Rising NPLs Postpone Bank Valuation Reset

According to the State Bank of Vietnam, as of January 2025, the non-performing loan (NPL) ratio of the entire banking system reached 4.3%, an increase of nearly 2.3 percentage points compared to the end of 2022, concentrated in a few weak banks or those under special control. The rise in NPLs not only affects the business operations of credit institutions but also impacts the valuation of bank stocks in the stock market.

During the 2017-2023 period, through the mechanism of Resolution No. 42/2017/QH14 (Resolution 42), the upward trend in NPLs was relatively well controlled. The resolution allowed banks to seize secured assets, simplified bad debt handling procedures in courts, and facilitated coordination with relevant authorities in enforcement. The process of handling secured assets was expedited and made more efficient, helping to maintain the NPL ratio below the 3% target from 2017 to 2022.

At the end of 2023, when this resolution expired, the banking system lost an important legal tool and had to revert to lengthy and inefficient litigation procedures, leading to an increase in NPLs and a decline in stock valuations.

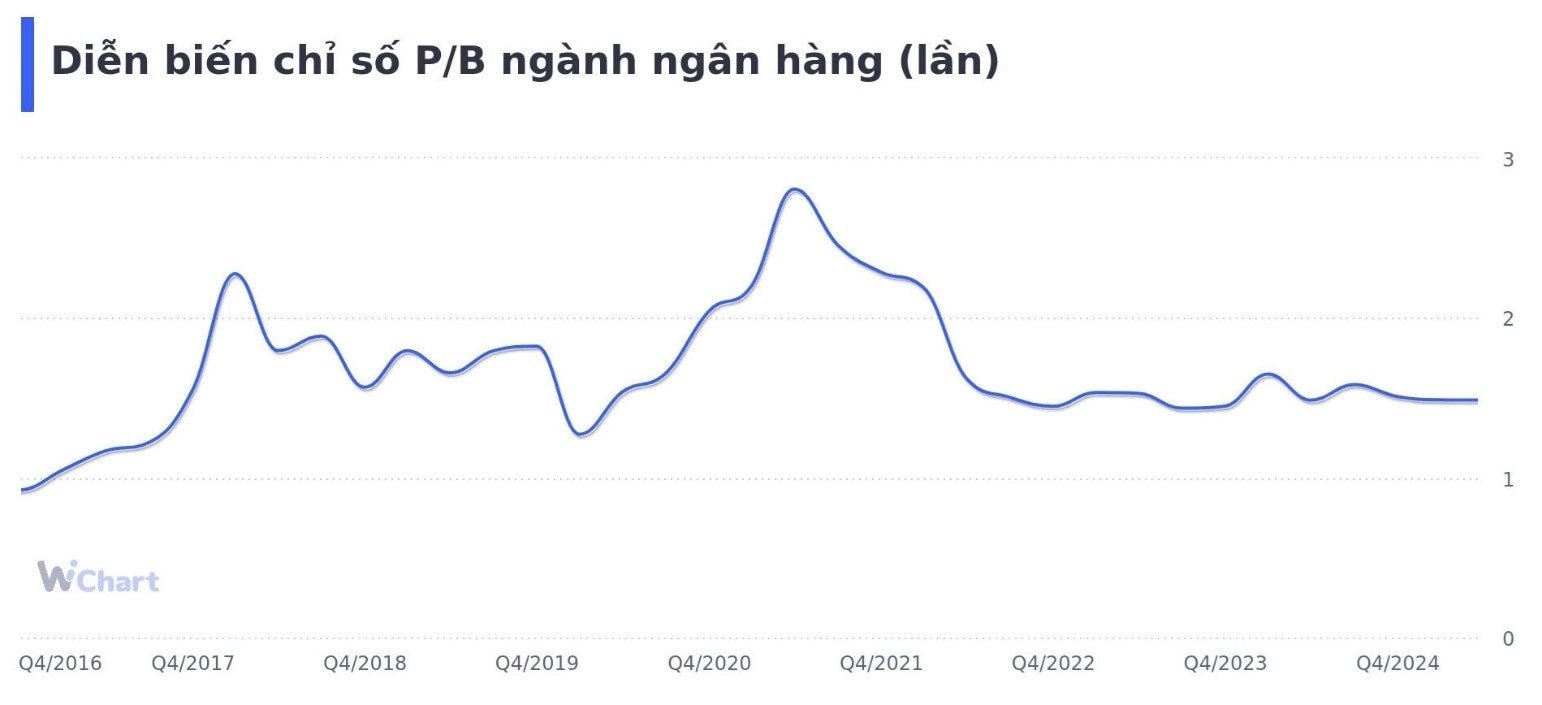

According to data from WiChart, the average P/B (price-to-book) ratio for the entire industry has dropped to around its lowest level in recent years, reaching only about 1.5 times as of mid-June 2025. This result is significantly lower than the five-year average and only half of the figure recorded in Q2 2021, when Resolution 42 was still in effect.

