While holding on to cash for too long can increase opportunity costs, investing in risky assets may not be suitable for all business models. So, what is the “balance point” for enterprise cash flow at this time?

Optimizing Idle Cash Flow – Trends and Opportunities for Businesses

In the context of many macro variables continuing to affect the market – from the US’s new tariff policies to fluctuating raw material prices – most enterprises in Vietnam are exhibiting a trend of “cautious optimism” in their financial strategies. Instead of investing in risky ventures or expanding production aggressively, many businesses choose to retain short-term cash flow and seek a balance between liquidity and capital efficiency.

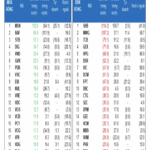

According to data from the State Bank of Vietnam, the total deposits of economic organizations in the banking system as of the first quarter of 2025 reached VND 7,520 trillion – a figure almost equivalent to the deposits of individuals. This clearly reflects the psychology of businesses shifting towards preserving and optimizing short-term capital, rather than letting cash “lie idle” in non-interest-bearing accounts.

Not only small and medium-sized enterprises but even giants such as Viettel Global, Duc Giang Chemical, and Vingroup have chosen fixed-term deposits to optimize their capital. Specifically, Viettel Global recorded more than VND 39,600 billion in cash and deposits, generating a profit of over VND 400 billion from savings activities in the first quarter of 2025. This is a vivid demonstration of a smart capital utilization strategy: ensuring the availability of funds for contingency while also earning stable profits from the “resting” cash flow.

It can be said that fixed-term deposits – especially in the medium and short term – are gradually becoming a prioritized financial strategy during this period. This solution ensures three factors: safe profitability, flexible capital withdrawal, and keeps businesses always ready for bigger plans in the future.

Flexible Financial Solutions for Idle Cash Flow

Understanding the clear trends and demands of enterprises today, Modern Commercial Joint Stock Bank (MBV) officially launched a preferential fixed-term deposit program exclusively for corporate customers. MBV’s fixed-term deposit product is specially designed to help businesses proactively optimize their idle cash flow. Competitive interest rates and flexible terms ranging from one to six months ensure businesses maximize financial efficiency while maintaining liquidity.

In addition to interest rates, MBV also focuses on creating added value for corporate customers. Specifically, for every deposit of VND 5 billion or more, businesses will receive a Winmart voucher worth up to VND 8 million.

MBV’s fixed-term deposit package not only offers attractive returns but also ensures stable profits – a priority for many businesses today.

At a time when efficient financial management plays a decisive role in competitive advantage, fixed-term deposits are becoming a lean yet effective strategy. With stable returns, low risk, and high flexibility, this option is being considered by many chief financial officers and executives, especially for short-term contingency funds.

Choosing MBV is not just about choosing a good interest rate. It’s about choosing a partner who understands the ins and outs of your business, values flexibility, provides timely support, and delivers long-term value. With the operating philosophy of “putting customers at the center,” MBV will continue to expand similar preferential programs, helping businesses maximize every opportunity to enhance their financial performance.

The Fed Unveils a Massive Cash Injection for the Banking System

The State Bank of Vietnam (SBV) injected a net amount of VND 40.042 trillion into the banking system through open market operations (OMO) on June 27, the highest amount in over a year.

Market Beat: Foreigners Turn Net Buyers, VN-Index Hits 2-Year High

The trading session concluded with the VN-Index climbing 4.63 points (+0.34%), reaching 1,376.07. Meanwhile, the HNX-Index witnessed a rise of 1.41 points (+0.62%), closing at 229.22. The market breadth tilted towards the bulls, as advancers outnumbered decliners by a margin of 469 to 269. Similarly, the VN30 basket echoed this bullish sentiment, displaying 16 gainers, 10 losers, and 4 unchanged stocks.

The Flow of Funds: What Does the Hesitant Money Trail Tell Us?

The VN-Index witnessed its second consecutive week of robust gains, surging past the 1370-point mark. The bulk of these gains were concentrated in the first two trading sessions, with the latter three sessions experiencing minimal fluctuations. Notably, excluding the high-volume trading session on June 24th, the average weekly trading volume was relatively low.

“Retail Investors Continue Strong Buying Streak, Accumulating Nearly VND 1,000 Billion Today”

Individual investors bought a net amount of VND 567 billion, of which VND 544.5 billion was net bought in matched orders. The proprietary business also bought a net of VND 333.1 billion, selling a net of VND 442 billion in matched orders only.