A production line at Dai Tu Factory – Photo: TNG

|

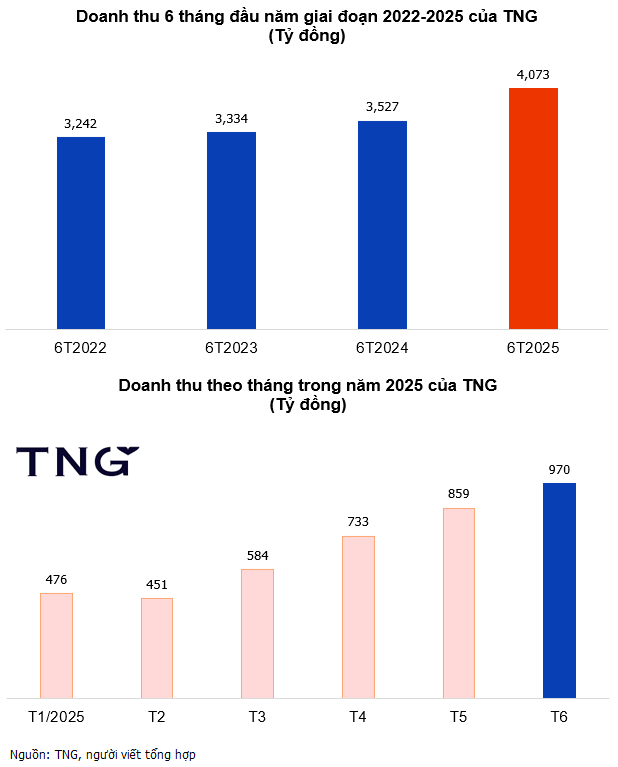

TNG Investment and Trading Joint Stock Company (HNX: TNG) has just announced its preliminary business results for the first six months of 2025, with an estimated revenue of VND 4,073 billion, up 15% over the same period last year, fulfilling 50% of the yearly plan. Particularly in June, the revenue reached VND 970 billion, doubling that of the first two months. This is also the highest revenue in the past four years for the same six-month period, increasing by 26% compared to the first half of 2021.

|

TNG’s growth takes place amid positive signals in Vietnam’s textile and garment industry. The industry’s export turnover reached approximately $17.8 billion in the first five months of the year, up 10% from the previous year. Especially in May 2025, the figure hit $3.84 billion, the highest ever recorded for the month of May.

Accelerating Export Orders and Mobilizing Capital for Production Expansion

Amid the industry’s recovery, TNG has been ramping up production and expanding its operations. Export orders are fully booked until Q4 2025, with Europe accounting for 50% of the orders, the US 26%, and Russia 10%. The company plans to add ten more production lines and recruit 1,000 new employees, prioritizing high-tech orders to improve profit margins.

To facilitate this expansion, TNG recently approved a plan to borrow up to VND 1,200 billion from BIDV – Thai Nguyen Branch to supplement working capital and trade finance in 2025. Previously, the company successfully raised VND 400 billion through a bond offering at the end of 2024, mainly from institutional investors.

