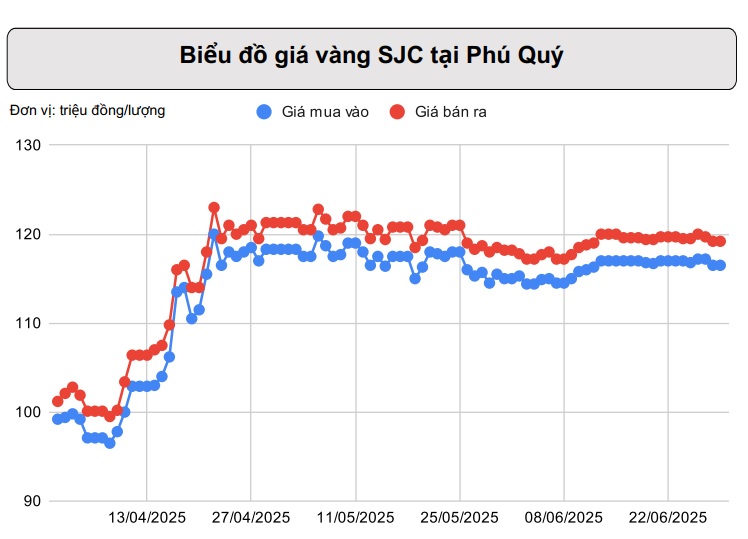

According to market analysts from Phu Quy Gem and Gold Group, international gold prices fell for the second consecutive week as trade tensions eased and China loosened export restrictions on certain goods to the US. Meanwhile, both countries agreed to abide by the accords reached in Geneva and London, boosting risk appetite and diverting funds to other assets such as equities.

This week, the market will face crucial economic data that could impact gold prices. Specifically, inflation data from Europe and the UK will pave the way for future interest rate decisions in these regions. In contrast, US job market data will directly influence the Fed’s mid-July meeting agenda.

Additionally, as we near the end of the second quarter and approach the US Independence Day holiday on July 4th, American investors and speculators may opt to square off profitable positions ahead of the long weekend. This could trigger significant volatility in the gold market and the broader financial landscape.

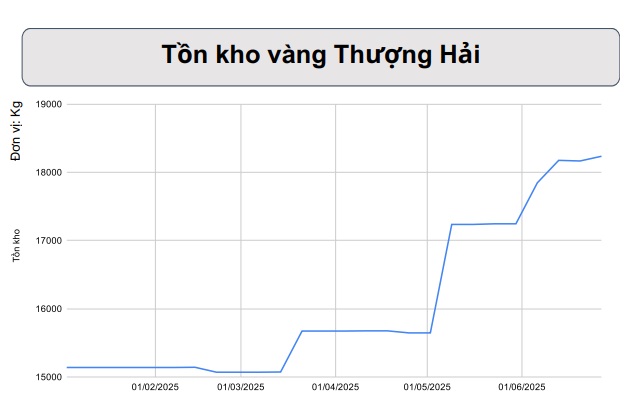

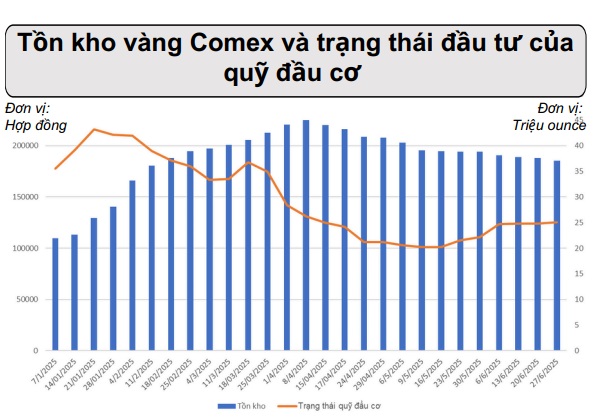

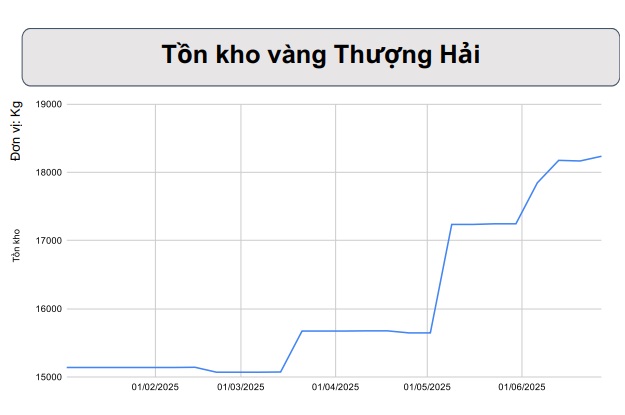

Turning to gold inventories, stocks in Shanghai witnessed a slight increase, whereas COMEX inventories continued to decline. The state of speculative funds also experienced a minor dip as gold prices retreated from peak levels. This situation could exert considerable pressure on gold prices in the short and medium term.

Analysts from Phu Quy predict that profit-taking at the peaks is pushing gold prices towards the middle of the long-term ascending channel. Gold prices remain on an upward trajectory, but corrective pressures may persist as prices seek liquidity to sustain their ascent. The gold price target is envisioned around $3,100 per ounce, near the lower band of the ascending channel.

However, should economic data continue to weaken, driving the US dollar lower, gold prices may find short-term support around the $3,250 liquidity zones.

Gold Prices Stall, SPDR Gold Trust Maintains Outflow

The recent inability of gold prices to rally amidst escalating geopolitical tensions in the Middle East is indicative of a precious metal that has run out of steam in the short term.

The Greenback Slumps to a Three-and-a-Half-Year Low

The specter of Trump’s tariff policies is once again haunting investors as the July 9 deadline for the 90-day tariff truce approaches. With the clock ticking, markets are on edge as they anticipate the potential fallout from renewed trade tensions. As the temporary ceasefire draws to a close, all eyes are on the potential implications for global trade and economic growth.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)