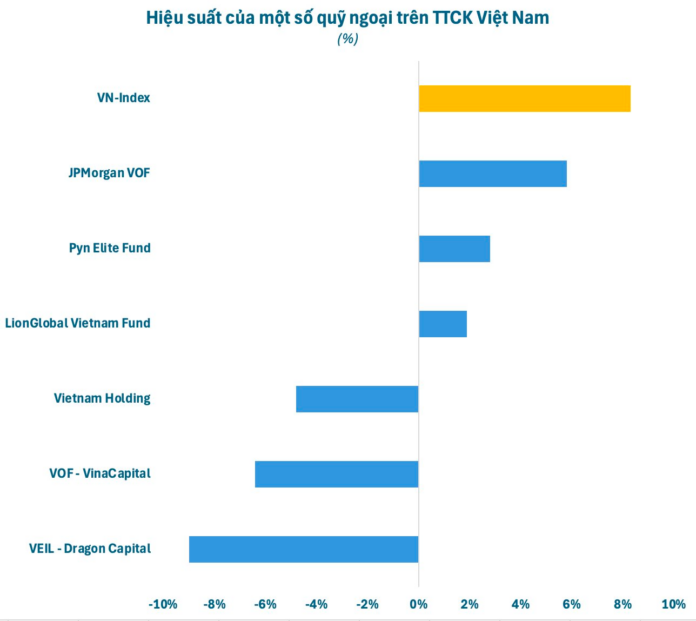

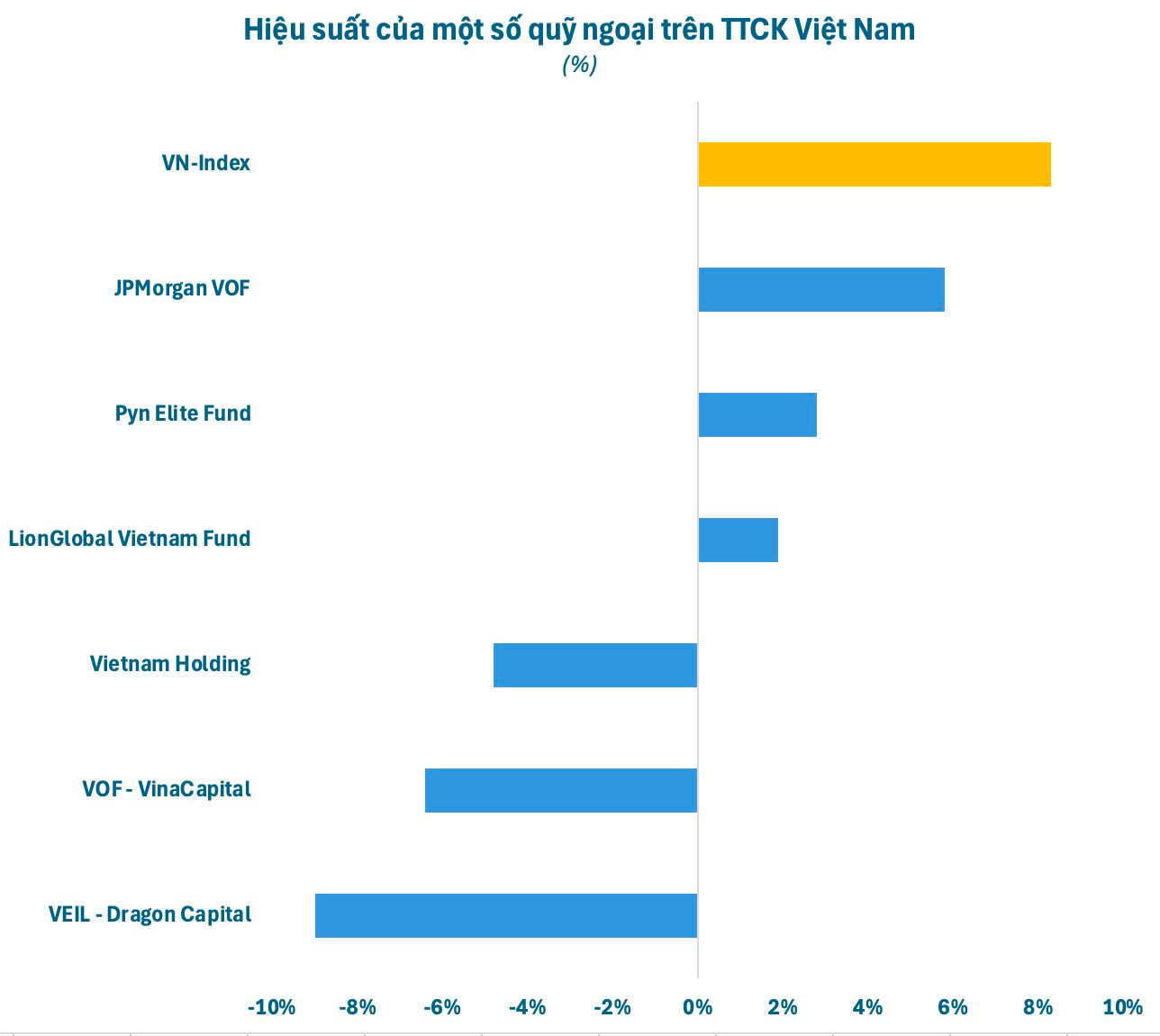

The Vietnamese stock market has been through a challenging period for investors. While the VN-Index climbed nearly 105 points (+8.3%), reaching a three-year high, many investors incurred losses. Both individual and large-scale foreign funds with assets worth billions of dollars faced difficulties.

Two of the leading foreign funds in the Vietnamese stock market, VEIL – Dragon Capital (-9%) and VOF – VinaCapital (-6.4%), recorded negative performance since the beginning of the year. Meanwhile, other funds, such as JPMorgan VOF and Pyn Elite Fund, despite showing better performance, could not outperform the VN-Index.

The underperformance of these foreign funds can be attributed in part to the rising exchange rate since the beginning of the year, surpassing the 26,000 mark. The Vietnamese dong (VND) has depreciated by nearly 3% against the US dollar (USD) year-to-date, reducing the value of foreign investment funds’ assets when converted into foreign currency.

