated report on the 2025 Annual General Meeting of the Vietnam Airports Corporation (ACV). According to the report, the preliminary business results for the first six months of 2025 (excluding take-off and landing fees) are estimated to reach VND 11,700 billion in revenue, a 19% increase compared to the same period in 2024.

The six-month pre-tax profit is estimated at VND 5,900 billion, a 14% decrease compared to the same period last year. In Q2 alone, ACV’s pre-tax profit is estimated at VND 2,600 billion, a 29% decrease year-on-year.

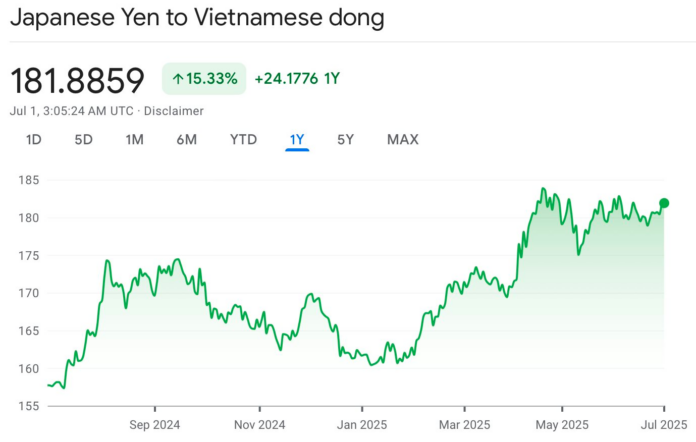

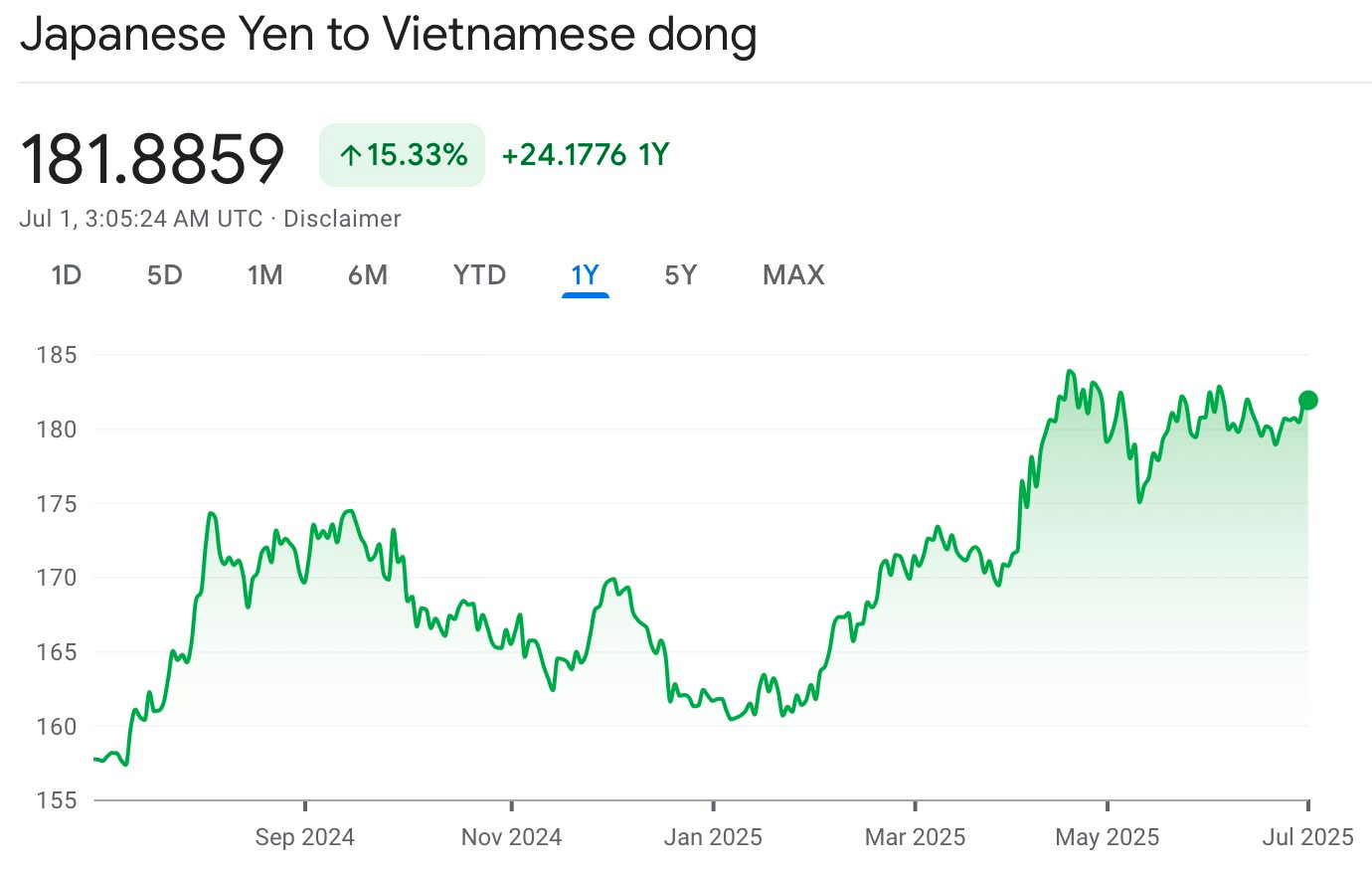

According to Vietcap, the weaker six-month pre-tax profit compared to 2024 is mainly due to a foreign exchange loss of VND 1,000 billion (compared to a pure foreign exchange gain of VND 524 billion in the same period in 2024). Since the beginning of 2025, the JPY/VND exchange rate has increased by about 13% and is currently at a three-year high.

Regarding the 2025 plan, ACV assumes a 20% increase in JPY/VND, resulting in a foreign exchange loss of VND 1,700 billion for the year (compared to a pure foreign exchange gain of VND 391 billion in 2024). While the core business remains in line with forecasts, Vietcap believes that the high foreign exchange loss warrants further detailed evaluation.

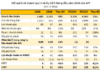

For 2025, ACV has planned a business revenue of VND 22,200 billion (including financial and other income), with a core revenue (excluding take-off and landing revenue) of VND 21,600 billion, representing a 2% and 8.6% increase, respectively, compared to the previous year. Pre-tax profit (excluding take-off and landing fees) is expected to reach VND 10,500 billion, a 17% decrease compared to 2024.

In 2025, the expected passenger volume is 119 million, an 8% increase compared to 2024, with international passengers reaching 45 million, a 9% increase year-on-year, and domestic passengers reaching 74 million, a 7% increase compared to 2024.

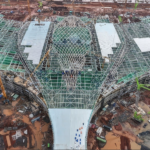

Additionally, ACV provided updates on several key projects. The Long Thanh International Airport Phase 1 is expected to commence commercial operations in the first half of 2026. The construction of the expanded Noi Bai T2 Terminal is on schedule, with operations planned to begin in 2026.

