In a recent Talk show Phố Tài chính, Mr. Le Duc Khanh, Director of Analysis at VPS Securities Joint Stock Company, shared his insights on the macroeconomic prospects and stock market outlook for the second half of 2025. He highlighted that the VN-Index has officially surpassed the strong resistance zone of 1,350 – 1,355 points, setting a new three-year high and gradually advancing towards higher levels, with the target zone of 1,380 – 1,400 points in Q3.

This development reflects a significant improvement in investor confidence, especially with the sustained high liquidity in the market over an extended period.

Sectors with positive performance include port services, real estate, agriculture, and finance – areas that benefit from supportive macro policies, improved cash flow, and expectations of an economic recovery trend. Moreover, the strong comeback of domestic cash flow, particularly from individual and institutional investors, has also contributed significantly to the overall index’s upward momentum.

As we move into the second half of 2025, the Vietnamese economy is expected to continue its robust recovery, bolstered by supportive factors both domestically and internationally.

On a global scale, uncertainties that once caused significant fluctuations in financial and commodity markets, such as conflicts in the Middle East or US-China trade tensions, are gradually easing. Additionally, the possibility of the US Federal Reserve lowering interest rates in Q4 2025 is a very positive signal, not only for global financial markets but also for reducing pressure on exchange rates and interest rates in Vietnam.

Domestically, 2025 is a pivotal year in the mid-term public investment plan for 2021-2025, with a total disbursed capital of up to VND 791,000 billion. The government is focusing on implementing key infrastructure projects, including the North-South Expressway and inter-regional expressways, as well as programs for developing new-generation energy sources.

In parallel, the policy of reducing VAT by 2% until the end of 2026 continues to play an important role in boosting domestic consumption and reducing operating costs for businesses. Furthermore, the adjustment of administrative units at the commune level from July 1, 2025, carries not only administrative significance but also contributes to improving state management efficiency and accelerating local investment disbursement progress, which is essential for promoting substantive growth.

Given these factors, Vietnam’s macroeconomic landscape in the last six months of 2025 has a solid basis for sustaining its recovery trajectory and even setting the stage for a new growth cycle in 2026.

Building on this positive macroeconomic backdrop, Vietnam’s stock market in the second half of 2025 is forecast to maintain its upward trend and expand its growth potential in the coming months. After surpassing the 1,350-point milestone, the VN-Index is on a journey towards higher target zones, specifically around the 1,400 – 1,450-point threshold.

Factors supporting this trend include the market’s prospects for an upgrade from frontier to emerging status, improved economic growth, brighter spots in the US-Vietnam trade negotiations, and expectations of looser monetary policies from major central banks worldwide.

In terms of sectors, the groups expected to lead the market include finance – securities, insurance, port services – logistics, construction – building materials, chemicals, textiles, and consumer retail. These sectors are benefiting from both macro support and strong intrinsic business capabilities.

Notably, the financial sector remains in the spotlight, benefiting from the recovery of the capital market, strong inflows of capital, and expectations of profit growth in the coming quarters. The port services and logistics sector is also worth noting, given the increasing role of Vietnam in the global trade landscape due to the ongoing supply chain shift.

Overall, the stock market in the second half is experiencing many favorable conditions, but the differentiation among sectors and individual stocks will become more pronounced, requiring investors to adopt suitable selection strategies and risk management.

For long-term investors, it is advisable to prioritize accumulating stocks with solid fundamentals and valuations that are still attractive relative to their long-term growth potential. Industries supported by macro policies, such as infrastructure, finance, technology, and consumer goods, should be given preference.

At the same time, investors should be prepared to restructure their portfolios when the market experiences strong upward movements to optimize their positions and manage risks effectively.

In the short term, opportunities will arise from liquid stocks that are experiencing upward momentum due to positive earnings performance, supportive news flow, or a return of cash inflows. Stocks in the financial, securities, construction materials, chemicals, and textiles sectors, or those showing positive developments in their production and business operations, should be given priority in monitoring and consideration.

Record-Breaking Revenue for Nghe An Province: A Mid-Year Triumph!

A catchy headline with a proud tone, emphasizing the impressive financial achievement.

“The first half of 2025 witnessed a remarkable economic rebound in Nghe An, with an estimated GRDP growth rate of 9.25%. Various sectors exhibited notable improvements, reflecting a vibrant provincial economy. Despite challenges, state budget revenue collection in the region surpassed VND 13,159 billion, equivalent to 74.2% of the annual estimate, indicating a resilient fiscal performance.”

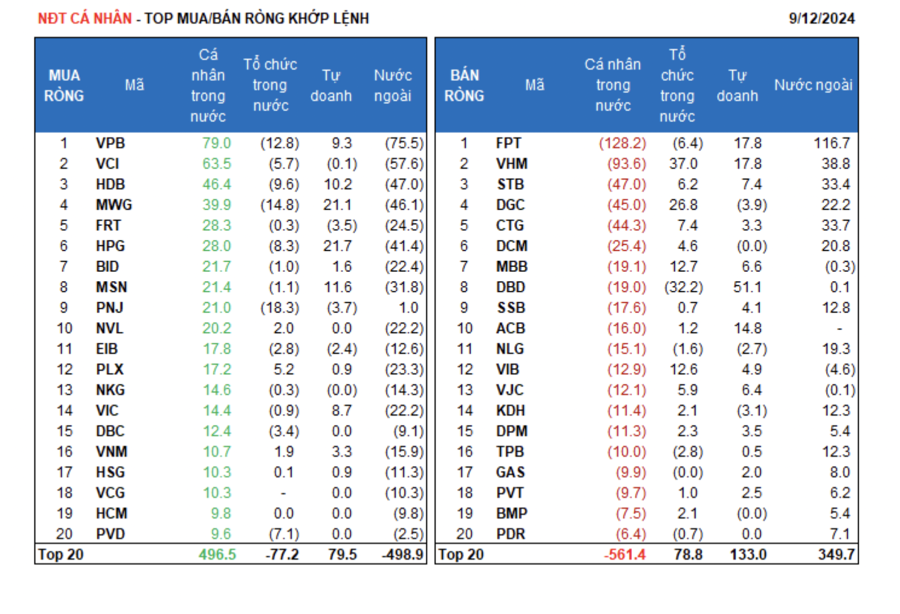

Market Beat July 1: Sellers Dominate, VCB Steps In to Support Index

The VN-Index witnessed a sharp drop in the afternoon session, but swiftly recovered to close above the reference level. The benchmark index of the Ho Chi Minh Stock Exchange ended today’s trading at 1,377.84 points. Meanwhile, the HNX-Index closed below the reference level, edging down 0.8 points to 228.45.

VnDirect: 7 Investment Themes for the End of 2025 – Upgrading the Stock Market Status Quo

“VnDirect anticipates an upgrade for Vietnam to a secondary emerging market by FTSE in September. The securities industry and large-cap stocks in the FTSE Vietnam Index, such as HPG, VIC, VCB, VNM, MSN, and SSI, are expected to benefit from this change.”

The Big Cap Stocks Pull VN-Index Up, But Many Stocks Still in the Red

The selling pressure intensified during the afternoon session, with the VN-Index plunging to its intraday low at 2:15 PM. Successful efforts to prop up large-cap stocks pushed the index back above the reference level, but this had little impact on the majority of other stocks. The sea of red prevailed, with nearly a hundred stocks falling over 1%.