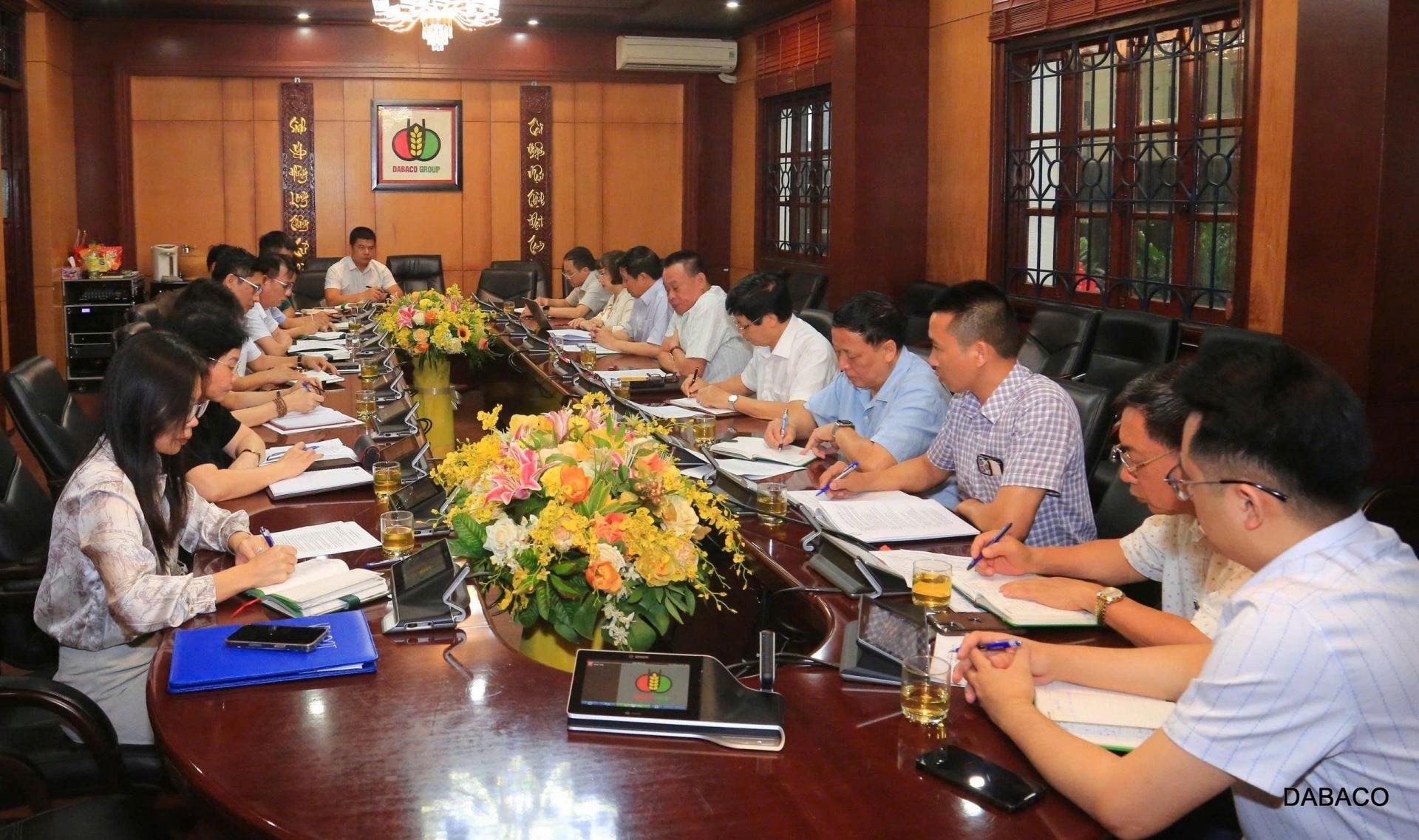

Dabaco Vietnam Group Corporation (code: DBC) has just held a meeting to evaluate its business results for Q2 2025, deploy tasks for Q3 2025, and the remaining months of the year.

According to the announcement, in the first six months of 2025, the company’s revenue reached VND 12,537 billion, up 7.3% compared to the same period last year, providing a solid foundation for the breakthrough acceleration phase in the latter part of the year. The company has completed 101% of its full-year 2025 profit plan, 4.6 times higher than the same period last year.