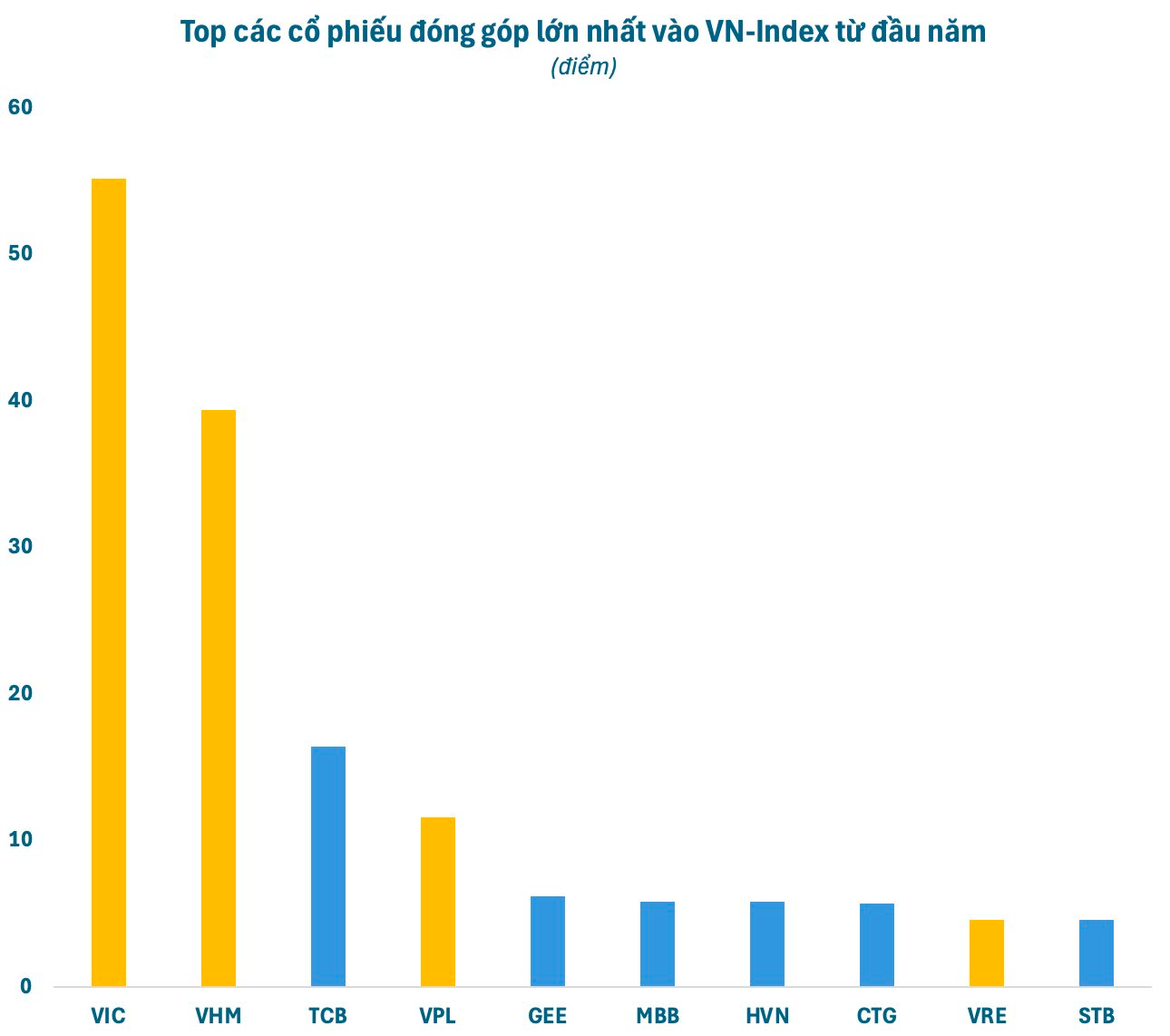

However, a more significant factor is the divergence between the portfolios of these foreign funds and the main drivers of the VN-Index. Since the beginning of the year, stocks from the Vingroup family (VIC, VHM, VPL, and VRE) have surged, contributing over 110 points to the VN-Index. Meanwhile, most other stock groups have either stagnated or declined.

The top foreign funds in the market, however, have not allocated a significant portion of their portfolios to the Vingroup stocks. JPMorgan VOF is a rare exception, with both VIC and VHM among the top holdings in its portfolio. Most other funds hold only a small amount of VHM.

In reality, it is challenging for large-scale foreign funds to restructure their portfolios to capture short-term market trends, especially in a frontier market like Vietnam, which is volatile and unpredictable. Moreover, the lack of significant market rallies in recent years has also contributed to the underperformance of these foreign funds.

