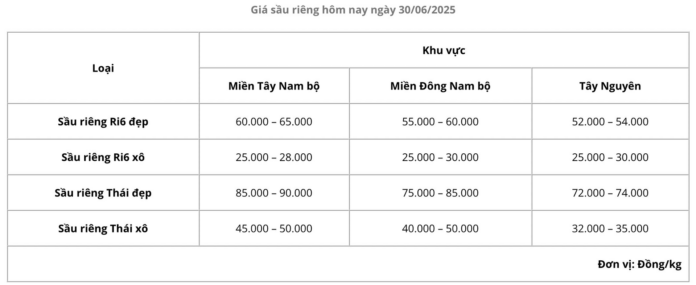

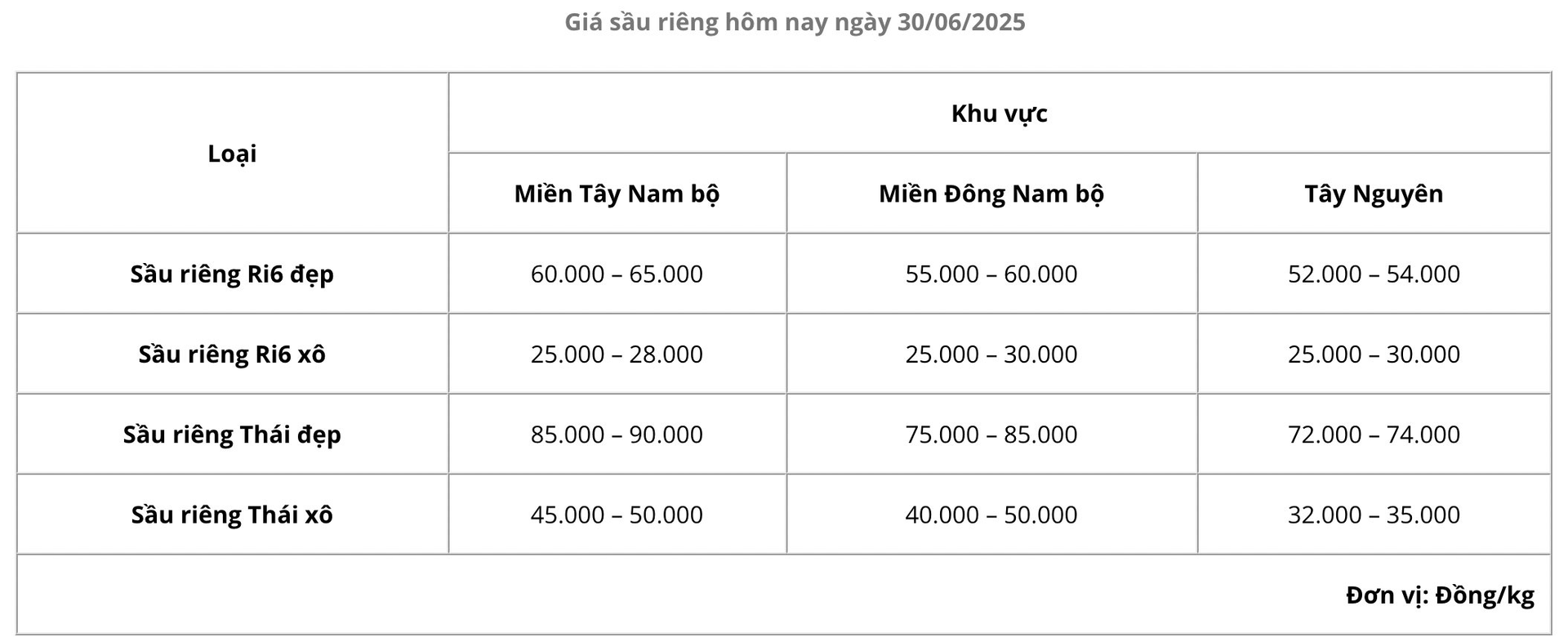

Latest statistics as of June 30, 2025, in the Southeast region of Vietnam, show that the export price of Ri 6 durians has dropped to a worrying low. The price for export-quality Ri 6 is approximately VND 42,000/kg, while the lower-grade B variety is even lower at only VND 27,000/kg. In comparison, the popular Monthong variety is priced at VND 75,000/kg for grade A and VND 55,000/kg for grade B, a significant decrease from the VND 83,000-91,000/kg range in late May 2025.

Compared to the same period last year, the price of Monthong has dropped by VND 8,000/kg, while Ri 6 has seen an even more drastic reduction of VND 16,000/kg. This downward trend has understandably caused anxiety among farmers as their income diminishes.

