The recently released Provincial Economic Position Index (PEPI) report for 2025 by Vietstats, a data-driven economic startup, introduces a groundbreaking set of standardized metrics for Vietnam. For the first time, the country has a comprehensive evaluation of its provinces’ relative economic standing, independent of administrative boundaries and traditional singular data points.

Compiled and published by Vietstats, PEPI is the culmination of extensive research aimed at establishing a novel analytical foundation for regional development strategies. This comes at a pivotal moment as the nation embarks on an unprecedented reorganization of its administrative and economic landscape, with province mergers reducing the number of provinces from 63 to 34.

While the mergers, effective July 1st, have resulted in larger territories and increased populations, it does not inherently elevate the economic status of these regions. Instead, this transformation necessitates an entirely novel approach to repositioning and redefining the developmental roles and functions of each locality within the context of regional and national linkages.

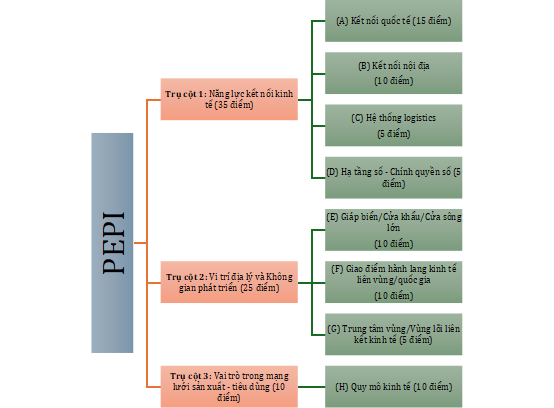

PEPI assesses provinces and cities based on three fundamental pillars: economic connectivity, spatial position, and economic scale. These pillars are further broken down into eight quantitative criteria, reflecting not only current capabilities but also potential and strategic functions within the national economic ecosystem.

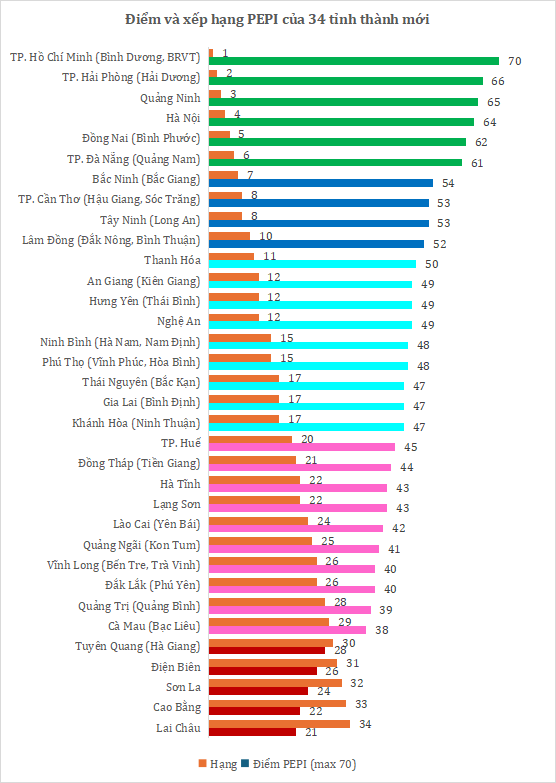

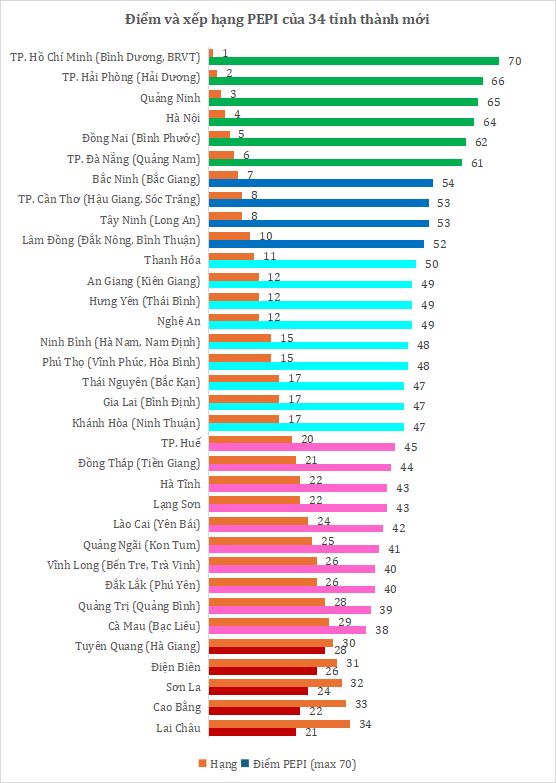

Rather than solely focusing on GRDP growth rates, PEPI considers the role of each locality in trade, logistics, consumption, and integration networks—emphasizing their position within the economic flow. The 2025 PEPI results reveal a starkly differentiated landscape, with Ho Chi Minh City, Hanoi, Hai Phong, Quang Ninh, and Dong Nai maintaining their status as exceptional growth poles, boasting robust integration capabilities and central roles in the national value chain.

Several provinces, including Bac Ninh, Tay Ninh, Khanh Hoa, and Lam Dong, are emerging as potential regional hubs or transit centers, given the right investment strategies. Conversely, many provinces, such as Lai Chau, Dien Bien, Tuyen Quang, and Cao Bang, find themselves in the lowest group, indicative of constrained infrastructure, connectivity, and economic scale. This underscores the urgent need for targeted public investment and specialized support mechanisms.

The pillars and evaluation criteria of PEPI

Notably, PEPI offers an alternative approach by identifying diverse economic functions among localities, ranging from production and logistics hubs to ecological buffers, agricultural transit centers, indigenous tourism hotspots, and border economic regions. This classification provides a foundation for the central and local governments to formulate policies that align with their unique roles and realities, steering clear of uniform development traps and dispersed investments.

The Gambling Insurance Executive: A Tale of High-Stakes and Female Empowerment

“In a shocking development, local authorities raided a gambling operation, catching the Head of Regional Insurance, PJICO Gia Lai Insurance Company, red-handed. Accompanying him were nine other individuals, all female, engaged in a high-stakes game of Xì Lát, a popular card game in the region. This brazen act of illegal gambling has sent shockwaves through the community, as the involvement of a prominent figure has left many reeling.”

An Intriguing Coincidence: VN-Index Surges 109 Points Since the Start of the Year, Mirroring Vingroup’s Contribution

“The Vietnamese stock market witnessed a remarkable surge with the VN-Index reaching a 3-year peak, largely driven by the impressive performance of the Vingroup conglomerate’s stocks, which have been on a strong upward trajectory since the beginning of the year.”