The market experienced a volatile first trading session of July. The main index opened slightly higher, inching towards the 1,380-point mark. However, weak liquidity and declining buying pressure led to strong fluctuations in the afternoon session. At the close, the VN-Index gained 1.77 points (+0.13%) to reach 1,377.84 points. Foreign investors turned net sellers with a net sell value of VND 349 billion on the entire market.

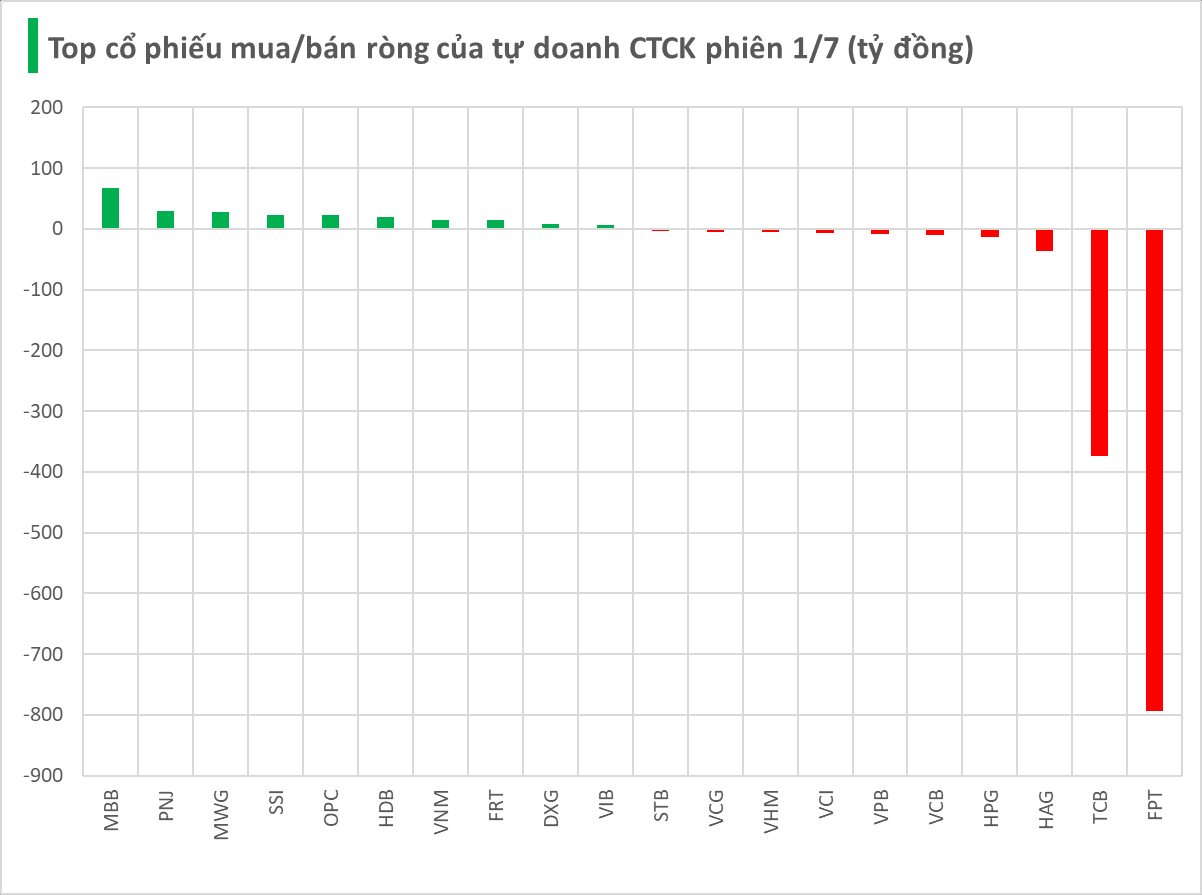

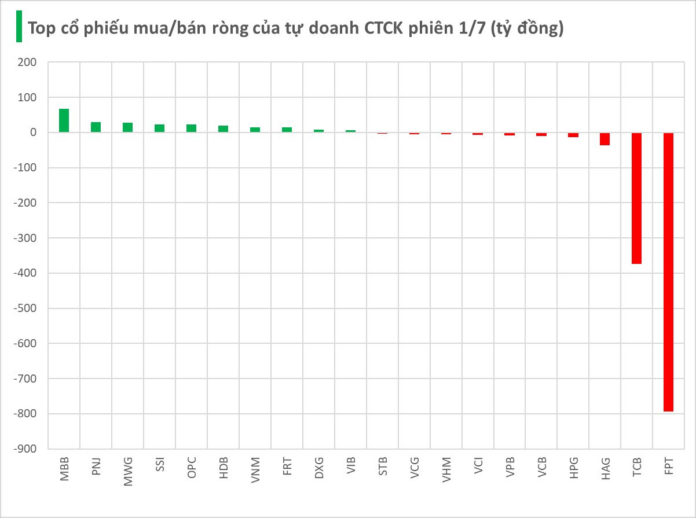

Securities companies’ proprietary trading activities recorded a sudden net sell value of VND 997 billion on the HoSE.

Specifically, securities companies net sold the most in FPT and TCB, with respective values of VND 794 billion and VND 374 billion. This was followed by HAG, which was net sold for VND 37 billion. Other stocks that experienced net selling today included HPG, VCB, VPB, VCI, VHM, VCG, and STB…

On the other hand, securities companies net bought MBB and PNJ, with respective values of VND 68 billion and VND 29 billion. MWG was also net bought for VND 27 billion. Other stocks that were net bought included SSI, OPC, HDB, VNM, FRT, DXG, and VIB…

“VNDirect Raises VN-Index Projection to 1,450 Points: Identifying the Key Sectors”

“VNDirect forecasts a robust profit growth of 14-15% for listed companies this year, reinforcing the VN-Index’s valuation at an estimated forward P/E of 13.5 times by year-end.”

With Expected Tariff Cuts of 10-15%, Historical Trends Suggest a Continued Bull Run for Vietnam’s Stock Market

The experts at Yuanta predict a likely scenario of a tariff regime based on a good’s origin, with rates ranging from 10% to 15%.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)