The VN-Index has recorded an impressive 6.7% year-to-date gain, outperforming other regional markets such as Thailand’s SET (-23.7%), Malaysia’s FBM KLCI (-8.6%), the Philippines’ PCOMP (-3.0%), Indonesia’s JCI (-1.6%), and Singapore’s STI (+2.8%).

This performance is even more remarkable considering Vietnam is facing proposed retaliatory tariffs that are among the highest in the region, at up to 46%. It reflects the underlying resilience of the economy and growing investor confidence in upcoming supportive factors, including the outcome of tariff reduction negotiations and market upgrade prospects.

However, the rally has not been broad-based. Real estate has been a standout performer, surging 66.8% year-to-date, led by pillar stocks VHM and VIC. Meanwhile, the banking sector has seen a modest 5.3% gain, driven mainly by a few names with specific supportive factors.

VnDirect expects the VN-Index to reach 1,450 points in the second half of 2025. Reflecting a more optimistic view on the prospects of tariff negotiations between Vietnam and the US, VnDirect has revised its VN-Index forecast for the end of 2025 to 1,450 points, a 14% increase from the end of 2024, up from the previous prediction of 1,400 points.

In the base case scenario, Vietnam is expected to successfully negotiate, bringing the average retaliatory tariff rate down to around 16-22%. Meanwhile, the Fed is anticipated to implement two rate cuts in the latter half of the year, helping to keep the DXY index below the 100 threshold.

Domestically, a solid macroeconomic foundation continues to underpin the market. GDP growth is projected to reach 7.3%, with credit growth expected to be 16%. These factors are anticipated to support the listed companies’ profit growth this year at around 14-15%, thereby consolidating the VN-Index’s pricing at a projected P/E of 13.5 times by year-end.

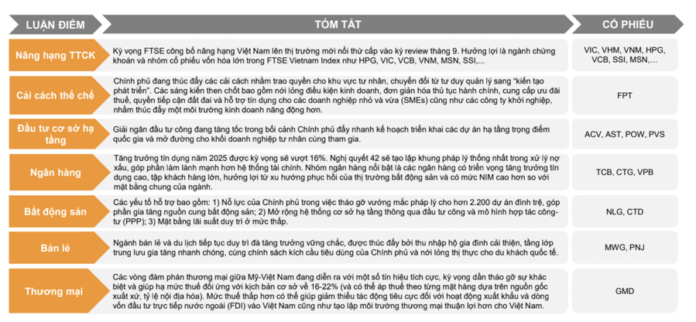

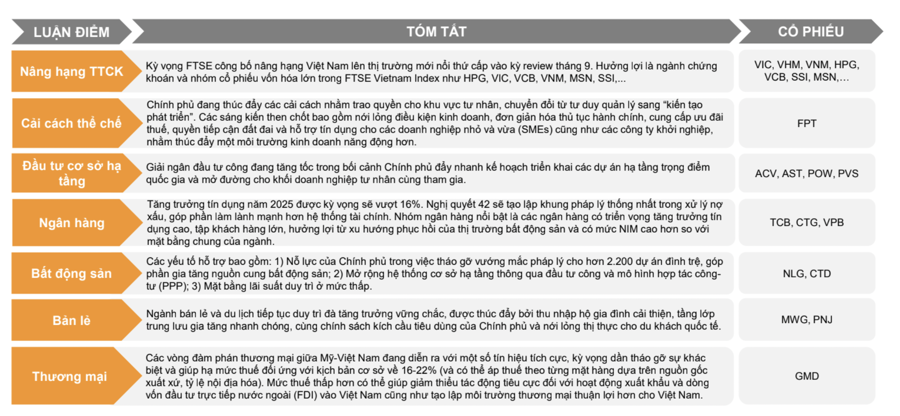

Key investment themes include the market upgrade. In FTSE’s periodic market upgrade assessment report in March 2025, while FTSE assessed that two criteria related to “DvP settlement cycle” and “payment for failed trades” were still restricted and unmet, they acknowledged Vietnam’s progress in implementing the Pre-Funding model.

VnDirect anticipates that FTSE will announce Vietnam’s upgrade to secondary emerging market status in the September review. The securities sector and large-cap stocks in the FTSE Vietnam Index, such as HPG, VIC, VCB, VNM, MSN, and SSI, are expected to benefit from this upgrade.

With a strong commitment to achieving the goal of upgrading the stock market and building a sustainable capital market, VnDirect expects the remaining MSCI upgrade criteria to be met by 2026, and the Vietnamese market to be officially upgraded to emerging market status by MSCI in the June 2027 review.

The second theme is reform. The government is driving reforms to empower the private sector, shifting from a management mindset to a “development facilitator” role. Key initiatives include easing business conditions, streamlining administrative procedures, providing tax incentives, improving land access, and offering credit support for small and medium-sized enterprises (SMEs) and startups to foster a more dynamic business environment.

Third, public investment disbursement is accelerating as the government expedites the implementation of key national infrastructure projects and opens up opportunities for private sector participation.

Fourth, credit growth for 2025 is expected to exceed 16%. Resolution 42 will establish a unified legal framework for handling bad debts, contributing to a healthier financial system. Banks with high credit growth prospects, a large customer base, benefiting from the real estate market recovery, and higher NIM than the industry average, stand out in this sector.

Fifth, the real estate sector is supported by factors such as: 1) Government efforts to resolve legal obstacles for over 2,200 stalled projects, increasing the real estate supply; 2) Infrastructure expansion through public investment and public-private partnership (PPP) models; and 3) Maintaining low-interest rates.

Sixth, the retail and tourism sectors continue their robust growth trajectory, propelled by improving household incomes, a rapidly expanding middle class, government consumption stimulus policies, and visa facilitation for international tourists.

Lastly, trade. The ongoing US-Vietnam trade negotiations have shown positive signs, and it is hoped that differences will be gradually resolved, leading to a reduction in retaliatory tariffs to the base case scenario of 16-22% (with the possibility of taxing based on origin and localization ratio). Lower tariffs could mitigate negative impacts on Vietnam’s exports and FDI inflows, creating a more favorable trade environment.

The Big Cap Stocks Pull VN-Index Up, But Many Stocks Still in the Red

The selling pressure intensified during the afternoon session, with the VN-Index plunging to its intraday low at 2:15 PM. Successful efforts to prop up large-cap stocks pushed the index back above the reference level, but this had little impact on the majority of other stocks. The sea of red prevailed, with nearly a hundred stocks falling over 1%.

“Securities Firms Hike Fees Starting Tomorrow”

As June draws to a close, the VN-Index soars to new heights, reaching a remarkable 1,376 points in today’s session. The market is painted in a sea of green, particularly for mid-cap and small-cap stocks. A new chapter begins tomorrow, July 1st, as multiple brokerage firms are set to increase their service charges.

The $380 Million Real Estate Firm Gets Approval to List 312 Million Shares on HOSE

The company is set to list over 311.85 million common shares on the Ho Chi Minh Stock Exchange (HOSE), equating to a charter capital of nearly VND 3,119 billion.