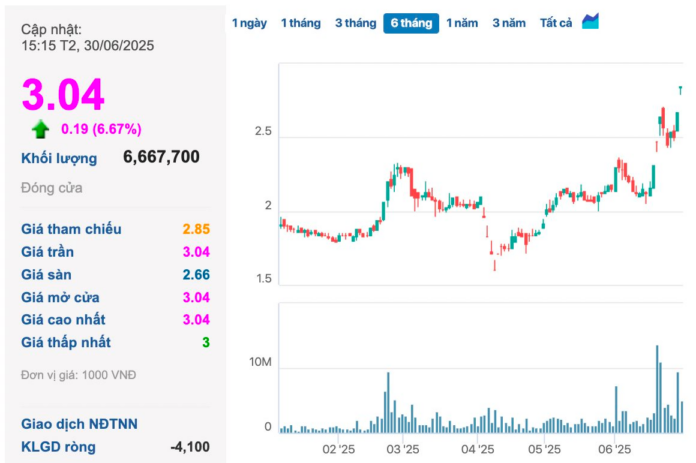

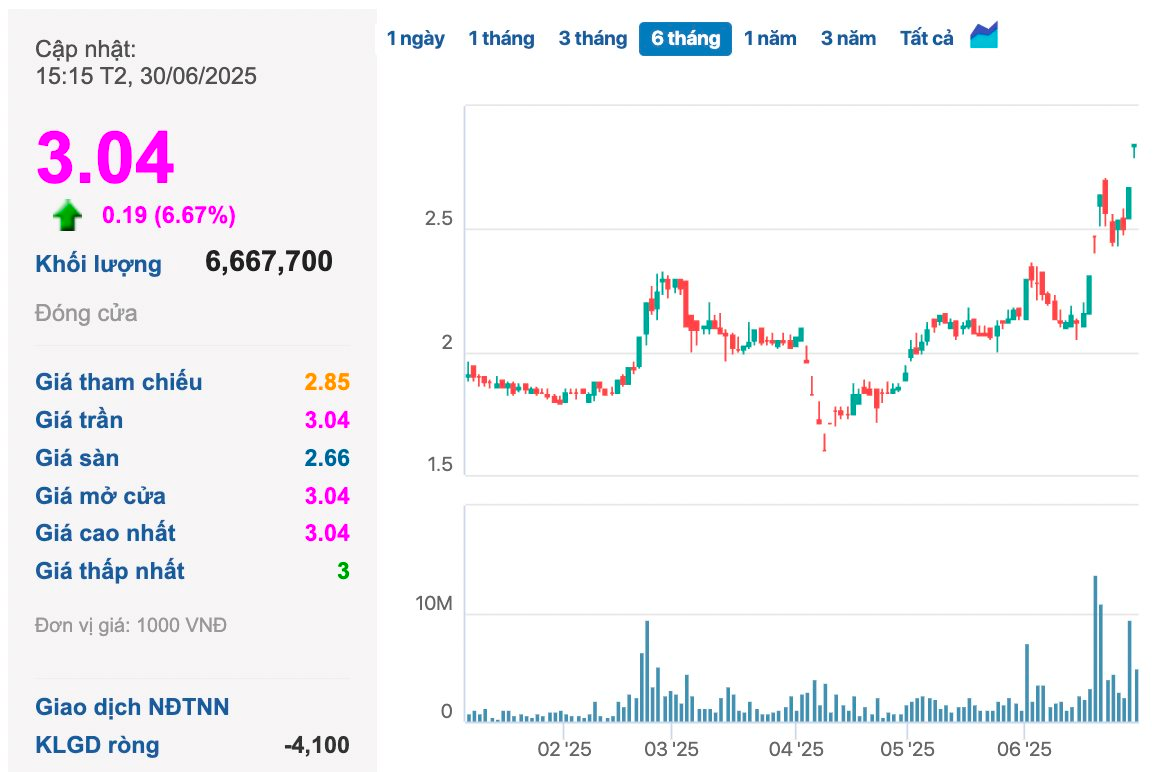

One of the notable stocks in today’s session (June 30, 2025) is LDG of LDG Investment JSC. At the closing bell, LDG soared to its daily limit of VND 3,040 per share with millions of matching volume.