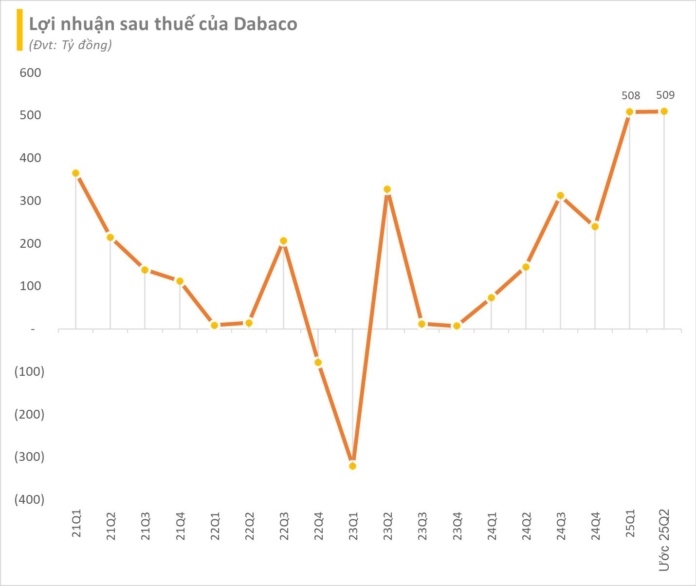

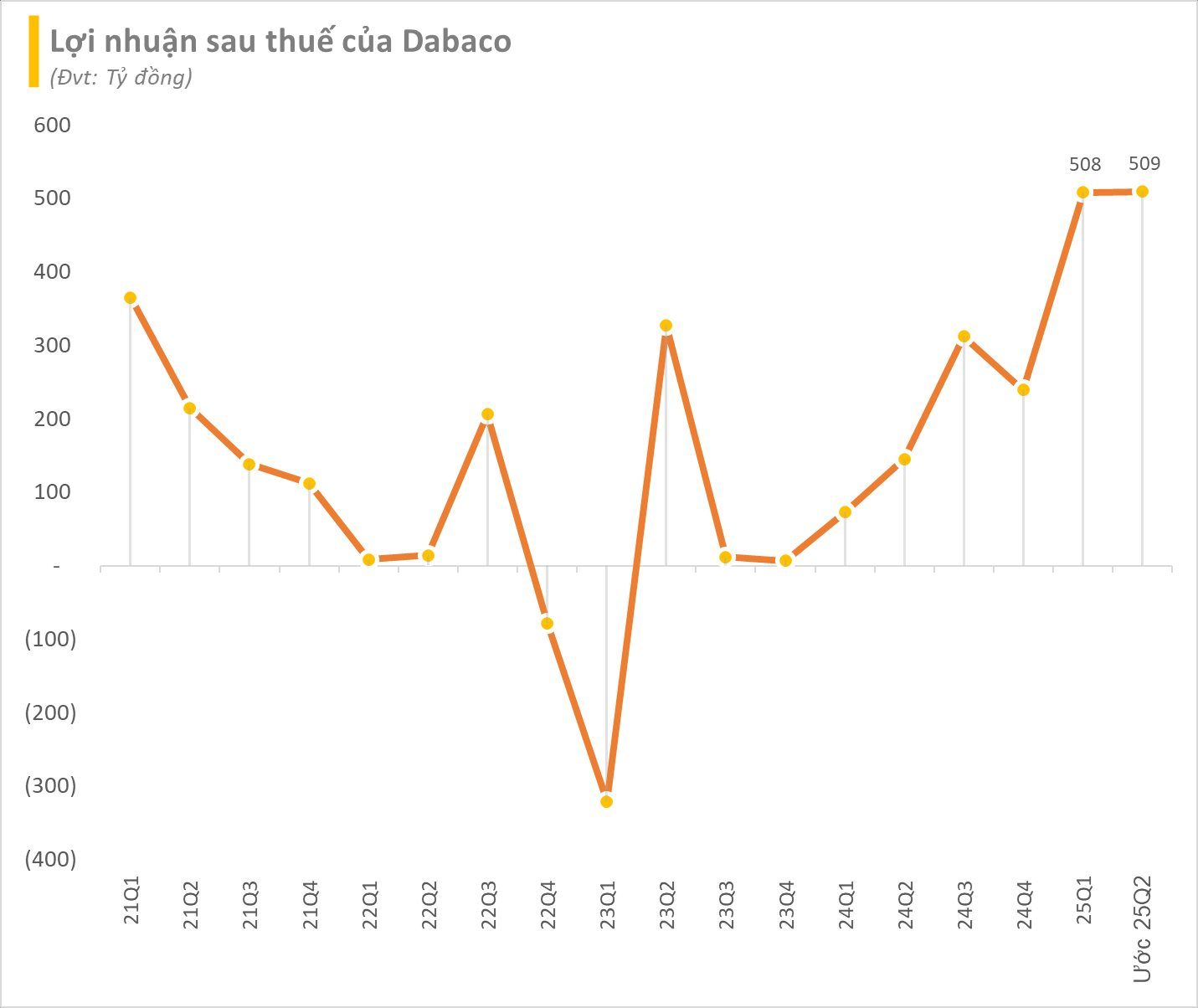

In 2025, Dabaco sets a target of VND 28,759 billion in revenue and VND 1,007 billion in after-tax profit. Thus, the company’s profit for the first six months reached approximately VND 1,017 billion, with an estimated profit of VND 509 billion in Q2 alone, up 251% over the same period last year , simultaneously setting the highest profit for a quarter recorded by the company.

According to DBC, in the context of a volatile market, along with inflation risks and tight monetary policies in many countries, the company still demonstrates its strong internal resources and stable, superior operation, closely following the strategic orientation of the sustainable development model of 3F+ (Feed – Farm – Food & Future).

Besides focusing on aggressively implementing and accelerating the progress of investment projects, DBC pays special attention to research, improvement, and enhancing the productivity and quality of its products; reviewing and reducing costs, and thoroughly saving expenses to lower production costs. Especially, the process of vaccination and biosecurity work is carried out seriously and effectively, helping the units maintain stability and ensure disease safety; the market system is expanded in terms of scale, quantity, and quality. As a result, all main business fields such as animal feed, livestock, and poultry, and vegetable oil have achieved good results.

Continuing the growth momentum, Dabaco officially launched a nationwide expansion campaign, implementing a series of high-tech farm projects in key localities. Q3 will mark a strategic milestone as the Group commences the construction of a series of projects in the core business and production fields, including: Animal Feed Factory in Ha Tinh (expected to be started in July 2025), followed by high-tech livestock projects in Quang Ninh, Quang Tri, Thanh Hoa, Thai Nguyen, and Lao Cai… along with the establishment of subsidiaries to directly invest, operate, and deploy modern closed-loop breeding, processing, and distribution complexes. Each project is a “strategic stronghold” in Dabaco’s development map, contributing to the formation of one of the largest industrial farm systems in Vietnam, determined to achieve the goal of increasing the basic sow herd to 80,000 and over 2 million pigs by 2028.

In the context of rampant counterfeit and unidentified food products, Dabaco affirms its role as a “pioneering fortress in protecting consumers” by comprehensively tightening its internal value chain: from breeds, feed, farming, processing to distribution, all are strictly controlled by high technology and a transparent traceability system.

At the meeting, the Board of Directors also approved the selection of Ernst & Young Vietnam LLC as the service provider for the review of the semi-annual financial statements (first 6 months) and the audit of the 2025 financial statements.