Regarding runway asset management, Decision 2007/QD-TTg assigns ACV to manage, use, and exploit aviation infrastructure assets invested by the State in the 2021-2025 period. This decision is expected to be extended until the end of 2026, according to the management. ACV has completed the asset inspection and classification and plans to submit proposals to relevant agencies regarding the use of runway assets to increase state capital in ACV, aiming to finalize the process by the end of 2026.

On the transfer of aviation security to the Ministry of Public Security, While the security segment accounted for 7% of revenue in 2024, these items represented 20% of operating expenses. Therefore, the transfer to the Ministry of Public Security will not impact ACV’s overall operational efficiency, according to the management. ACV and the Ministry of Public Security are coordinating to develop a suitable transition plan.

Concerning bad debt, post-pandemic receivables are now automatically collected through daily banking transactions, preventing new bad debt. The majority of the outstanding receivables were generated during the COVID-19 pandemic. ACV notes that airlines such as HVN and VJC are planning to repay their debts, aiming to resolve them by 2025.

On profit distribution, ACV will pay a 65% stock dividend from retained earnings for the 2019-2023 period, with the distribution expected to be completed in the second half of 2025. As a result, ACV’s charter capital will increase by 65% from VND 21,800 billion to VND 35,800 billion. Additionally, ACV is awaiting feedback from state agencies on the 2024 profit distribution plan and will seek approval from shareholders in writing or at an extraordinary general meeting.

“Stocks This Week: VN-Index Surges Past 1,370 Points, a Stealth Stock Peaks 14 Times This Year”

The stock market is on fire with the VN-Index surging past 1,370 points. Amid this frenzy, a stealthy stock has quietly soared to new heights, recording a staggering 14 peak visits since the year’s turn, with its share price now flirting with the 170,000 VND mark. As foreign investors offload hundreds of billions in the week of June 23-27, what’s the underlying story here? And why is Vietcap’s CEO splashing billions on VCI stock?

Unlocking the Appeal of The Global City: 6 Golden Factors for Long-Term Growth Potential

The East of Ho Chi Minh City is asserting its position as the new economic and financial center, with “The Global City” redefining living and investment standards. Developed by the prestigious international real estate developer, Masterise Homes, this urban area is attracting long-term investment with its six core fundamentals.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)