Despite external pressures, from US trade protectionism to geopolitical tensions, Vietnam’s economy has demonstrated resilience in the first half of 2025, according to a newly published strategic report by VNDirect.

Solid growth is expected to continue in the second half, led by pro-growth policies such as boosting public investment, expansionary fiscal policy, legal relaxation for real estate projects, and measures to promote the development of the private sector.

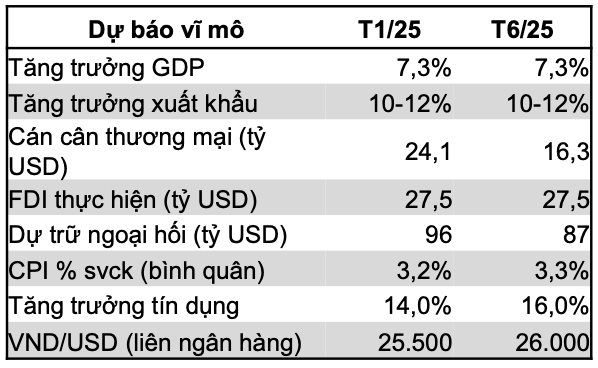

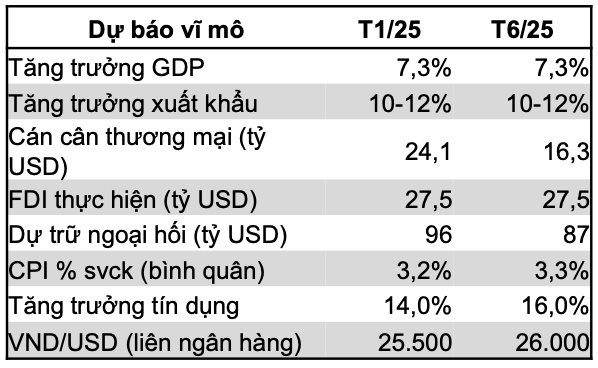

On the other hand, VNDirect has raised its average inflation forecast for 2025 to 3.3% svck, up from 3.2% previously, mainly due to the impact of geopolitical tensions between Iran and Israel, which have pushed oil prices higher again. If the conflict persists, CPI for transportation in Q3 may face additional pressure. However, this inflation rate is still lower than the 3.6% recorded in 2024.

Reflecting a more optimistic outlook on Vietnam-US tax negotiations, VNDirect expects Vietnam to successfully negotiate and bring the average countervailing duty down to around 16-22% in the base case scenario. In addition, the securities firm expects the Fed to cut interest rates twice in the second half of this year, helping to keep the DXY index below the 100 threshold.

Domestically, a solid macroeconomic foundation remains the main support for the market, with GDP growth forecast at 7.3% and credit growth at 16%. These factors are expected to support the profit growth of listed companies this year in the range of 14-15%, thereby consolidating the VN-Index’s valuation at a projected P/E of 13.5 times by year-end.