There are several key factors contributing to this situation, the most notable being China’s stricter quality control policies.

Frequent Rainfall Predicts Further Decrease in Durian Prices

China, being the largest consumer of durians globally and specifically for Vietnamese exports, has implemented more rigorous inspections since the beginning of 2025, particularly regarding heavy metals such as cadmium and yellow substance O, which pose potential health risks.

Vietnamese durians also face stiff competition from other countries, namely Thailand and Malaysia, which are currently in their main harvest season. These countries boast larger production volumes (Thailand produces double the amount of Vietnam) and offer more consistent quality, especially with the popular Monthong variety, giving them a competitive edge in the Chinese market.

Additionally, Malaysia has recently been permitted to export fresh durians to China, further intensifying the competition faced by Vietnamese durians. With over 80% of Vietnam’s durian exports destined for the Chinese market, the increased international supply has exerted downward pressure on prices.

Another concerning factor is the weather. According to experts, Vietnamese agricultural products are struggling to find alternative export markets due to their failure to meet export standards, mainly because the early arrival of the rainy season has resulted in unripe fruits that do not meet the desired level of maturity. Many experts predict that prices are likely to continue falling in the coming months.

With the price of Ri 6 durians plunging to a record low of approximately VND 25,000/kg, farmers are facing significant financial challenges.

This situation brings to mind the bold statement made by Mr. Doan Nguyen Duc, Chairman of Hoang Anh Gia Lai (HAGL), at the 2023 Annual General Meeting.

Mr. Duc confidently asserted, “Even if we sell durians at VND 20,000/kg, we will still make a profit.” He justified this claim by explaining that the production cost of durians is exceptionally low, ranging from only VND 5,000 to VND 10,000 per kilogram, depending on the scale of the operation.

In 2023, HAGL first unveiled its ambitious plans for durian cultivation, and that same year, Vietnamese durians gained official access to the massive Chinese market. As a result, 2023 marked a pivotal year, with durians becoming Vietnam’s latest billion-dollar agricultural export.

At that time, HAGL already had 1,000 hectares of durian plantations, which had been planted between five and six years prior. 2024 marked the first year of HAGL’s durian harvest.

Today, HAGL boasts an impressive 2,000 hectares of durian plantations, with 300 hectares in Vietnam and a substantial 1,700 hectares in Laos. Approximately 600 hectares of these plantations will be ready for harvest in 2025, and an impressive 80% of the total area will be productive from 2026 onwards.

Image: HAGL owns the largest durian plantation in Southeast Asia, spanning 2,000 hectares.

Mr. Duc’s optimism and success with durians have inspired other prominent companies listed on the stock exchange to venture into durian cultivation.

Large Listed Companies Venture into Durian Cultivation

One notable example is the Dak Lak Rubber Investment Joint Stock Company (DRI) , which, according to its Q4 2023 report, has officially started generating revenue from durian sales.

Specifically, DRI recorded VND 2 billion in revenue from durian sales during this period, in addition to its primary product, rubber. The cost of goods sold for durians was just over VND 365 million, indicating an impressive profit margin of nearly five times the production cost.

While Dak Lak Rubber Investment Joint Stock Company primarily focuses on rubber, they began diversifying their crops in 2018 by adding bananas, cashews, and durians. The company started recognizing revenue from bananas in 2021 and durians in late 2023.

Another company following suit is Hoang Anh Gia Lai Agricultural Joint Stock Company (HAGL Agrico) , which has announced plans to invest in fruit tree cultivation, including durians, with an expected annual output of approximately 9,500 tons of durians.

Despite price fluctuations, durians remain in high demand, especially in the Chinese market. Mr. Nguyen Van Muoi, Vice Secretary-General of the Vietnam Fruit and Vegetable Association, affirms that China’s appetite for durians remains robust.

Mr. Duc shares this optimism, believing that the market for durians is vast, particularly in China, and that other markets are also opening up. Statistics suggest that only about 10% of Chinese consumers currently eat durians due to their high price, so a decrease in price could lead to increased consumption.

Mr. Duc is confident that durians will always find buyers, even if prices fluctuate. He points out that China cannot cultivate durians due to their unique climate requirements, and even areas west of the Hai Van Pass in Vietnam are unsuitable for durian cultivation, naturally limiting the supply.

In his latest move, Mr. Duc is actively recruiting 100 durian technicians, offering a referral bonus of VND 700,000 with no limit on referrals, demonstrating his continued commitment to this lucrative crop.

Tiền Giang: Durian Shortage Leads to Price Drop

Currently, the durian orchards in Tien Giang province are entering the harvest season. The main crop harvest this time, however, is not a joyous occasion for the gardeners as both productivity and prices have fallen sharply.