The final trading week of June concluded with a strong upward trend for the VN-Index, despite global geopolitical tensions. On the first trading day of the week, the market experienced heavy selling pressure as the US officially entered the conflict between Iran and Israel. However, this downward trend quickly presented an opportunity for the index to shake off the pressure, attracting robust buying interest, and breaking through the previous peak of 1,350 points.

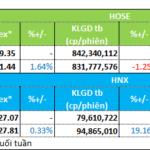

In the following sessions, the VN-Index maintained its upward trajectory despite some volatility when approaching the two-year high price range. The index ended the week at 1,371 points, a gain of 22 points (equivalent to 1.64%), setting a new peak for 2025. The average trading volume on HoSE slightly decreased compared to the previous week, reaching VND 21,455 billion per session.

Across sectors, 16 out of 21 industry groups witnessed gains, led by real estate. In contrast, oil and gas, fertilizer, and pharmaceutical sectors were among the top losers. Foreign investors’ activities were relatively balanced, with a slight net sell position of VND 42 billion. VND (VND 393 billion), SSI (VND 368 billion), and HPG (VND 298 billion) were the top three stocks with the largest net buy value, while STB, FPT, and VCB experienced notable net selling.

According to the analysis of Kien Tiet Securities, the VN-Index has witnessed gains for two consecutive weeks. However, the trading volume during these two weeks has been lower than the 20-week average, indicating that investors remain cautious. CSI predicts that the VN-Index may target the resistance zone of 1,398 – 1,418 points in the coming week and recommends that investors continue to hold their current portfolios and gradually take profits when approaching the resistance zone.

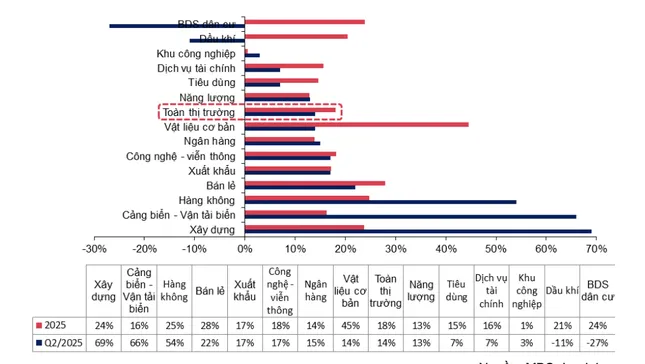

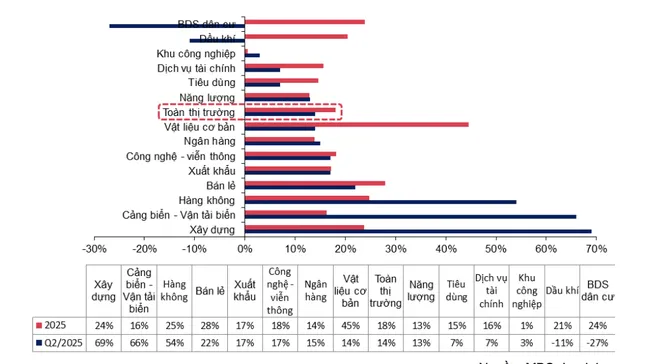

Additionally, the market is entering the season for the announcement of Q2/2025 financial results. MBS expects to ride the wave of Q2 earnings, and according to their analysis, the market-wide profit for this quarter is likely to increase by approximately 14% year-on-year, despite risks arising from geopolitical instability and trade conflicts.

Q2 and full-year 2025 profit growth forecasts for various sectors. Statistics: MBS.

Several sectors are expected to witness robust growth in Q2. The construction sector’s profit is forecasted to increase by 69%, attributed to accelerated progress in infrastructure and expressway projects, as well as benefits from public investment.

The port and maritime transport sector is anticipated to witness a profit surge of approximately 66% due to vibrant international trade, particularly the significant increase in exports to the US, along with the 90-day tariff delay.

The aviation industry is projected to experience a 54% year-on-year profit increase, driven by the recovery in tourism and passenger transport demand.

In the banking sector, the industry-wide profit is expected to grow by 15% compared to the same period last year, supported by favorable credit growth and stable NIM. Banks with positive profit outlooks include VPB, CTG, and EIB.

As of June 16, the credit growth of the entire banking system had reached 6.99% year-to-date, significantly higher than the 3.75% recorded in the same period last year. This growth is attributed to the accommodative monetary policy and low-interest-rate environment, which are expected to support the targeted 8% GDP growth for the year.

On the other hand, the residential real estate sector is likely to witness a 27% decline in profit in Q2 due to low product delivery progress. However, the long-term outlook remains positive, driven by surging FDI inflows into the real estate sector (accounting for 25.9% of registered capital), improving legal framework, and anticipated infrastructure development following local merger projects. Real estate enterprises are forecasted to achieve a profit growth of approximately 24% for the full year, supported by the expected delivery of projects towards the end of the year.

For industrial real estate, profit in Q2 is expected to increase slightly by 3% due to MOUs signed before the US imposed tariffs. However, the performance in the following quarters needs to be monitored closely as the countervailing duty policy remains unclear.

Although the oil and gas sector’s profit improved compared to the previous quarter, it still witnessed an 11% decline compared to the same period last year. Nevertheless, rising oil prices and geopolitical developments could support a recovery in profit margins towards the end of the quarter.

The Smart Money Loses Out to VN-Index

The top foreign-owned funds in Vietnam’s stock market have underperformed the VN-Index so far this year.

The Little Engine That Could: Small-Cap Stocks Chugging Along Nicely

The optimistic sentiment continues to bolster the market’s slow but steady ascent, despite lackluster performances from leading stocks. While the blue-chips struggled to keep pace with the indices, the small and mid-cap stocks witnessed notable price advancements. Trading liquidity on the two exchanges witnessed a 10% increase, indicating a potential shift in investor appetite.