Decree 158 of the Government, effective from July 1, details and guides the implementation of several articles of the Social Insurance Law on compulsory social insurance, clarifying the monthly allowance regime for those who do not meet the conditions to enjoy retirement benefits.

Accordingly, the regime for employees who do not meet the conditions to enjoy retirement benefits and are not old enough to receive social retirement allowances is implemented according to the regulations in Articles 23 and 24 of the Social Insurance Law and is detailed as follows:

Specifically, according to Decree 158, the subjects of application are employees as prescribed in Clause 1, Article 2 of the Law on Social Insurance, who are of retirement age and have social insurance payment history but do not meet the conditions to enjoy retirement benefits as prescribed and are not eligible for social retirement allowances under Article 21 of the Law on Social Insurance.

The condition for enjoyment is that the above-mentioned subjects do not enjoy social insurance benefits once, do not preserve the social insurance payment history, and must request to enjoy the monthly allowance.

From July 1, those who do not meet the conditions to enjoy retirement benefits will receive a monthly allowance. Illustrative image.

The period of enjoyment of the monthly allowance is determined based on the employee’s payment history and the basis of social insurance contribution.

The period of enjoyment of the monthly allowance is determined within the period from the month the employee has a written request when they are old enough to retire until they are old enough to receive a social retirement allowance according to the law at the time of settlement.

In case the period of enjoyment of the monthly allowance exceeds the period until the employee is old enough to receive the social retirement allowance, the employee shall be entitled to enjoy the monthly allowance at a higher level according to the regulations in Clause 2, Article 24 of this Decree.

In case the period of enjoyment of the monthly allowance is not enough for the employee to receive the monthly allowance until they are old enough to receive the social retirement allowance, if the employee wishes, they can pay once for the remaining period to enjoy it until they are old enough to receive the social retirement allowance…

Regarding the level of monthly allowance, according to Decree 158, the monthly allowance is calculated based on the level of social retirement allowance prescribed in Clause 1, Article 22 of the Law on Social Insurance at the time of settlement of the monthly allowance.

Clause 1, Article 22 of the Law on Social Insurance stipulates that the level of social retirement allowance is prescribed by the Government, suitable for socio-economic development conditions and the state budget capacity of each period. Every three years, the Government reviews and considers adjusting the level of social retirement allowance.

Depending on socio-economic conditions, budget balance, and mobilization of social resources, the provincial People’s Committees shall submit to the Provincial People’s Councils to decide on additional support for those enjoying social retirement allowances.

Also according to Decree 158, in case the period of enjoyment of the monthly allowance exceeds the period until the employee is old enough to receive the social retirement allowance, the employee shall be entitled to enjoy the monthly allowance at a higher level than the social retirement allowance at the time of settlement.

The monthly allowance shall be adjusted when the Government adjusts retirement benefits as prescribed in Article 67 of the Law on Social Insurance.

The employee’s written request for the monthly allowance shall be made according to the form issued by Vietnam Social Insurance.

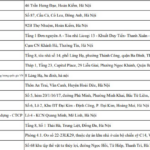

The Big Pay Out: Announcing the July 2025 Schedule for Hanoi’s Social Insurance Payouts, Totaling 4,000 Billion VND in Pension and Benefit Payments.

The operational structure of Hanoi’s government will not impact the social insurance payment schedule. From the 1st of July onwards, the city will implement a two-tier administration system, ensuring seamless and efficient governance. This strategic reorganization aims to enhance the city’s management and service delivery without causing any disruptions to the existing social security framework.

What are the Scenarios that Disqualify Individuals from Withdrawing Social Insurance Benefits in One Go, Effective July 1st?

The new Social Insurance Law of 2024 will come into force on July 1st, 2025, with significant revisions and additions to its provisions. One of the key highlights of this updated legislation is the introduction of a new one-time social insurance regime, marking a pivotal change in social security benefits for citizens.

Microsoft Vietnam Named in Social Insurance Delinquency List for 3 Billion VND

Microsoft Vietnam Limited Liability Company has been operating since 2007 as a subsidiary of Microsoft Corporation (USA), a global technology leader.