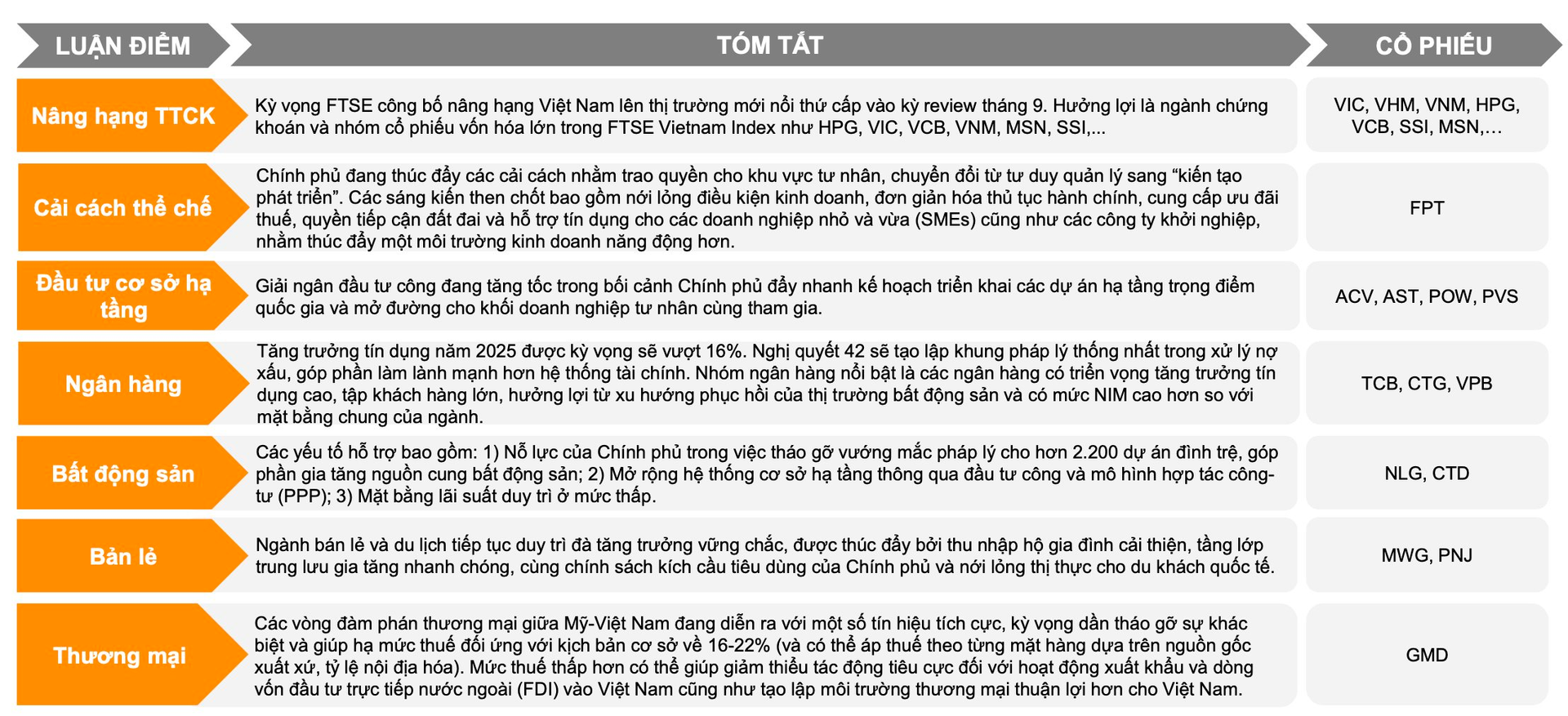

VNDirect adjusts its forecast for VN-Index at the end of 2025 to 1,450 points (+14% compared to the end of 2024), up from the previous forecast of 1,400 points. In the second half, VNDirect highlights several notable investment arguments such as market upgrade, institutional reform, and infrastructure investment.

Regarding the market upgrade story, VNDirect expects FTSE to announce Vietnam’s upgrade to secondary emerging market status in the September review. The securities firm believes that the beneficiaries of this upgrade will be the securities sector and large-cap stocks in the FTSE Vietnam Index such as HPG, VIC, VCB, VNM, MSN, and SSI.

Meanwhile, the government is promoting reforms to empower the private sector and shift from a management mindset to a “development facilitator” approach. Key initiatives include easing business conditions, simplifying administrative procedures, providing tax incentives, land access rights, and credit support for small and medium-sized enterprises (SMEs) and startups, to foster a more dynamic business environment.

Additionally, public investment disbursement is accelerating as the government expedites plans for key national infrastructure projects and opens up opportunities for private sector participation.

