The market gained slightly, but the green spread evenly across most sectors, indicating that there is no longer an overly negative or pessimistic sentiment regarding the retaliatory tariffs that the US will impose on Vietnam at the beginning of July. The closing index rose 4.63 points, advancing further into the 1,376 range, the highest in three years, with a broad advance-decline ratio of 216 gainers over 92 losers.

There weren’t many highlights, except for the seafood group, which surged today due to the prospect of low tariffs. ANV hit the daily limit, while MPC, FMC, and IDI also saw significant gains. The food sector also excelled today, with DBC up 6.25% and PAN up 3.15%. Meanwhile, most other sectors gradually climbed higher.

In the large-cap sector, leading banks such as VCB, BID, TCB, MBB, and ACB posted average gains of 0.5%. The real estate sector was robust in the residential group, including NLG, PDR, and KDH, as well as industrial zones, with SIP, BCM, and KBC breaking free from psychological barriers. However, the Vin group appeared relatively weak, with VHM and VRE in the red, while VIC hovered around the reference price.

Despite being unaffected by tariffs and the government’s continuous push for upgrading, securities stocks have yet to break out, with SSI, VCI, and VIX posting insignificant gains, while VND traded around the reference price.

Overall, the market anticipates that the tariffs imposed by the US on Vietnam will be relatively low at 10-15%. Sectors directly impacted by tariffs, such as logistics, exports, and industrial real estate, are gradually turning positive again.

The sentiment is positive, but the money flow is not yet fully engaged. Today’s total matched transactions across the three exchanges were low at VND 20,500 billion, while foreign investors started to buy strongly again, with a net buy value of VND 541.6 billion. Specifically, in matched transactions, they net bought VND 589.5 billion.

Foreign investors’ main net bought matched transactions were in the Food & Beverage and Financial Services sectors. The top net bought matched transactions by foreign investors included MSN, NLG, DBC, VND, MWG, HDC, FRT, STB, PDR, and VIX.

On the net sell side of matched transactions by foreign investors was the Basic Resources sector. The top net sold matched transactions by foreign investors included HPG, VHM, BID, KDH, SAB, HDG, VPB, KBC, and VNM.

