Vinaconex JSC (VCG on HoSE) recently sent a document to the Vietnam Stock Exchange and Ho Chi Minh City Stock Exchange (HoSE) disclosing information related to the transfer of capital contribution by its subsidiary.

Specifically, on June 30, 2025, the Board of Directors of Vinaconex issued Decision No. 1439/2025/QD-HDQT approving the transfer of the Company’s capital contribution in Vinaconex Investment and Tourism Development Joint Stock Company (Vinaconex ITC, VCR on UPCoM).

The number of shares to be transferred is 107.1 million (51%) with a minimum selling price of VND 48,000/share. The form of capital sale is direct negotiation with interested investors.

The Board of Directors authorized the General Director of the Company to implement the relevant procedures to transfer the Company’s entire capital in Vinaconex ITC according to the approved plan, ensuring compliance with relevant laws and the Company’s Charter.

Vinaconex ITC is known as the investor of the Cai Gia, Cat Ba Tourism Urban Area project (commercial name Cat Ba Amatina) in Hai Phong city.

Master plan of Cat Ba Amatina project. Photo: VCR

At the 2025 Annual General Meeting of Vinaconex held on April 21, 2025, the management board announced that the project is currently completing technical infrastructure and legal procedures.

The project is planned to become a Green – Smart – Luxury tourism urban area, including: 1,300 detached, semi-detached and terraced villas; mixed-use high-rise buildings; serviced apartments; luxury resort villas and hotels including mini hotels, 5-star hotels and super luxury hotels; indoor and outdoor entertainment areas, commercial centers, marinas and many other highlights.

Vinaconex expects to sell a part of the Cat Ba Amatina project to a partner this year to ensure cash flow and profit. The enterprise said it is negotiating with a partner but has not yet signed officially, expecting to sell a significant portion in 2025.

On April 22, 2025, the Board of Directors of Vinaconex ITC issued a resolution approving a maximum loan of VND 300 billion from Vinaconex with a term of 12 months from the disbursement date.

The company plans to borrow at a time according to the loan agreement, with an interest rate in line with the market lending rate. The security measure is the revenue source from business sales at the Cat Ba Amatina project.

The purpose of this loan of Vinaconex ITC is to serve the company’s production and business activities. This includes but is not limited to payment of debts to contractors; regular operating expenses of the company; making payments (if any) to the state budget, repayment of principal and interest on bank loans when the company does not have cash flow… and other expenses related to the Cat Ba Amatina tourism urban area project.

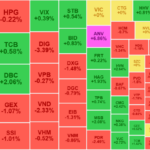

The Big Cap Stocks Pull VN-Index Up, But Many Stocks Still in the Red

The selling pressure intensified during the afternoon session, with the VN-Index plunging to its intraday low at 2:15 PM. Successful efforts to prop up large-cap stocks pushed the index back above the reference level, but this had little impact on the majority of other stocks. The sea of red prevailed, with nearly a hundred stocks falling over 1%.

The Big Bank Stock Shuffle

VAB is the 19th bank stock to be listed on the HoSE. With over 1 billion shares of NAB, belonging to Nam A Commercial Joint Stock Bank, being officially traded on the HoSE after leaving the Upcom exchange, VietABank follows suit, and other banks are expected to make the same move this year.

“Bond Default: NVL Fails to Repay Debt Obligations”

“The company is in advanced discussions with investors regarding the settlement of its outstanding NOVALAND.BOND.2019 debt. The bond repayment is expected to be completed by July 2025, according to sources close to the negotiations. This development underscores the company’s commitment to meeting its financial obligations and fostering positive relationships with its investors.”