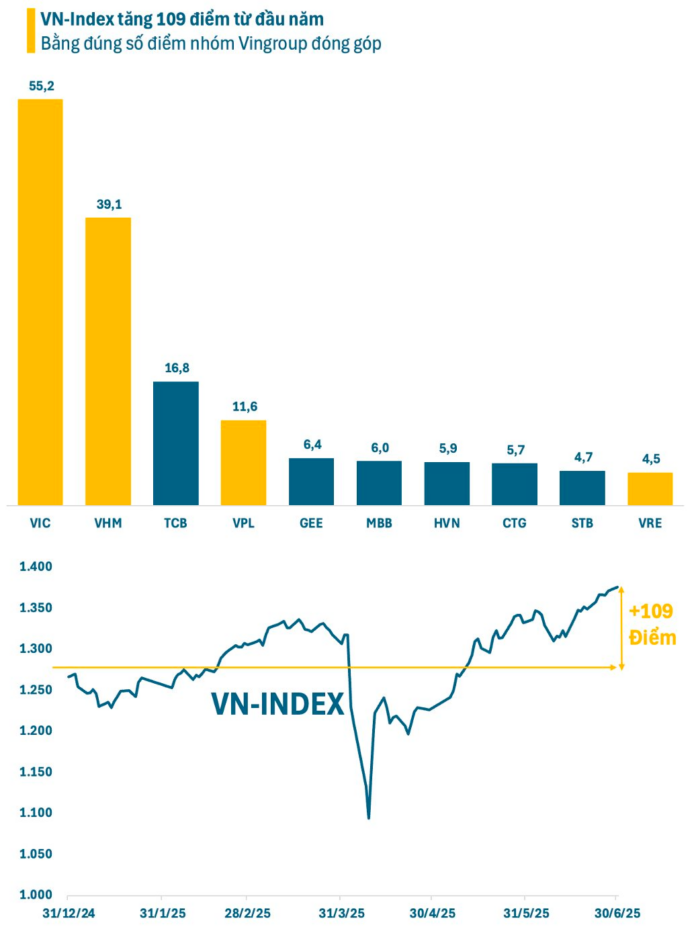

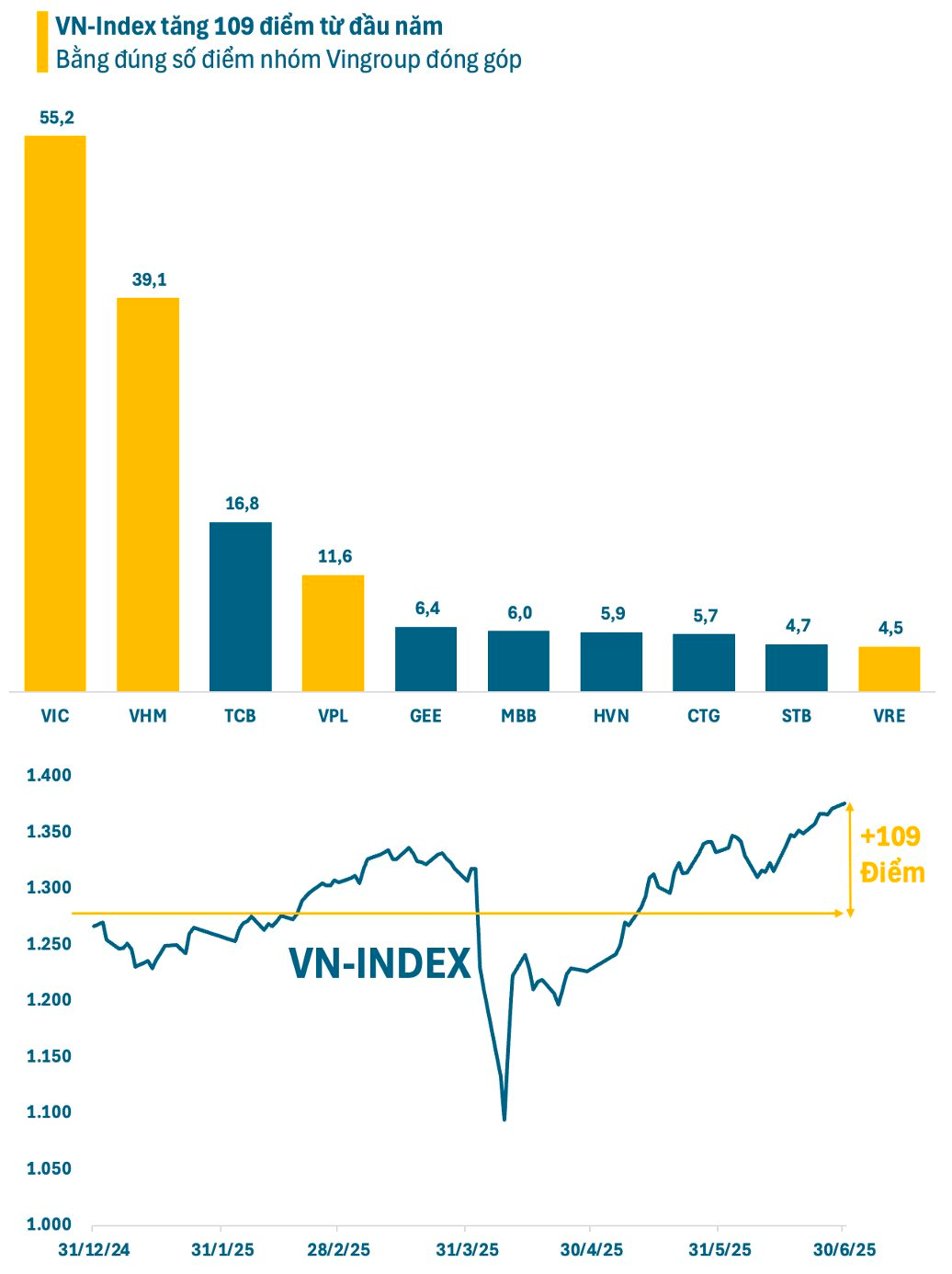

The Vietnamese stock market closed the first half of 2025 on a positive note, with the VN-Index ending at 1,376.07 points – the highest in over three years since April 2022. Since the beginning of the year, the index has gained more than 109 points, equivalent to approximately 8.6%. Interestingly, the VN-Index’s gain from the start of the year exactly matches the contribution from the Vingroup conglomerate (VIC, VHM, VPL, and VRE).

This partly explains why the market has seen strong gains, yet many investors remain unhappy. The upward momentum has been concentrated on a select few stocks, while most codes on the exchange have declined year-to-date, including prominent Bluechips such as FPT, VNM, SAB, VCB, and BID, among others.

In the first half, Vingroup’s stocks witnessed substantial gains of several dozen percent, and even doubled in some cases. Many investors are concerned that a correction in these stocks could impact the broader market. However, the Vingroup stocks have maintained their long-term peak prices. Moreover, many pillar stocks still have room for growth after a period of relative quiet.

As the VN-Index hovers near a three-year peak, profit-taking pressure is inevitable. Additionally, the Vietnamese stock market faces short-term challenges, including: (1) global economic and geopolitical instability; (2) escalating exchange rates; and (3) continued foreign capital outflows from frontier and emerging markets.

Another critical factor that may influence the stock market in the coming period is the issue of US tariffs. In their recently published strategy report, VNDirect presents an optimistic outlook on tariff negotiations between Vietnam and the US, anticipating a countervailing duty of around 16-22% in the base case scenario.

Furthermore, the analysts expect the Fed to execute two rate cuts in the latter half of the year, keeping the DXY index below 100. Domestically, a solid macroeconomic foundation continues to underpin the market: GDP growth is projected at 7.3%, and credit growth at 16%.

