Novaland’s (NVL) annual general meeting on April 24, 2025, approved the cancellation of its plan to issue a maximum of 1.17 billion shares to existing shareholders.

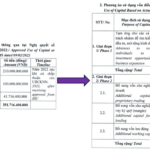

The meeting also agreed to replace the plan to issue a maximum of 200 million shares privately with a new plan to issue a maximum of 350 million shares to a maximum of 20 professional investors at VND 10,000 per share.

Novaland’s 2025 Annual General Meeting was held on April 24, 2025

In addition to issuing shares to raise capital, Novaland also plans to issue bonus shares to reward shareholders.

Specifically, NVL plans to issue 48.75 million ESOP bonus shares from the surplus capital source and 48.75 million ESOP shares at VND 10,000 per share.

The total issuance volume is over 97.5 million shares, equivalent to 5% of the total circulating shares. The issuance is expected to be carried out in the second and third quarters of 2025, after the State Securities Commission announces the receipt of the full report on the issuance.

Shares issued will be restricted from transfer for one year. Unallocated shares will be issued to other members or employees.

After the issuance, NVL expects to increase its charter capital to VND 20,476 billion. All proceeds from the offering will be used to supplement the Company’s business activities and working capital.

Novaland stated that the purpose of the program is to recognize the contributions of the leaders during the Company’s business operations and, at the same time, to attract and encourage the long-term commitment of the personnel.

Novaland also announced the list of 25 leaders and officers who will receive and purchase shares in this issuance. Among them, General Director Duong Van Bac will receive and purchase the most, with a total of 8.91 million shares.

DIC Corp (DIG) returns to the plan to offer shares to existing shareholders at a ratio of 24.596%, corresponding to an offer of 150 million shares at VND 12,000 per share, mobilizing a maximum of VND 1,800 billion, expected to be implemented from the third quarter of 2025 to the fourth quarter of 2025.

The total amount of money collected from the offering is expected to be used by DIC Corp for the following purposes: payment for the repurchase of DIG12301 bonds in the amount of VND 600 billion, expected to be implemented in the fourth quarter of 2025 to the first quarter of 2026.

Next is to supplement the investment capital for the implementation of the Cap Saint Jacques Complex – Phase 3 (Block C4) project at 169 Thuy Van, Ward 8, Vung Tau city, with an expected allocation of VND 600 billion.

Supplement investment capital for the implementation of the Commercial Residential Area project in Vi Thanh, Vi Thanh city, Hau Giang province, with an expected allocation of VND 600 billion.

The time of capital use for the above two projects will follow the progress of the project (expected from the fourth quarter of 2025 to 2026)

Previously, in the middle of December 2024, DIC Corp announced the offering of 200 million DIG shares to existing shareholders at an offering price of VND 15,000 per share. However, the DIC Corp’s Board of Directors later decided to stop implementing the offering of shares to existing shareholders.

In 2025, Dat Xanh Corporation (DXG, HoSE floor) also chose to increase its charter capital by issuing bonus shares and offering private placement shares.

On June 5, Dat Xanh completed the distribution of 148.03 million bonus shares to 44,003 shareholders. The remaining 9,849 fractional shares will be canceled. The entitlement ratio is 100:17, meaning that for every 100 shares owned, shareholders will receive 17 new shares.

The additionally issued shares are not restricted from transfer, except that existing shareholders holding ESOP 2023 (bonus) shares during the restricted transfer period will still be entitled to receive new shares, but the shares will be restricted from transfer for the same period as the initial ESOP shares.

The issuance capital is VND 1,480.4 billion, including VND 1,200 billion from after-tax profit not yet distributed according to the audited consolidated financial statements for 2024; and over VND 280.4 billion from capital surplus based on the audited separate financial statements for 2024 of the company.

At the end of the issuance, the charter capital of Dat Xanh Group increased from nearly VND 8,726 billion to VND 10,206.3 billion.

This plan to increase charter capital has been approved by Dat Xanh Group’s shareholders at the 2025 Annual General Meeting of Shareholders held on May 9, 2025.

After this issuance, Dat Xanh will continue to implement a plan to increase capital that was approved at the 2024 Annual General Meeting of Shareholders. This involves the private offering of 93.5 million shares to no more than 20 strategic investors. The minimum selling price is expected to be VND 18,600 per share, and the proceeds will be used to contribute additional capital and increase ownership in the subsidiary.

SJ Group (HOSE: SJS) also plans to issue shares to increase capital from owner equity, replacing the plan to issue shares according to the resolution of the 2022 Annual General Meeting of Shareholders.

Accordingly, SJ Group will issue 182.6 million shares, a ratio of 159%. Of these, nearly 86.3 shares will be paid as dividends for the years 2018, 2019, 2020, 2021, and 2024, with an entitlement ratio of 75.1%. And nearly 96.4 million shares will be issued to increase capital from owner’s equity, with an entitlement ratio of 83.9%.

The source of capital for issuing dividend payment shares comes from undistributed profits on the consolidated financial statements for 2024, expected to be VND 862.56 billion. For the bonus share plan, the source of capital comes from the investment fund (nearly VND 745 billion) and capital surplus (VND 218.8 billion)

If the above two issuances are completed, SJ Group will increase its charter capital from VND 1,149 billion to nearly VND 2,975 billion.

Ho Chi Minh City Technical Infrastructure Investment JSC (CII, HoSE floor) also approved the adjustment of the plan to issue shares to increase capital from owner’s equity with a ratio of 14%, corresponding to the issuance of more than 76.9 million shares. If the issuance is completed, CII will increase its charter capital from VND 5,495 billion to VND 6,264 billion.

Landscape of Vuon Vua Resort & Villas project. Photo: TIG

In 2025, Thang Long Investment Group (TIG, HNX floor) plans to mobilize a large amount of capital to promote the implementation of the Vuon Vua project – one of TIG’s key projects in Phu Tho.

Specifically, TIG plans to issue over 193.6 million shares to existing shareholders at VND 10,000 per share. Notably, the offering price is higher than the current market price of TIG shares.

With the expected proceeds of VND 1,936 billion, TIG plans to use VND 200 billion to repay bank loans and VND 1,736 billion for the implementation of phase 2 of the Vuon Vua Resort & Villas project.

In addition, TIG will issue 50 million shares in private placement to no more than 100 professional investors at VND 10,000 per share. The proceeds of VND 500 billion will also be used to supplement working capital and invest in the Vuon Vua project.

The Elusive Cash Flow: A Business Conundrum

While Becamex IDC aims to offer up to 25,000 bonds in the domestic market, each with a face value of VND 100 million, to raise VND 2.5 trillion, BacABank plans to issue nearly 96 million shares to existing shareholders, aiming to raise VND 958 billion.

Becamex IDC Plans to Issue $108 Million in Bonds

Let me know if you would like me to continue refining or expanding on this title to better suit your needs.

Becamex IDC is set to offer a substantial amount of bonds worth VND 2.5 trillion in the period from June to November 2025.

“Rebranding and Revitalization: Alpha Securities’ Post-Penalty Capital Allocation Strategy”

The upcoming Extraordinary General Meeting of Shareholders of Alpha Securities Joint Stock Company (APSC), scheduled for July 18, 2025, in Hanoi, promises to be a pivotal event. Shareholders will decide on critical agenda items, including the revision of capital allocation plans from the 2022 equity offering, leadership changes with the proposed dismissal of two key executives, a change of headquarter location, and various transactions with Alpha AM. These decisions are poised to shape the future strategic direction of APSC, making this a highly anticipated event for investors and stakeholders alike.