Global stocks are buoyed by positive trade news. According to US Trade Representative Howard Lutnick on June 26, the US and China have finalized a framework trade agreement.

On June 27, US Treasury Secretary Scott Bessent said the US expects to finalize trade deals with 18 major partners outside of China before September 1. US officials are currently in active negotiations with economies such as India, Vietnam, South Korea, Japan, and the European Union.

In the past trading week, the VN-Index surpassed the 1,360-point peak, reaching a three-year high, but liquidity did not increase. Compared to the weeks at the end of May and the beginning of June, when the VN-Index was in the 1,350-point range, the market liquidity reached over 25,500 billion VND, but in the last three weeks, liquidity has not reached 23,000 billion VND.

The market’s increase was mainly concentrated in the first two sessions, after which the market fluctuated within a narrow range, and liquidity also decreased from the threshold of 26,600 billion VND to 22,000 billion VND in the last three sessions. The decrease in market liquidity is also reflected in leading stocks such as Vingroup, where net inflows have declined for five consecutive weeks, while the concentration of capital has decreased from a market weight of 8% to 5.1% in the past week.

A positive signal for the market is that the breadth remains quite positive despite the decrease in liquidity, but money is spreading, especially in export stocks or stocks affected by tariffs at the beginning of April.

Commenting on the market situation, Mr. Nguyen The Minh, Director of Individual Customer Analysis at Yuanta Securities, said that contrary to a few weeks ago, countries are becoming more optimistic about the results of tariff negotiations, with 10-12 initial trade agreements expected and another 20 agreements to follow.

At the same time, the US also sent a message that it does not want to separate, indicating that the negotiations may be more relaxed. In addition to Japan and India, the EU is also expected to reach an agreement in July 2025, especially as the G7 has announced a joint declaration of tax exemption for US goods.

President Trump also sent a message that he had made four to five trade agreements, and the deadline for taxation on July 9 could be extended or shortened. Thus, with the easing of trade tensions between the US and China, negotiations between the US and Vietnam will also have more positive signals.

Vietnam remains an important supply chain for the US, and the US has also considered Vietnam as a possible replacement for the supply chain from China, as Ms. Yellen has stated. Therefore, the scenarios for tariffs on Vietnamese goods may change as tensions ease, and Yuanta is more optimistic about the negotiation results as it still assesses the importance of Vietnam’s supply chain to the US economy.

Yuanta’s experts proposed a high-probability scenario of imposing taxes by industry according to the origin of goods at a rate of 10-15%.

Also, according to Yuanta’s analysis, the V-shaped model in the first six months is defined as the S&P 500 index falling more than 18% and then quickly recovering to a one-year high within three months. By the end of June 2025, this V-shaped model reappeared and predicted a strong market performance afterward.

According to statistics on the S&P 500 index data from 1927–2025, the V-shaped model in the first six months always creates a very strong signal about the market’s rebound, with the results showing: “Such a strong recovery is an extremely positive signal, with a 100% probability of growth in the following year. The average profit of 21.71% after one year is very high compared to the long-term average growth rate of the S&P 500 (~8–10%/year). The probability of profit after three months, six months, and one year is very high, especially after two months (86–100%).”

The Vietnamese stock market often moves in tandem with the US stock market. Nevertheless, the price strength of the VN-Index has improved but remains neutral, so the Vietnamese stock market will still experience a split and avoid spreading too much into different stock groups, prioritizing holding outstanding leading stocks.

MBS Securities believes that this week is crucial for the retaliatory tax rate, and the signal of decreasing liquidity, despite the VN-Index surpassing the 1,360-point peak, shows that the psychology of waiting for clearer information will continue to dominate the market. In this context, liquidity may continue to decrease this week.

A positive scenario for the market is a retaliatory tax rate for Vietnam below 15.5%, and the tax rate for the base scenario will range from 15-20%. In addition, it is expected that the retaliatory tax rate will be applied specifically to basic goods (high domestic content) and goods originating from China. For basic goods (purely domestic or highly localized), the retaliatory tax rate will be lower than for goods originating from China.

Technically, the VN30 index, after two weeks of strong increases, is heading towards the historical peak of 1,500–1,545 points, and the spot market will be cautious about the index, likely moving sideways within a narrow range, waiting for information, with a notable resistance zone at 1,380–1,386 points and a support zone at 1,350–1,356 points.

The market is betting on a positive outcome for the retaliatory tax rate but with a classification according to the origin of goods. After the tax information, it is the season for semi-annual business results reports. Stock groups oriented towards the domestic market remain noteworthy, and investors can allocate a proportion to groups that are attracting capital, such as Export, Food, and Retail.

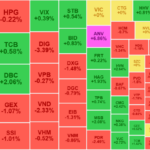

Market Beat July 1: Sellers Dominate, VCB Steps In to Support Index

The VN-Index witnessed a sharp drop in the afternoon session, but swiftly recovered to close above the reference level. The benchmark index of the Ho Chi Minh Stock Exchange ended today’s trading at 1,377.84 points. Meanwhile, the HNX-Index closed below the reference level, edging down 0.8 points to 228.45.

Stock Market Blog: Money Goes Round and Round, Awaiting the Next Big Push

The market may appear “green on the outside, red on the inside” today, but this is not out of the ordinary. Profit-taking has been shortening the cycles of price hikes as investors focus on safeguarding their gains ahead of the upcoming final countervailing duties.

The Big Cap Stocks Pull VN-Index Up, But Many Stocks Still in the Red

The selling pressure intensified during the afternoon session, with the VN-Index plunging to its intraday low at 2:15 PM. Successful efforts to prop up large-cap stocks pushed the index back above the reference level, but this had little impact on the majority of other stocks. The sea of red prevailed, with nearly a hundred stocks falling over 1%.