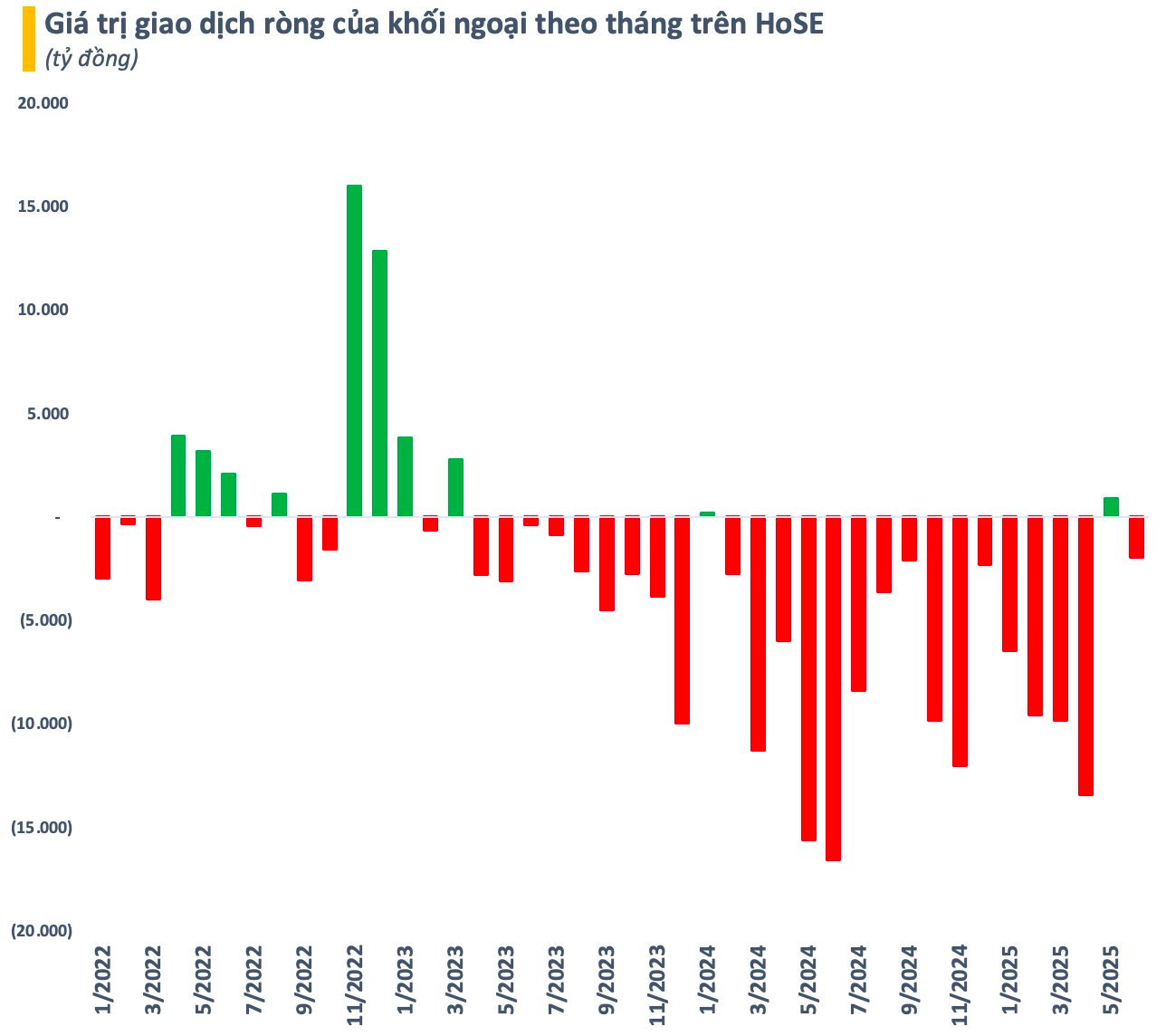

The difficulty in generating profits is one of the reasons why foreign investors have been less enthusiastic about the Vietnamese stock market. This is evident from the long-standing net selling trend in the market. Foreign investors set a record by net selling over 90,000 billion VND on HoSE last year and have continued to net sell more than 40,000 billion VND since the beginning of this year.

However, the net selling by foreign investors on the stock market does not necessarily mean they are exiting the Vietnamese market. Many foreign investors continue to invest in private placements by Vietnamese enterprises, with deal values reaching hundreds of millions of dollars. Nonetheless, the persistent net selling trend by foreign investors is noteworthy.

In summary, the Vietnamese stock market faces certain short-term challenges due to (1) profit-taking pressure after the previous uptrend, (2) unstable economic and geopolitical conditions globally, and (3) continued foreign capital outflows from frontier and emerging markets. These variables can impact the performance of funds and individual investors in the short term.

Nevertheless, the long-term growth prospects of the Vietnamese stock market remain positive due to (1) stable macroeconomic conditions and government initiatives to boost the economy, (2) the potential for profit growth among listed companies, and (3) the increasing likelihood of an upgrade to emerging market status following efforts by regulatory authorities.

The Little Engine That Could: Small-Cap Stocks Chugging Along Nicely

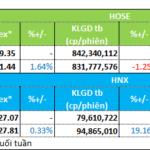