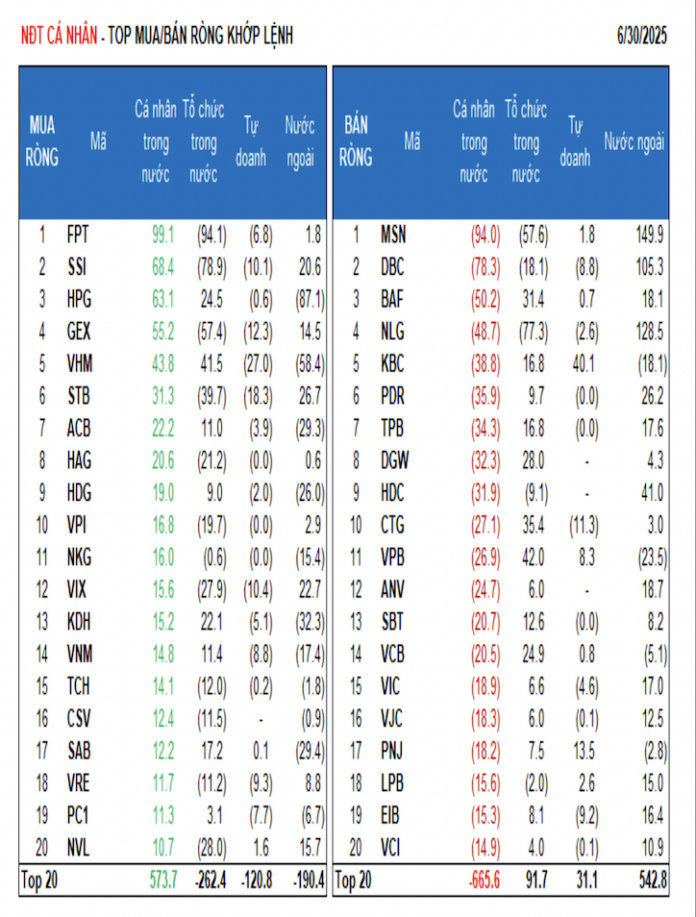

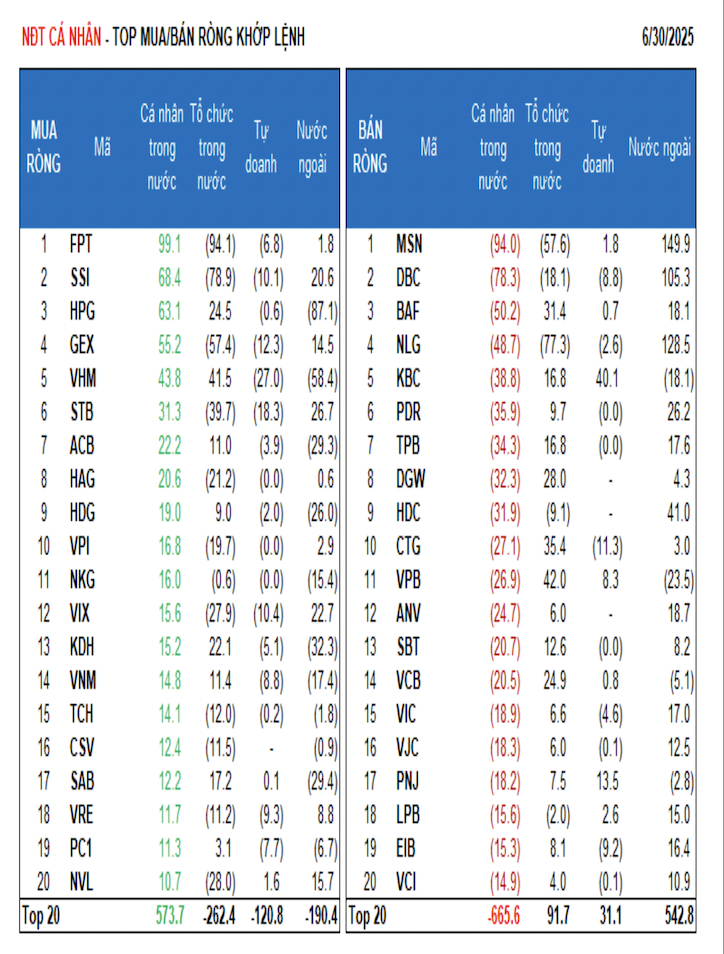

Individual investors net sold VND 130.5 billion, of which VND 177.6 billion was net sold in matched transactions. Specifically, in matched transactions, they net bought 8/18 sectors, mainly in the Information Technology sector. The top net bought by individual investors included FPT, SSI, HPG, GEX, VHM, STB, ACB, HAG, HDG, and VPI.

On the net sell side of matched transactions, they net sold 10/18 sectors, mainly in the Food & Beverage and Banking sectors. The top net sold included MSN, DBC, BAF, NLG, KBC, PDR, DGW, HDC, and CTG.

Proprietary trading net bought VND 181.8 billion, of which VND 106.3 billion was net sold in matched transactions. Specifically, in matched transactions, proprietary trading net bought 5/18 sectors. The group with the largest net buy was Personal & Household Goods, Automobiles & Parts. The top net bought matched transactions by proprietary trading today included VIB, KBC, E1VFVN30, PNJ, FUEVFVND, VPB, MWG, DRC, ELC, and LPB. The top net sold was the Banking sector. The top net sold stocks included VHM, TCB, MBB, FRT, STB, GEX, CTG, VIX, SSI, and GMD.

Domestic institutional investors net sold VND 643.4 billion, of which VND 305.5 billion was net sold in matched transactions. Specifically, in matched transactions, domestic institutions net sold 11/18 sectors, with the largest value in the Financial Services sector. The top net sold included FPT, VND, SSI, NLG, MWG, MSN, GEX, STB, VIB, and NVL. The group with the largest net buy value was the Banking sector. The top net bought included BID, VPB, VHM, CTG, MBB, BAF, TCB, DGW, VCB, and HPG.

Today’s matched transactions value reached VND 2,494.8 billion, up 37.9% from the previous session and contributing 12.1% of the total transaction value. Today, there was a notable transaction in MSN stock, with more than 12.5 million shares worth VND 961.4 billion changing hands between domestic institutions.

In addition, domestic institutions also conducted matched transactions in the Banking sector (VIB, VCB, HDB), large-cap stocks (FPT, VHM, SSI), and SIP.

The money flow allocation ratio increased in Securities, Steel, Chemicals, Agriculture & Seafood, Oil & Gas, Software, Warehousing, and Personal Finance, while it decreased in Real Estate, Banking, Construction, Food, Retail, Electrical Equipment, Textiles, and Courier Services.

Specifically, in matched transactions, the money flow allocation ratio increased in the mid-cap VNMID and small-cap VNSML groups and decreased in the large-cap VN30 group.

Who are Vietnam’s Richest Stock-Market Billionaires in the First Half of 2023?

“Billionaire Pham Nhat Vuong tops Vietnam’s stock market wealth rankings with a staggering net worth of VND 184,223 billion. His wealth approximates the combined fortunes of the next eight richest individuals.”

The Coastal Road Connects the East-West Economic Corridor: A Capital Conundrum

The project is envisioned as a vital transportation artery, boosting the economic and social development of Quang Tri Province and the Central region of Vietnam. With its interregional and international connections, it will facilitate trade and improve accessibility, acting as a catalyst for growth and progress in the area.

With Expected Tariff Cuts of 10-15%, Historical Trends Suggest a Continued Bull Run for Vietnam’s Stock Market

The experts at Yuanta predict a likely scenario of a tariff regime based on a good’s origin, with rates ranging from 10% to 15%.