At the seminar “Trade in Wood and Wood Products between Vietnam and the US: What Should the Vietnamese Wood Industry Do in the Context of Current Trade Tensions?” hosted by the Department of Forestry and Forest Rangers (Ministry of Agriculture and Environment) in collaboration with the Vietnam Timber and Forest Product Association (VIFORES) and Forest Trends, managers and industry experts shared their insights on the expansion of the market in terms of Vietnam’s exports of wood products to the US and imports of wood materials from this market. However, they also highlighted the significant challenges posed by potential high tariffs and trade remedies imposed by the US, which have greatly impacted the business operations of Vietnamese wood enterprises.

PRESSURE FROM TRADE REMEDIES

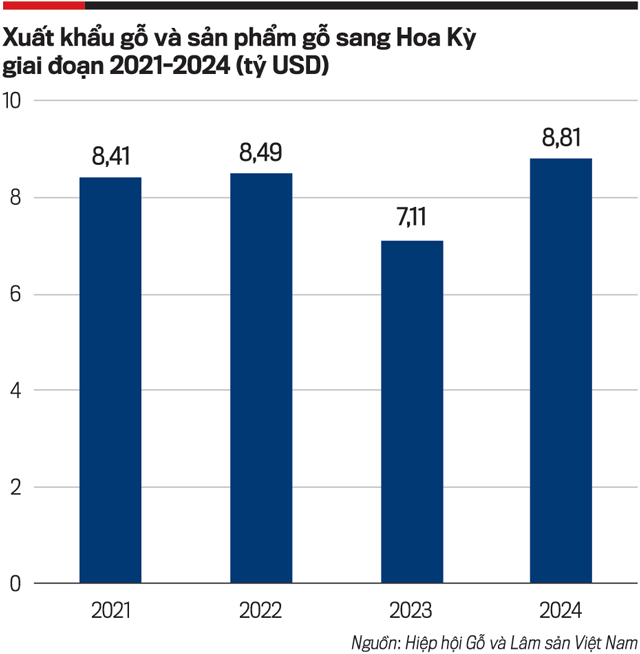

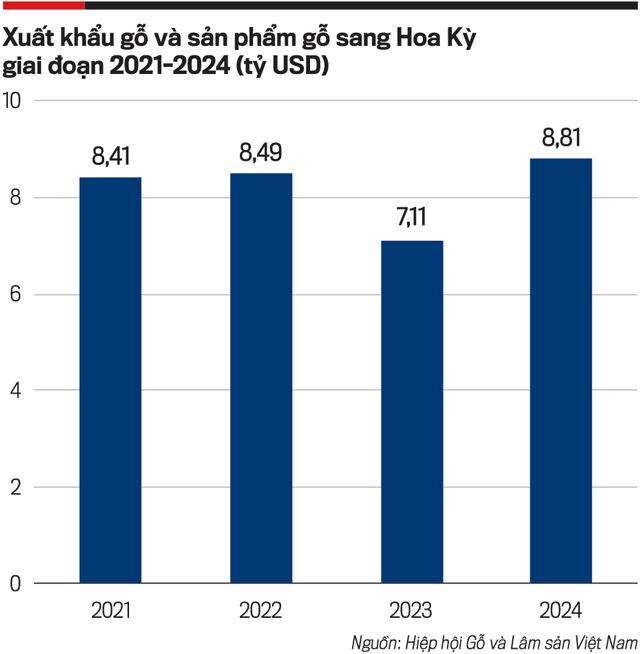

Regarding the trade situation of wood and wood products between Vietnam and the US, Mr. Tran Le Huy, Vice President of Binh Dinh Wood and Forest Product Association and representative of the research team of wood associations, shared that the US is the most important export market for Vietnam’s wood industry. In 2024, export turnover to the US reached approximately $9 billion, accounting for over 50% of the industry’s total export turnover. On the import side, Vietnam imported over 303,000 cubic meters of roundwood and 429,000 cubic meters of sawn timber from the US, with a total import turnover of over $300 million.

However, there are underlying instabilities in the trade of wood products between the two countries as the US government considers imposing a 46% retaliatory tariff on imported products, including wood. Simultaneously, most of Vietnam’s high-value wood exports to the US market are under investigation according to Section 232 of the US Government’s Trade Expansion Act. Additionally, anti-subsidy and anti-dumping lawsuits are putting immense pressure on Vietnamese wood enterprises.