The optimistic sentiment continues to bolster the market’s slow but steady ascent, despite lackluster performances from leading stocks. While the blue-chips struggled to keep pace with the indices, the small and mid-cap stocks witnessed notable price advancements. Trading liquidity on the two exchanges witnessed a 10% increase, indicating a potential shift in investor appetite.

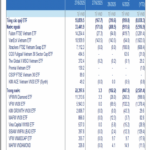

The Great ETF Exodus: Unraveling the Sudden Outflow of Funds from Vietnam, Particularly from Thailand

The Vietnam equity market witnessed another week of outflows, with ETFs investing in the country’s stock market experiencing net withdrawals of over VND 360 billion, a surge of 55% compared to the previous week.

Market Beat: Foreigners Turn Net Buyers, VN-Index Hits 2-Year High

The trading session concluded with the VN-Index climbing 4.63 points (+0.34%), reaching 1,376.07. Meanwhile, the HNX-Index witnessed a rise of 1.41 points (+0.62%), closing at 229.22. The market breadth tilted towards the bulls, as advancers outnumbered decliners by a margin of 469 to 269. Similarly, the VN30 basket echoed this bullish sentiment, displaying 16 gainers, 10 losers, and 4 unchanged stocks.

Vietstock Daily: Liquidity Recovery Anticipated

The VN-Index sustains its upward momentum, closely hugging the upper band of the Bollinger Bands. The MACD indicator continues to widen the gap with the signal line, providing a bullish signal and indicating sustained positive short-term sentiment. However, a caveat lies in the trading volume, which has not yet surpassed the 20-session average, reflecting investors’ lingering caution. If this trend persists in upcoming sessions, the risk of a corrective shake-up warrants attention.