The VN-Index closed at 1,376 points on June 30th, marking a 0.34% increase or 4.6 points.

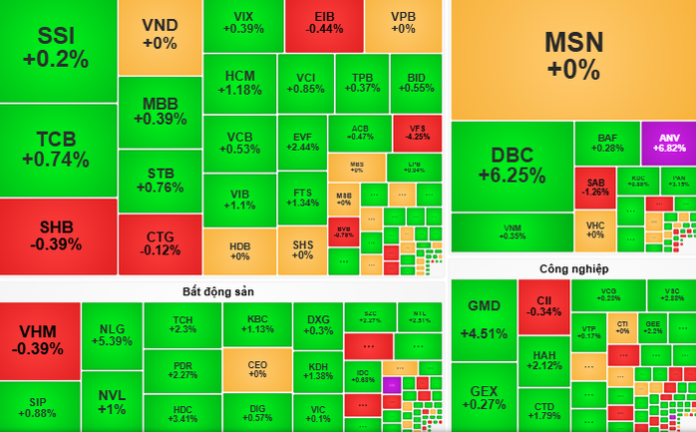

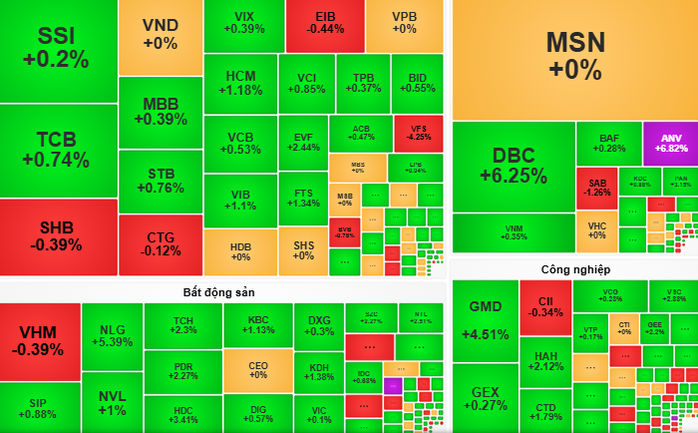

Vietnam’s stock market opened on June 30th with fluctuations of around 5 points. Banking, consumer goods, and technology sectors were the main drivers, attracting strong capital inflows and leading the market’s upward trend. Notably, livestock and seafood stocks performed positively. Real estate, chemicals, and shipping stocks also attracted interest during the morning session.

In the afternoon session, the VN-Index continued to fluctuate. Capital rotated among blue-chip stocks, with banks remaining the top gainers. However, some large-cap stocks like GVR (rubber) and MWG (consumer goods) declined, and VHM and HPG faced strong selling pressure.

At the close, the VN-Index settled at 1,376 points, a gain of 0.34% or 4.6 points. A bright spot in the session was the strong buying from foreign investors, with a net buy value of VND 591 billion, focusing on MSN, NLG, and DBC stocks.

According to VCBS Securities Company, the VN-Index needs more time to accumulate points to consolidate the upward trend. Therefore, investors should note the possibility of continued market volatility in the next session.

“With strong capital differentiation among industries and information about retaliatory tariffs between Vietnam and the US in the coming weeks, investors can continue to hold stocks with upward momentum; consider reducing leverage in sensitive industries such as industrial real estate, seafood, and textiles to manage risks,” advised VCBS Securities Company.

Meanwhile, Rong Viet Securities Company expects the market to continue rising in the next session, but with a narrow range of fluctuation.

With Expected Tariff Cuts of 10-15%, Historical Trends Suggest a Continued Bull Run for Vietnam’s Stock Market

The experts at Yuanta predict a likely scenario of a tariff regime based on a good’s origin, with rates ranging from 10% to 15%.

Market Beat July 1: Sellers Dominate, VCB Steps In to Support Index

The VN-Index witnessed a sharp drop in the afternoon session, but swiftly recovered to close above the reference level. The benchmark index of the Ho Chi Minh Stock Exchange ended today’s trading at 1,377.84 points. Meanwhile, the HNX-Index closed below the reference level, edging down 0.8 points to 228.45.