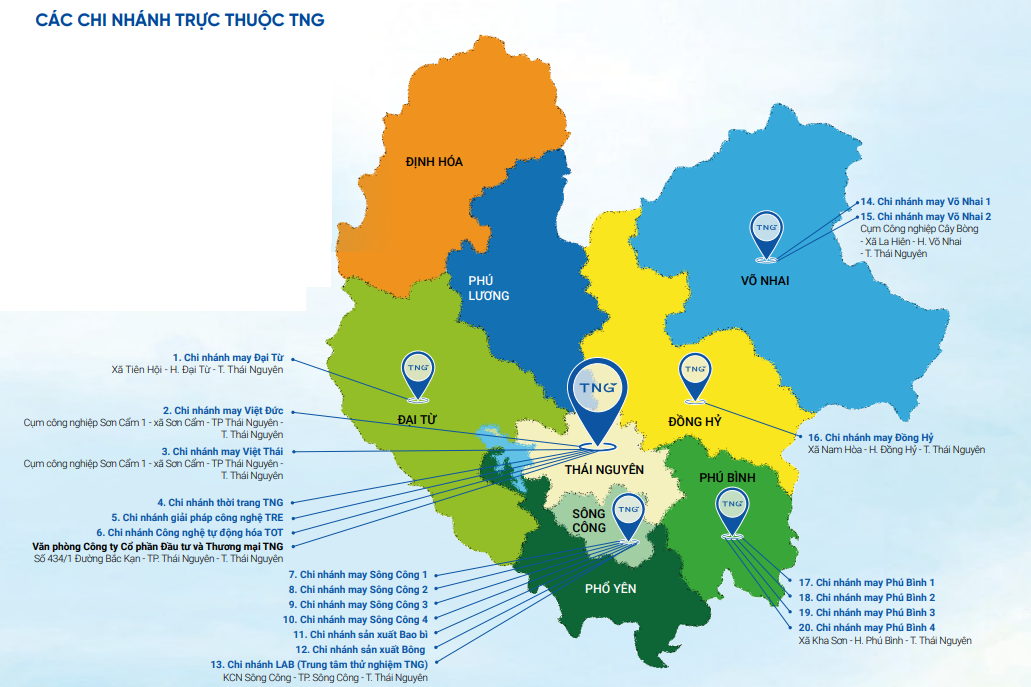

At a meeting on June 27, the Board of Directors decided to terminate the operation of May Phu Binh 4 Branch from July 1, 2025, due to changes in business orientation and strategy. This branch will be merged with May Phu Binh 3 Branch. Prior to this decision, TNG had a total of 20 branches, including four factories in Phu Binh district, which will now be reduced to three.

Source: TNG’s 2024 Annual Report

|

Changes in Leadership

At the same meeting, the Board of Directors approved the dismissal of Luong Thi Thuy Ha from the position of Deputy General Director. Previously, Ms. Ha had submitted her resignation from the position of Board member and was replaced by Dao Duc Thanh at the 2025 Annual General Meeting of Shareholders.

There was also a change in the position of General Director, as Nguyen Duc Manh was dismissed and elected as Permanent Vice Chairman of the Board of Directors. His successor is Tran Minh Hieu, former Deputy General Director of Sales.

In the stock market, TNG shares have been on a positive upward trend, with eight consecutive gaining sessions and an 18% increase. The shares are currently trading at around VND 21,500 each, which is still 7% lower than the price a year ago but has impressively recovered by 54% from the low of below VND 14,000 per share at the beginning of April. Trading liquidity remains stable, with an average matched volume of nearly 1.8 million shares per session.

| TNG Share Price Movement since the Beginning of 2025 |

– 13:58 01/07/2025

The HBS Conference Heats Up: Calls for a Forensic Audit and Investment in Crypto Firm

The annual General Meeting of HBS Securities Joint Stock Company (HNX: HBS) took place on the afternoon of June 26 in Hanoi, with a key focus on addressing concerns regarding financial statement discrepancies for the period of January 1, 2022, to December 31, 2024. The meeting approved a proposal for a re-audit of the financial statements due to significant discrepancies in the data. In addition to addressing these financial matters, the gathering also witnessed the introduction of new key personnel to the team. One notable decision from the meeting was the approval of the company’s investment in a cryptocurrency firm, marking a strategic move towards embracing the potential of decentralized finance.

“TPBank Strengthens Executive Team for Sustainable Growth”

TPBank, a leading joint-stock commercial bank in Vietnam, is proud to announce strategic enhancements to its executive team. These changes are in line with the bank’s growth trajectory and expansion plans, underscoring its commitment to delivering exceptional performance in the next phase of its development.

Unlocking Capital: Resolution 68 Aims to Ease Businesses’ Access to Credit

“At the seminar, ‘Promoting the Role of Commercial Banks in Implementing Resolution 68’, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, shared that there are still many limitations and obstacles in accessing credit capital that need to be addressed, especially the current legal bottlenecks of some projects. Resolution 68 is expected to solve these issues and unblock the bottlenecks that are hindering the progress of these projects.”