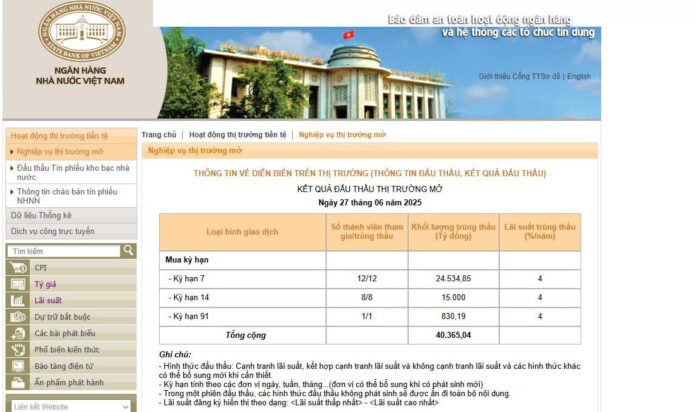

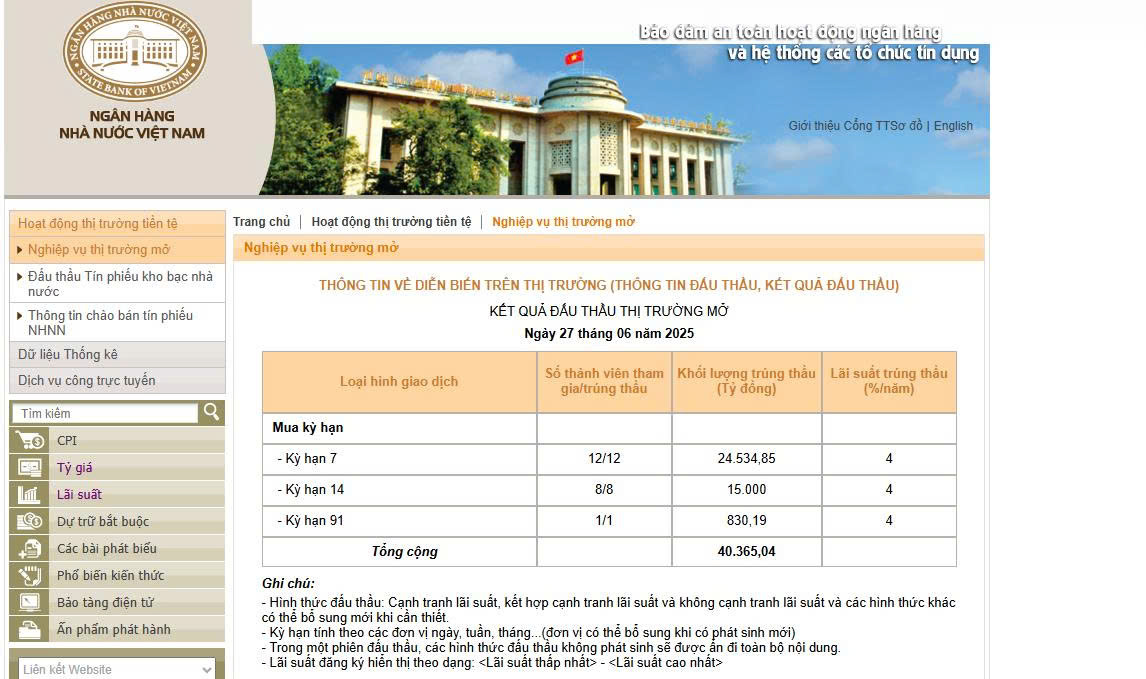

The trading session on June 27 witnessed notable developments in the open market as the State Bank of Vietnam (SBV) successfully auctioned over VND 40,365 billion on the collateralized lending channel (OMO). Accordingly, 12 market members “borrowed” VND 24,535 billion from the SBV at a term of 7 days, 8 members borrowed VND 15,000 billion at a term of 14 days, and 1 member borrowed over VND 830 billion at a term of 91 days. The auction interest rate was 4%/year.

Meanwhile, nearly VND 323 billion in OMO matured. Overall, the SBV net injected more than VND 40,042 billion into the banking system through the OMO channel in the June 27 session – the highest level in over a year.

In parallel with open market operations through the collateralized lending channel, the SBV also halted the issuance of bills on June 27. Prior to this, the SBV had resumed bill auctions after nearly 4 months of suspension since the June 24 session and withdrew a total of VND 22,500 billion in 3 sessions (June 24-26).

In total, during the past week (June 23-27), the SBV lent market members nearly VND 70,191 billion at an interest rate of 4% on the collateralized lending channel. Meanwhile, the volume of OMO maturities was VND 7,833 billion.

On the bill channel, the regulator issued VND 22,500 billion in bills during the week of June 23-27 and did not record any bill maturities, resulting in a net withdrawal of VND 22,500 billion through this channel.

Thus, the SBV net injected VND 39,858 billion in the past week.

These moves by the SBV were made against the backdrop of typically rising liquidity needs in the system towards the end of each quarter. And with the winning contracts mostly at terms of 7-14 days, the money injected by the SBV into banks through the OMO channel will be withdrawn again in the first half of July.

Previously, the SBV had consistently been in a net withdrawal status in April and May as the system’s liquidity was abundant and interbank rates fell sharply. The overnight lending rate dropped to the lowest level since March 2024, causing the overnight VND-USD interest rate spread to narrow to a level similar to that of September 2024 and putting pressure on the exchange rate.

After the SBV resumed bill issuance, the overnight lending rate gradually recovered to 4.37%/year as of the June 26 session.

The Fed’s Rate Hike Outlook: What to Expect in the Final Months of 2024

The interbank interest rates, as experts suggest, have a profound impact on the liquidity of the system and play a pivotal role in determining the rise or fall of deposit rates in the retail market.