This was LDG’s sixth consecutive limit-up session, taking place amid the unexpected return of its former Chairman, Mr. Nguyen Khanh Hung, at the recent Annual General Meeting, where a record business plan was also announced.

Former Chairman Returns After Prison Term, LDG Attracts Massive Capital Inflow with Six Limit-Up Sessions

Recapping the events, in late November 2023, Mr. Nguyen Khanh Hung, Chairman of the Board of LDG, was arrested and detained for irregularities related to the Tan Thinh Residential Area project in Trang Bom district, Dong Nai province. Mr. Hung was accused of selling houses that did not meet the legal requirements, deceiving customers, which led to his prosecution and trial in early 2025. Consequently, the former leader of LDG was sentenced to 16 months in prison, and the company was ordered to refund all money collected from customers.

Furthermore, in mid-2024, the People’s Court of Dong Nai province initiated bankruptcy proceedings against LDG following a lawsuit filed by Phuc Thuan Phat Trading and Construction JSC. LDG incurred substantial losses in 2023 and 2024, amounting to VND 527 billion and VND 1,506 billion, respectively…

Surprisingly, at the Annual General Meeting held on June 26, 2025, Mr. Nguyen Khanh Hung reappeared after completing his prison term. He announced his intention to work with the management team to restructure LDG.

LDG also unveiled its 2025 business plan, targeting revenue of over VND 1,800 billion and after-tax profit of nearly VND 92 billion. The company is currently developing nine projects, including five significant ones such as LDG Grand Da Nang, LDG Sky, and West/High Intela… which are expected to be transferred or divested.

Photo: Mr. Nguyen Khanh Hung (third from left) at the 2025 Annual General Meeting of LDG Investment JSC.

Tan Hoang Minh Makes a Resurgence with Chairman Do Anh Dung’s Special Pardon

Another businessman who has recently been pardoned and made a comeback is Mr. Do Anh Dung, Chairman of Tan Hoang Minh Group. The group has been actively proposing several large-scale projects lately.

On June 2, 2025, the People’s Council of Khanh Hoa province approved a list of four land plots for pilot commercial housing projects in the province, including one project belonging to a company under the Tan Hoang Minh Group.

Specifically, the Tan Hoang Minh mixed-use office, commercial, and luxury apartment building project of Tan Hoang Minh Trading, Hotel, and Service Company Ltd. (under the Tan Hoang Minh Group) spans an area of 0.7 hectares, with a total investment of VND 1,800 billion. The project is scheduled for completion between 2025 and 2028.

Photo: Chairman Do Anh Dung proposes new investment projects after receiving a special pardon.

The return of Mr. Do Anh Dung, Chairman of Tan Hoang Minh, following his special pardon on April 30, 2025, has attracted significant attention from the public and investors. In addition to Mr. Dung’s reappearance, the Tan Hoang Minh Group has actively proposed multiple projects since the beginning of 2025.

In January 2025, during a working session with the People’s Committee of Quang Binh province, Tan Hoang Minh Trading, Hotel, and Service Company Ltd. proposed the idea of developing the Bau Sen eco-tourism resort project. The proposed project covers an area of over 1,600 hectares in Ngư Thủy and Sen Thủy communes, Lệ Thủy district.

In March 2025, Tan Hoang Minh, in collaboration with TBH Joint Stock Company, commenced the construction of the Greenera Southmark residential project at 486 Ngoc Hoi, Thanh Tri district, Hanoi. This is one of the few apartment projects in Hanoi that received the investment policy decision from the Hanoi People’s Committee in 2024. In January 2025, the project was granted a construction permit.

