There’s less than 24 hours left until all magnetic stripe cards are deactivated nationwide. According to the State Bank’s regulations, any transactions using stripe cards will be declined. If you still have a stripe card, switch to a chip card immediately to avoid disruptions.

There are various types of bank cards available, but they can be categorized based on two main criteria: card technology and payment functions. Clear distinctions will help you understand which type of card needs to be replaced.

How to differentiate between stripe and chip cards

This is the crux of the new regulation. Distinguishing between the two types of cards is quite simple and can be done with the naked eye:

-

Magnetic Stripe Card: This is an old technology card. The main identifying feature is a black magnetic stripe on the back of the card. All cardholder information is stored on this stripe.

-

EMV Chip Card: This is a newer and more secure type of card. It is identified by a small, copper-colored electronic chip embedded on the front of the card.

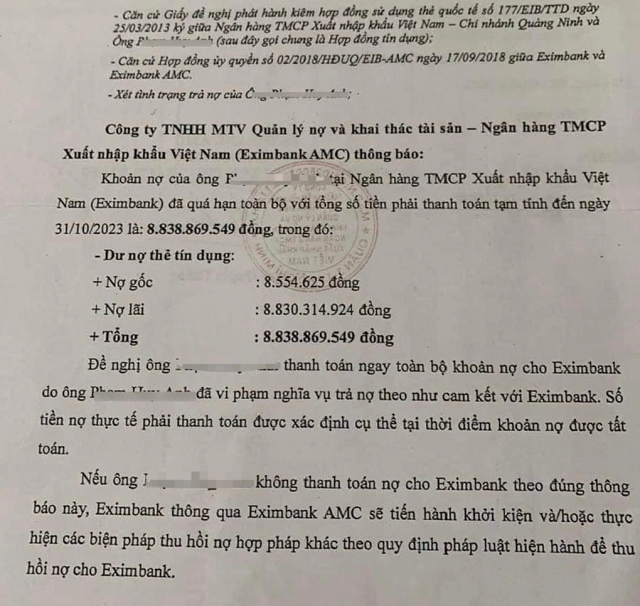

Stripe card (left) with a black magnetic stripe and chip card (right) with an electronic chip. (Image: Agribank)

Which type of card will be blocked from July 1st?

According to the State Bank’s roadmap, the type of card that will no longer be supported for transactions system-wide (at ATMs and POS machines) from July 1, 2025, is the domestic debit stripe card. In simpler terms, this refers to the standard ATM card with only a black magnetic stripe on the back and no chip on the front.

If the front of the card does not have a golden chip (electronic circuit), but only a black stripe on the back, it is a stripe card and must be replaced. Even combination cards (with both a chip and a stripe) need to be replaced.

The reason for discontinuing transactions with this type of card is that stripe cards have low security, and information on the stripe is easily copied, leading to the risk of information and money theft by criminals through skimming devices secretly installed at ATMs. The complete transition to chip cards is mandatory to enhance security for users.

Distinguishing between stripe and chip cards

Which cards are unaffected?

You can continue using your card without any worries if it belongs to any of the following types:

-

Chip cards without a magnetic stripe: Any card with a chip on the front is unaffected and will function normally. This includes:

-

Domestic debit cards that have been upgraded to chip technology (Napas chip cards)

-

International payment cards such as Visa, Mastercard, JCB, and American Express (as most of these cards on the market are already chip cards)

-

-

Credit Cards: As most credit cards (Visa, Mastercard, JCB, etc.) on the market today are chip cards, this type of card is NOT affected by the regulation and can still be used normally.

-

Prepaid Cards: Similarly, if your prepaid card is a chip card, you can continue to use it without any issues.

Chip cards will remain unaffected and can be used as usual

If your ATM card only has a magnetic stripe, you need to act fast and switch to a chip card to avoid transaction disruptions. Checking and switching to a chip card is not just about complying with the regulation but also about ensuring the best protection for your account.

“From June 1st, Transactions of This Kind Will Be a Thing of the Past for Some Banks; Attempting Them Will Result in Rejection”

As of July, a slew of banks, including Vietcombank, Agribank, MB, and SHB, will officially cease dealings with similar entities. This decision underscores a broader trend in the financial industry, as institutions distance themselves from certain operations to mitigate risks and align with evolving regulatory landscapes.

What Do Banks Have to Say About the Sudden Halt of Magnetic Stripe Card Transactions?

“With the ever-evolving landscape of technology, banks are now encouraging their customers to switch from magnetic stripe ATM cards to the more secure chip-based cards. This shift is essential as it enhances security and protects users from potential fraud and unauthorized transactions. The new chip-enabled cards offer a more robust defense mechanism against malicious activities, ensuring that users can transact with peace of mind.”