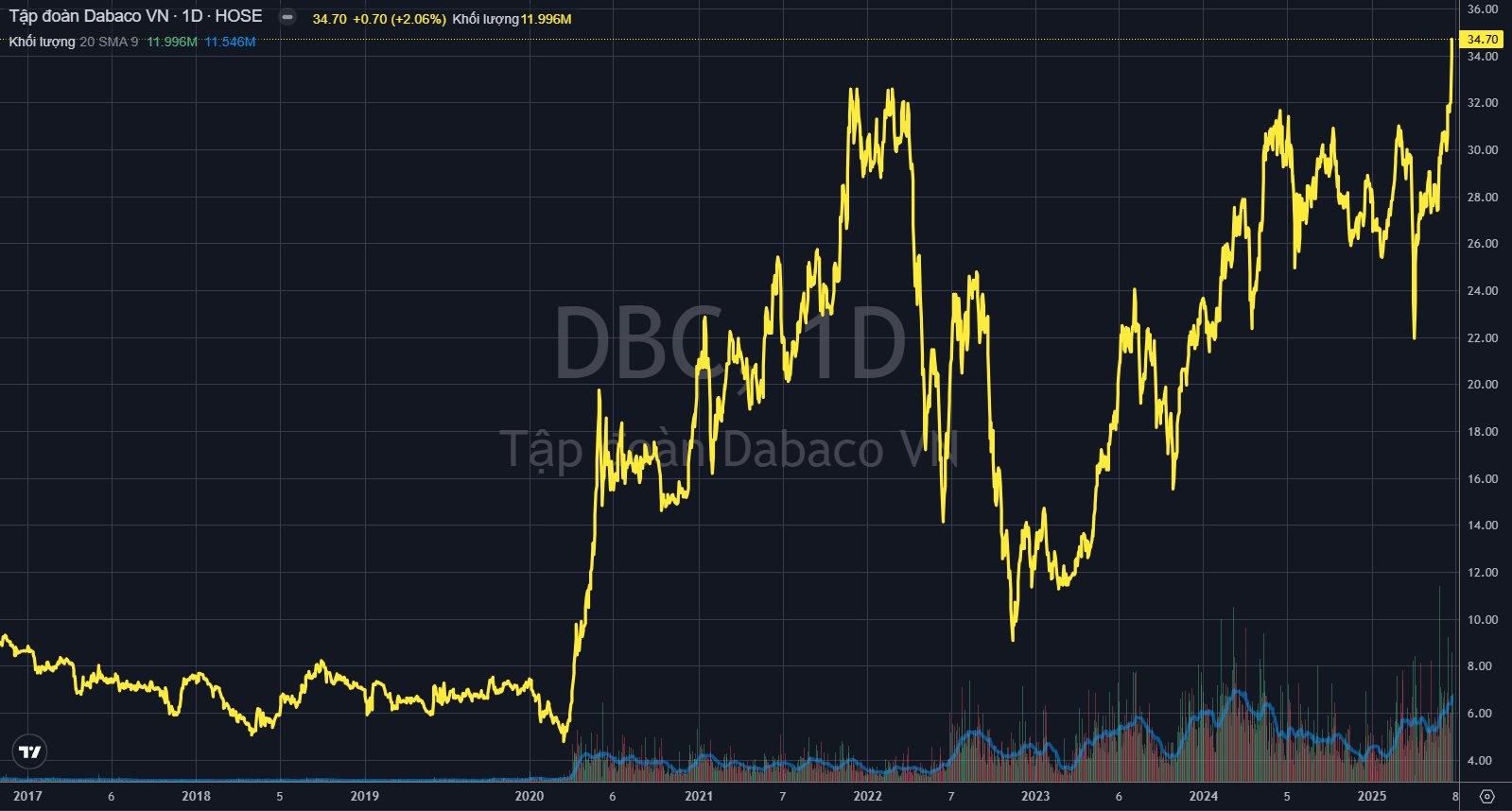

In the stock market, after a period of sideways trading, DBC stock suddenly broke out strongly from the beginning of June. After one month, DBC price surged nearly 27% to a new peak of VND 34,700/share. Dabaco’s market capitalization also set a record of over VND 11,600 billion.

The Livestock Mogul Dabaco Reports Six-Month Profit Surpassing Annual Plan

As announced by Dabaco (HOSE: DBC), the Group has achieved 101% of its full-year 2025 profit plan in just six months. Based on the plan announced at the 2025 Annual General Meeting of Shareholders, the leading agribusiness conglomerate is estimated to have earned after-tax profits of over VND 1,000 billion.

“OCB and OCBS Securities Sign Comprehensive Strategic Partnership”

On May 28, 2025, Orient Commercial Joint Stock Bank (OCB) and OCBS Securities Joint Stock Company (OCBS) solidified their partnership by signing a comprehensive strategic cooperation agreement. This momentous occasion marked a significant step forward in both entities’ journey to enhance customer benefits and experiences.

The Big Players in Textile Industry Navigate a 90-Day Tariff Reprieve from the US

Amidst the pressures of price-sharing, order competition, and tariff risks, prominent textile and garment enterprises such as Vinatex, Hoa Tho, Huegatex, and M10 are in a 90-day sprint before the tariff exemption ends. With the volatile American market, the garment industry is compelled to pivot, diversify risks, and pinpoint strategies for the third quarter of 2025.