These factors are expected to support the growth of listed companies’ profits this year by around 14-15%, thereby bolstering the VN-Index’s projected P/E ratio of 13.5 times by year-end. VNDirect has upwardly revised its VN-Index forecast for the end of 2025 from 1,400 to 1,450 points, representing a 14% increase compared to the end of 2024.

In the long term, Vietnam’s stock market prospects are highly regarded by numerous prominent domestic and international organizations due to: (1) stable macroeconomic conditions and government initiatives to boost the economy; (2) the potential for profit growth among listed companies; and (3) increasing clarity around market upgrades following concerted efforts by regulatory authorities.

With Expected Tariff Cuts of 10-15%, Historical Trends Suggest a Continued Bull Run for Vietnam’s Stock Market

The experts at Yuanta predict a likely scenario of a tariff regime based on a good’s origin, with rates ranging from 10% to 15%.

“Brokerage Fees Rise as VAT Takes Effect”

The recent introduction of a new value-added tax law has led to a stir in the stockbrokerage community. With a 10% tax rate now applicable to certain previously exempt securities operations, brokerages are having to adjust their service fee structures accordingly. This has sparked a wave of announcements from brokerages, notifying their clients of the impending changes.

“PM Requests JBIC to Facilitate Financial Restructuring for the Nghi Son Refinery and Petrochemical Project”

The Nghi Son Refinery and Petrochemical Complex Project (NSRP) is undergoing a comprehensive restructuring by the Government of Vietnam. As the leading financier, JBIC is urged to continue taking a central role in addressing challenges and paving the way for Phase 2. The Prime Minister calls for a spirit of transparent cooperation, effectiveness, and shared risk management to guide this endeavor.