Golden Lotus Securities’ Successful Annual General Meeting

On June 27th, Golden Lotus Securities Joint Stock Company successfully held its 2025 Annual General Meeting. According to the minutes, the company’s shareholder structure is concentrated, with four major shareholders in attendance: Agricultural Trading Company Limited Khang An holding 2.7 million shares (20% of capital), Ms. Thai Kieu Huong holding 2,043,212 shares (15.13% of capital), Mr. Le Huy Dung holding 2,704,088 shares (20.03% of capital), and Mr. Ho Ngoc Bach holding 2,684,000 shares (19.88% of capital).

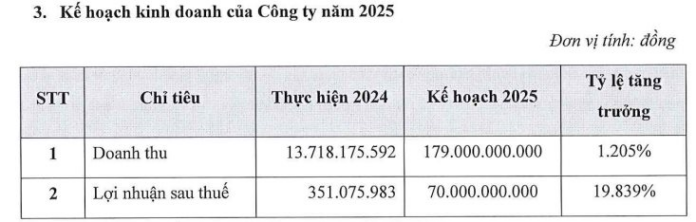

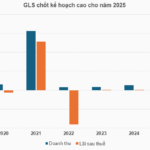

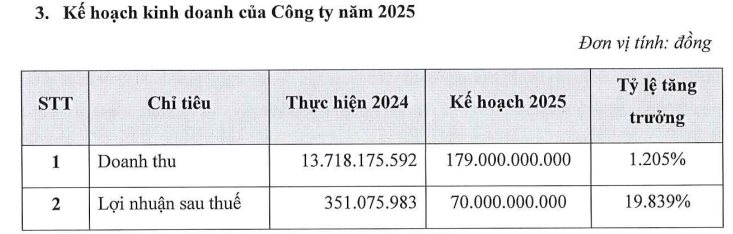

A Bold Profitability Goal: Aiming for a 19,800% Surge

During the meeting, shareholders approved the 2025 business plan, targeting a remarkable 1,205% and over 19,800% year-on-year surge in revenue and net profit, respectively. The company forecasts the VN-Index to reach 1,450–1,500 points in 2025, marking a 15–18% increase from the previous year’s end.

The company’s leadership emphasized key focuses for 2024–2025, including completing the process of exiting the controlled status and working towards changing the company’s address, name, and seal. These changes aim to facilitate a more efficient concentration of human resources and a refreshed brand identity that aligns with the company’s new direction and business strategy. Specifically, the company will rename itself Xuan Thien Securities (abbreviated as XTSC). The name change is intended to better reflect the company’s vision for building and promoting its brand, as well as its operational and developmental strategies.

Golden Lotus Securities also intends to establish connections with stock exchanges (VNX, HNX, and HSX). Additionally, to supplement the company’s business activities, shareholders approved a plan to increase charter capital. Following a successful capital increase, the company will allocate resources efficiently to develop permitted securities business activities.

Regarding business segments, the company aims for a 20% profit margin in proprietary trading. Meanwhile, brokerage revenue in the initial phase is expected to contribute a smaller proportion to total revenue, mainly derived from margin lending activities. The company will also deploy a robust brokerage team from the outset, focusing on large client segments (corporate clients, VIP clients, etc.) and expanding to a broader client base. Competitive compensation packages will be offered to attract experienced brokers with established client networks.

Xuan Thien Group’s Chairman Invests, Aiming for a Charter Capital of VND 20,000 Billion

Regarding the capital increase plan, Golden Lotus Securities intends to offer 135 million shares to existing shareholders at a ratio of 1:10 and a price of VND 10,000/share. This means that for every 1 share held, shareholders can purchase 10 new shares. If successful, the charter capital will increase to VND 1,485 billion. The offering is scheduled for 2025–2026.

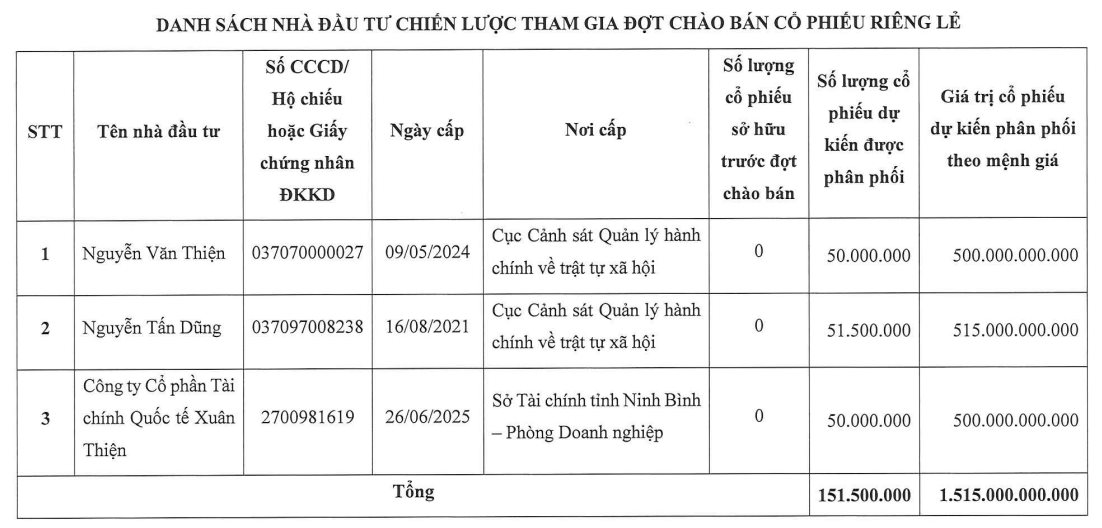

Additionally, the company plans to offer 165 million shares in a private placement at VND 10,000/share. The list of strategic investors includes Mr. Nguyen Van Thien, Chairman of Xuan Thien Group, who intends to purchase 50 million shares, along with two other investors.

The company’s representative explained to shareholders that the capital increase plan demonstrates the alignment of interests between the company and its existing shareholders. Meanwhile, the private placement to strategic investors, with a three-year lock-up period, signifies the investors’ commitment and confidence in the company’s future prospects.

“The figure of VND 3,000 billion is suitable for the current context. It asserts the financial strength of major shareholders and marks just the beginning of a powerful entry into the market. However, it is not the final destination. Abundant financial resources are a necessary condition for the company to quickly enter and capture market share in Vietnam’s securities market. We aim to continue increasing capital, with a target of VND 20,000 billion, striving to join the top 3 in the market,” the company representative responded to shareholders’ inquiries.

Nevertheless, the company’s financial situation is not yet optimistic. As of Q1 2025, Golden Lotus Securities’ total assets exceeded VND 69 billion, but the company incurred accumulated losses of over VND 68.6 billion.

“CEO of FPTS Plans to Sell Nearly 709,000 Shares Post ESOP Purchase”

On June 27, Mr. Nguyen Diep Tung, CEO of FPT Securities Joint Stock Company (FPTS, HOSE: FTS), registered to sell nearly 709,000 FTS shares through a matched transaction to meet his personal financial needs. The sale is expected to take place between July 3 and August 1.

The Future is Now: GLS Transforms into Xuan Thien Securities, Unveiling Ambitious Plans for 20,000 Billion Dong Capital Increase

Sharing at the 2025 Annual General Meeting of Golden Lotus Securities Joint Stock Company (GLS) in Hanoi on June 27, the Presidium revealed plans to increase charter capital to VND 20,000 billion and strive to join the top 3 in the market.