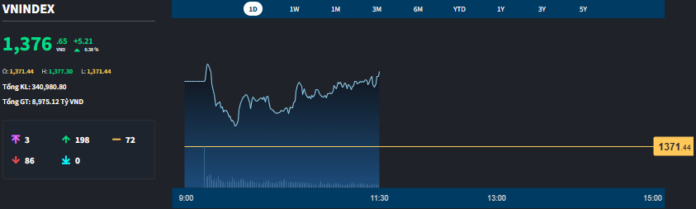

The optimistic market sentiment continues to bolster a slow but steady upward trend in the market, despite lackluster performances from large-cap stocks. Mid-cap and small-cap stocks shone, with the latter group witnessing notable price advancements. The VN-Index closed the morning session with a 0.38% gain (+5.21 points), while the VN30-Index rose by 0.37%. It was a rare occasion where mid-cap stocks provided prominent support to the index. Specifically, out of the top 10 stocks contributing the most to the VN-Index, three were non-VN30 stocks: DGC, up 3.24%; GMD, up 4.51%; and GEE, up 2.94%.

Even within the VN30 basket, mid-cap stocks outperformed their large-cap counterparts. TCB led the gains with a 1.62% increase, followed by FPT, which rose by 1.45%. These were the only two large-cap stocks that made significant moves. Additionally, VJC climbed by 1.49%, SSI by 1.22%, and BVH by 2.3%, rounding up the top performers in the basket. Out of the 25 stocks in the VN30, 18 advanced while 7 declined, but the gains were relatively modest. FPT and TCB contributed more than half of the basket’s 5.48-point increase.

Although the blue-chip stocks didn’t fuel explosive index gains, their role remained crucial. The VN-Index’s fluctuations were relatively narrow, and the upward trend prevailed. This favorable environment benefited the mid-cap and small-cap stocks. VHM, CTG, and GAS were the three worst-performing blue chips, falling by 0.78%, 0.82%, and 0.74%, respectively, but their impact on the overall market was limited. Conversely, FPT, SSI, MSN, and TCB boasted healthy trading volumes, ensuring that the VN30 basket accounted for over 60% of the total trading value on the HoSE in the morning session.

The mid-cap and small-cap groups also witnessed impressive trading activities, with some stocks matching the blue chips in liquidity while surpassing them in price performance. Out of the 24 stocks on the HoSE that recorded trading values above 100 billion VND, 10 belonged to the VN30. Notable performers outside the VN30 included DBC, which rose by 6.09% with a trading value of 480.5 billion VND; DGC, up 3.24% with 203.4 billion VND; GMD, climbing 4.51% with 201.7 billion VND; NLG, advancing 5.12% with 158 billion VND; NVL, up 2.33% with 148.3 billion VND; and CMG, surging 6.91% with 137.9 billion VND…

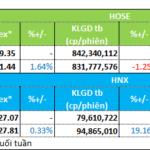

The mid-cap basket contributed two stocks that hit the daily trading limit, CMG and ANV, and 30 out of the 95 stocks that rose over 1% on the HoSE. The overall breadth on the exchange remained positive, with 198 gainers and 86 losers, despite modest trading activity. The trading value on the HoSE increased by just 9.4% compared to the previous Friday morning session. However, the 95 stocks with the highest gains accounted for 51.7% of the total trading value, indicating effective support and buying pressure in the market.

On the downside, the stocks with the largest losses witnessed meager trading volumes. Out of the 35 stocks that declined by more than 1%, only DGW and DXS had notable trading values, with DGW falling 3.35% with a trading value of 96.1 billion VND and DXS dropping 1.23% with a value of 17.5 billion VND. A few other stocks traded around the billion-VND mark, including NAF, SHI, KOS, CRC, BDB, LGL, TTF, and DRH.

Foreign investors significantly reduced their selling activities in the morning session, with net selling on the HoSE amounting to approximately 870 billion VND, the lowest in the last ten morning sessions. On the buying side, net buying reached its highest level in ten sessions at 1,072 billion VND, resulting in a net purchase of 202 billion VND. While this net buying figure is not extraordinary, it marks a positive shift after eight consecutive morning sessions of net selling. The best-bought stocks were NLG (+92.3 billion VND), DBC (+78.3 billion VND), MSN (+69.5 billion VND), VIX (+24.9 billion VND), and GEX (+21.3 billion VND). On the other hand, the most sold stocks were HPG (-47.9 billion VND), CTG (-29.1 billion VND), KDH (-27.5 billion VND), HDG (-22.8 billion VND), DGC (-22.4 billion VND), and VNM (-22.3 billion VND).

Industrial Real Estate and Stocks: Where the Money Flows

The stock market witnessed improved liquidity during the trading week of June 23-27. Industrial real estate stocks and securities were the focal point for cash flow, attracting the attention of investors.

Market Beat: Foreigners Turn Net Buyers, VN-Index Hits 2-Year High

The trading session concluded with the VN-Index climbing 4.63 points (+0.34%), reaching 1,376.07. Meanwhile, the HNX-Index witnessed a rise of 1.41 points (+0.62%), closing at 229.22. The market breadth tilted towards the bulls, as advancers outnumbered decliners by a margin of 469 to 269. Similarly, the VN30 basket echoed this bullish sentiment, displaying 16 gainers, 10 losers, and 4 unchanged stocks.

Vietstock Daily: Liquidity Recovery Anticipated

The VN-Index sustains its upward momentum, closely hugging the upper band of the Bollinger Bands. The MACD indicator continues to widen the gap with the signal line, providing a bullish signal and indicating sustained positive short-term sentiment. However, a caveat lies in the trading volume, which has not yet surpassed the 20-session average, reflecting investors’ lingering caution. If this trend persists in upcoming sessions, the risk of a corrective shake-up warrants attention.

The Surprising Dividend of The Mobile World

For the first time in 2 years, Mobile World Investment Corporation has increased its cash dividend ratio from 5% to 10%, and is expected to pay out nearly VND 1,480 billion to shareholders in this round.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)