Personal Identification Number to replace Tax Code

According to Clause 7, Article 35 of the Law on Tax Administration No. 38/2019/QH14 and Circular No. 86/2024/TT-BTC, from July 1st, the personal identification number issued under the Law on ID Cards will be used instead of the tax code for Vietnamese individuals.

Not only individuals but also households, business households, and business individuals will use the representative’s identification number to fulfill tax obligations, instead of using tax codes as currently applied.

Each individual has a unique tax code.

From July 1st, the tax authority will not issue separate tax codes for each business location. Business households will use a single identification number to fulfill all tax obligations at their operating locations.

Invoices and documents issued under the old tax codes remain valid and do not need to be amended. People can look up information on the tax authority’s electronic information portal, phone apps, or contact the local tax office directly.

No bank transfer, no VAT deduction

The Value Added Tax Law No. 48/2024/QH15 has several notable changes: removing VAT exemption for fertilizers, agricultural equipment, offshore fishing vessels, and certain securities services; adding VAT exemption for disaster and epidemic prevention aid; adjusting import tax calculation; changing conditions for additional VAT declaration; and requiring all transactions from July 1st, 2025, to be cashless for VAT deduction.

Some goods and services have changed tax rates, such as fertilizers moving from tax exemption to 5%, and unprocessed forest products increasing from 5% to 10%. There is also a VAT refund for entities that only supply 5% VAT-rated goods and services if they have not deducted enough after 300 million VND within 12 months. The VAT threshold for households and business individuals will increase to 200 million VND from 2026.

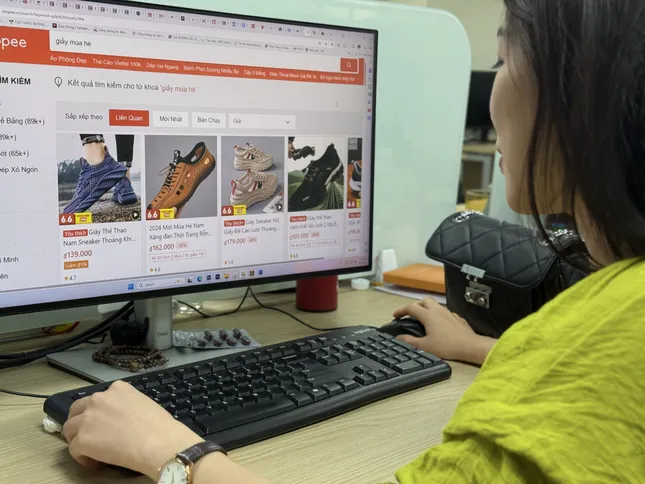

E-commerce platforms to declare and pay tax on behalf of sellers

VAT and PIT are deducted and paid immediately upon successful transaction confirmation and payment acceptance.

According to Decree No. 117/2025/ND-CP, which takes effect on July 1st, e-commerce platform management organizations, both domestic and foreign, are responsible for VAT and Personal Income Tax (PIT) deduction and payment on behalf of sellers for each transaction generating revenue in Vietnam. This includes PIT for transactions by resident individuals inside and outside the country and non-resident individuals inside the country.

Households and business individuals who have had their VAT and PIT deducted, declared, and paid by e-commerce platform management organizations do not need to declare and pay these taxes again.

VAT and PIT are deducted and paid immediately upon successful transaction confirmation and payment acceptance. That is, when revenue is generated, platforms with payment functions must deduct and pay taxes on behalf of households and business individuals.

Business individuals operating on platforms without payment functions must declare and pay taxes themselves.

Continued reduction of VAT rates until the end of 2026

The National Assembly has resolved to reduce the VAT rate by 2% for goods and services currently subject to a 10% rate. This reduction will be effective from July 1st, 2025, until December 31st, 2026.

Goods and services that are not subject to this reduction include telecommunications, financial activities, banking, securities, insurance, real estate business, metal products, mining products (except coal), and special consumption tax goods and services (except for gasoline).

Delegation and decentralization in tax management

Under Decree No. 122/2025/ND-CP, which takes effect on July 1st, the Government assigns the Ministry of Finance to perform state management tasks related to tax administration, including guiding taxpayers on not submitting documents in tax declaration and payment dossiers, tax refund dossiers, and other tax dossiers that state management agencies already possess, based on practical situations and information technology application conditions.

The Ministry of Finance will also guide the contents of tax declarations, types of taxes declared monthly, quarterly, annually, or per occurrence, and tax finalization. In addition, they will provide guidance on the deadline for submitting tax declaration dossiers for land use tax, non-agricultural land use tax, land use fees, land and water surface rent, mineral exploitation rights, water resource exploitation rights, and registration fees.

“Securities Firms Hike Fees Starting Tomorrow”

As June draws to a close, the VN-Index soars to new heights, reaching a remarkable 1,376 points in today’s session. The market is painted in a sea of green, particularly for mid-cap and small-cap stocks. A new chapter begins tomorrow, July 1st, as multiple brokerage firms are set to increase their service charges.

The Rising Cost of Comfort Food: “Bread and Pho on the Price Hike: An Extra 2,000 to 5,000 Dong”

“With operating costs on the rise, many businesses are facing a challenging dilemma. The decision to increase prices is a delicate one, as it can impact customer loyalty and brand perception. However, with careful consideration and strategic planning, it is possible to navigate this tricky situation. This article will explore the reasons behind the price hikes and provide insights into how businesses can mitigate the impact on their customers while maintaining a sustainable operation.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)