Given these risks, Mr. Huy suggested that Vietnam should intensify trade negotiations to reduce the likelihood of high tariffs and improve supply chain transparency. Moreover, it is essential to conduct risk assessments to support enterprises in devising appropriate solutions for specific supply chains and industries. On the part of wood enterprises and associations, there is a need to strengthen cooperation within the supply chain, focus on developing e-commerce, explore new markets, and enhance competitiveness in the global supply chain.

Mr. Ngo Sy Hoai, Vice President and General Secretary of the Vietnam Timber and Forest Product Association (VIFOREST), added that in 2024, the main exports to the US included wooden furniture, wood boards, wooden doors, and wooden handicrafts, totaling $9 billion in value. Conversely, Vietnam imported sawn timber, roundwood, and veneer from the US, valued at $316.36 million. Although this figure is not substantial, Vietnam remains one of the largest consumers of US wood and wood products globally.

In the first five months of 2025, Vietnam’s exports of wood and wood products to the US reached $3.7 billion, a 10.3% increase compared to the same period in 2024, accounting for 55.4% of the total export turnover of wood and wood products. Conversely, import turnover from this market reached $176 million, a nearly 52% increase compared to the previous year, representing 15% of Vietnam’s total import turnover of wood and wood products.

“During the recent visit to the US by Minister of Agriculture and Environment Do Duc Duy, Vietnam committed to increasing imports of wood materials from the US to contribute to trade balance between the two countries. Notably, following the proposal of the Ministry of Agriculture and Environment and VIFORES, the Vietnamese government decided to reduce the import tax on indoor and outdoor wooden furniture from the US from 15-25% to 0%. This is a significant incentive to boost imports in the coming time,” emphasized Mr. Hoai.

Mr. Joe O’Donnell, Director of Government and Public Affairs at the International Wood Products Association (IWPA), agreed that importing hardwood from the US would be advantageous for Vietnamese businesses in terms of origin certification. He also advised Vietnamese enterprises to proactively provide information to US consumers to build trust and protect their market share.

ENHANCING TRANSPARENCY IN WOOD ORIGIN

Ms. Ashley Amidon, Executive Director of the International Wood Products Association (IWPA), pointed out that the first concern of US authorities is the origin of the wood. Transparency in the supply chain is mandatory, while certified wood is considered a secondary factor. US consumers prioritize competitive pricing over the origin of the wood, whether it is from the US or another country.

However, some Vietnamese wood and plywood products are currently under investigation, facing the risk of simultaneous application of countervailing and anti-dumping duties. Specifically, on May 22, 2025, the US Fair Trade Alliance in the Wood-Based Panel Sector filed a petition requesting the imposition of anti-dumping and countervailing duties on enterprises from China, Indonesia, and Vietnam. The proposed tax rates are as follows: China 474.2%, Indonesia 202.8%, and Vietnam 133.72%. If the investigation proceeds as scheduled, the preliminary duties could be applied from Q4 2025. Therefore, IWPA recommends that Vietnamese enterprises closely monitor the Separate Rate Application (SRA) issued by the US Department of Commerce, expected at the end of July or early August 2025.

According to Ms. Ashley Amidon, timely responses to this issue will significantly impact the final tax rates imposed. The current tariffs not only affect Vietnam but also the entire supply chain and global businesses. Therefore, enterprises must enhance cooperation and information sharing to improve their understanding and proactively manage risks…

The full content of this article was published in the Vietnam Economic Magazine, Issue 26-2025, released on June 30, 2025. We invite readers to find the complete article at the following link: https://postenp.phaha.vn/tap-chi-kinh-te-viet-nam/detail/1473

The U.S. Imposes Temporary Anti-Dumping Duties on Vietnamese Hard Capsule Shells

The U.S. Department of Commerce (DOC) has announced its preliminary decision to impose a countervailing duty of 8.35% on imports of certain products from Vietnam. In this case, the DOC selected one mandatory respondent, and as a result, the margin of dumping determined for the mandatory respondent will be applied to all other producers and exporters in Vietnam.

The Wood Industry of Dong Nai Strives for $2 Billion in Exports by 2025

As the second-largest wood product exporter in Vietnam, after Binh Duong, Dong Nai’s wood industry has embarked on a journey of innovation with a focus on technical wood projects. With a sustainable development mindset, the province is unlocking the vast potential of the technical wood market for the future. Aiming high, Dong Nai strives to achieve a remarkable export target of $2 billion by 2025.