Most recently, in June 2025, during a working session with the leadership of Lam Dong province, the Tan Hoang Minh Group proposed to continue studying and developing a detailed planning concept for a project covering an area of approximately 4,320 hectares in Xuan Tho, Da Lat city….

“Tra Fish King” Rebuilds His Empire after Prison

In reality, numerous Vietnamese businessmen, after facing legal issues and serving their sentences, have demonstrated determination to start anew.

One notable example is Mr. Duong Ngoc Minh, Chairman of Hung Vuong Corporation (stock code HVG), once known as the “Tra Fish King.”

As a young leader of a state-owned enterprise, Mr. Duong Ngoc Minh found himself entangled in legal troubles at the age of 30, convicted of “deliberately violating state regulations, causing serious consequences, and establishing illegal funds,” resulting in a ten-year prison sentence.

Photo: Mr. Duong Ngoc Minh and HVG – The former “Tra Fish King.”

Upon his release, he shared that he started anew by renting 1,000 tons of cold storage space to sublet at a rate of VND 100 million per month, requiring a three-month deposit. Fortunately, a former client (the owner of the Sun Wah building on Nguyen Hue street) was willing to lend him VND 150 million. From there, his business expanded to exporting tra fish, generating trillions of dong in revenue and hundreds of billions in profit annually.

HVG used to be a sought-after stock in the market. However, its ambitious diversification strategy and scattered investments, especially in underperforming sectors, led to HVG’s subsequent decline.

In early 2020, the news of Thaco’s subsidiary “rescuing” HVG caused a stir. Nonetheless, this rescue effort lasted only a year and a half. On July 2, 2021, Tran Oanh Production and Trading Private Enterprise and its Chairman, Mr. Tran Ba Duong, simultaneously sold off their entire stake of over 19.8 million HVG shares.

On December 15, 2023, HVG shares of Hung Vuong Corporation were officially suspended from trading on the UPCoM market due to the company’s failure to publish audited financial statements for three consecutive financial years.

Another noteworthy case is Mr. Le Minh Hai, also known as “Hai Robert.” He was sentenced to death in the Tamexco case in 1995 but later had his sentence commuted to life imprisonment. After years of rehabilitation, he was released from prison.

Following his release, Mr. Hai continued his entrepreneurial journey with significant projects such as importing a floating dock to Vietnam, purchasing high-speed boats to exploit red coral, and investing in sturgeon farming… He also served as the Director of Vinashin Vung Tau.

Photo: Mr. Le Minh Hai, known as “Hai Robert.”

Another individual who faced a death sentence but was later granted a pardon is Mr. Nguyen Van Muoi Hai, the owner of Thanh Huong perfume brand , one of the most notorious tycoons in Saigon in the late 1980s.

He was involved in a “capital mobilization” scheme, collecting an enormous sum of VND 37 billion (an astronomical amount at that time) with an outrageous interest rate of 15% per month. He faced the death penalty for defrauding citizens, undermining the implementation of socio-economic policies, and bribery.

Eventually, his sentence was commuted to life imprisonment for fraudulently appropriating citizens’ property, undermining the implementation of socio-economic policies, and bribery. He received a special pardon at the end of 2006.

After regaining his freedom, he started from scratch, opening a modest restaurant. Gradually, with his experience and determination, he ventured into business consulting for various enterprises.

The LDG Investment Ex-Chairman’s Testimony on Illegal Construction in the Tan Thinh Residential Area

“Mr. Nguyen Khanh Hung, the former Chairman of LDG Corporation, acknowledged his overconfidence and haste in commencing construction before the legal procedures for the Tan Thinh Residential Area project were completed. This admission highlights a critical lapse in judgment, as such actions can have significant repercussions.”

The Real Estate Mogul, Do Anh Dung, Appeals to a Higher Court

Ending the first-instance trial of the case that took place at Tan Hoang Minh Group, only Do Anh Dung has filed an appeal requesting a reduced sentence.