The banking industry’s P/B ratio has declined sharply since the end of 2022, coinciding with the rise in NPLs.

Notably, some banks in the retail group—characterized by a dispersed loan portfolio, small loan values, and weak financial standing of borrowers—are being discounted more heavily than the overall market. Currently, many retail bank stocks are trading at P/B ratios of only around 1-1.3 times, lower than the industry average.

Prospects for a Reset in Bank Valuations with the Enactment of Resolution 42 into Law

On June 27, the National Assembly officially passed the Draft Law amending and supplementing a number of articles of the Law on Credit Institutions, including legalizing certain contents of Resolution 42 related to the right to seize secured assets, provisions on the seizure of secured assets, and the return of secured assets that are exhibits or confiscated property in a case or violation.

Many securities companies and professional investors emphasize that legalizing Resolution 42 will be a strong catalyst, opening up opportunities for improving asset quality, business performance, and potential for stock revaluation in the banking sector—which is currently heavily discounted.

In a letter to investors earlier in June, Petri Deryng, fund manager of PYN Elite (Finland), assessed that legalizing Resolution 42 and allowing faster disposal of secured assets would bring unexpected revenue to many banks. He also noted that the industry’s valuation remains low, while capital structure and net interest margin show signs of improvement.

In its industry analysis report released on June 20, MBS Securities (MBS) stated that the amended Law on Credit Institutions helps reduce the pressure of provisioning, debt handling costs, enhances transparency, and reduces procedures in debt trading, asset acquisition, and disposal. It also raises borrowers’ awareness and improves the quality of assets across the system in the long run. MBS believes that large banks with high provisioning costs, such as VPBank, VietinBank, and some smaller banks, will benefit the most from this change.

Similarly, VNDirect Securities estimates that the NPL ratio for the entire system could drop below 3% in the first year of legalizing Resolution 42. VNDirect particularly emphasizes that credit institutions with a high proportion of retail lending (consumer, auto, and unsecured loans) will benefit the most. In addition, banks that are mandated to take over weak banks, such as VPBank, MB, HDBank, and Vietcombank, will also have more favorable conditions in the process of restructuring weak banks due to the clearer legal framework. Sharing the same view, SSI Research highlights that shortening the time to handle small loans will significantly reduce operating costs and risk management pressure for retail banks.

In analyses of Resolution 42, one name that frequently appears is VPBank, a bank with a large proportion of retail loans and which is in the process of taking over a weak bank.

Recently, Vietcap Securities recommended a “Buy” rating for VPB. According to Vietcap, if Resolution 42 is legalized, VPBank’s debt recovery efficiency in 2025 will improve significantly, thereby reducing pressure from funding costs and competitive interest rates. Additionally, support from the strategic shareholder SMBC, along with room to reduce funding costs by increasing the proportion of non-term deposits and the recovery of FE CREDIT, are driving forces for VPBank’s valuation in 2025.

KBSV Securities (KBSV) stated that Resolution 42 would help shorten the time to handle secured assets, thereby increasing VPBank’s income from bad debt recovery. With the current scale of off-balance-sheet debt, KBSV estimates that bad debt income will not be insignificant, contributing to the bank’s total operating income. Under a similar outlook, VNDirect gave a “Positive” rating, projecting that VPB’s stock could be revalued with a P/B target of 1.2 times in 2025, approaching the industry average.

Even before the legalization of Resolution 42, VPBank had taken steps to enhance debt recovery efficiency. In 2024, the bank established the Debt Collection and Handling Block (DCD) to meet the increasingly high risk management requirements. As a result, in Q1/2025, VPBank’s income from handled risky debts reached VND 856 billion, more than doubling that of the same period last year, contributing significantly to net income from other activities. With the positive impact of the new legal framework and the proactive strategy for handling bad debts, VPBank is ready to make a breakthrough in asset quality, creating new momentum for valuation in the coming period.