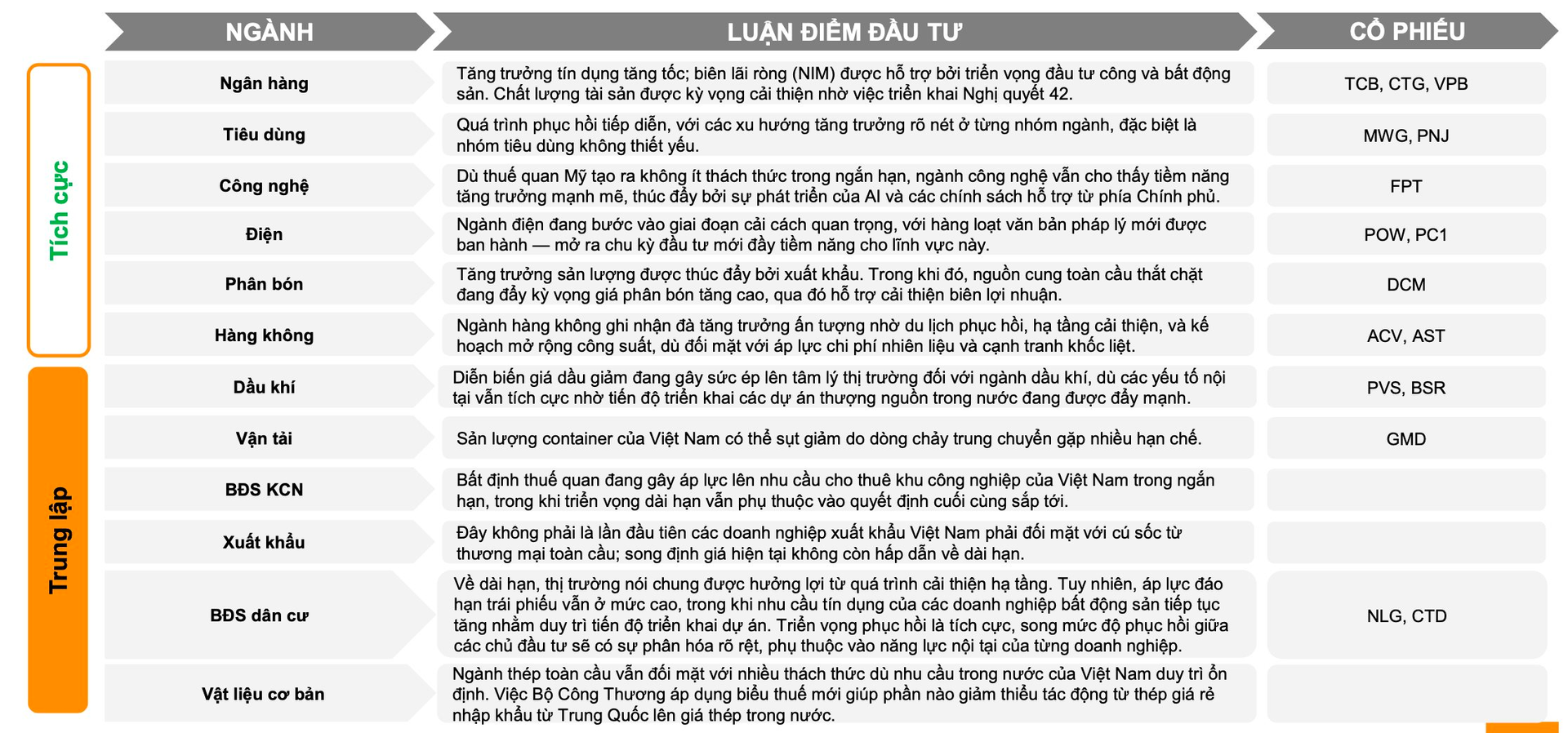

According to VNDirect, sectors such as banking, real estate, consumer – retail, technology, fertilizers, and aviation will play a pivotal role in 2025.

For the banking sector, VNDirect expects credit growth in 2025 to exceed 16%. Resolution 42 will establish a unified legal framework for bad debt handling, contributing to a healthier financial system. Notable banks include those with high credit growth prospects, a large customer base, benefiting from the real estate market recovery, and higher NIM compared to the industry average.

For the real estate sector, supportive factors include: 1) The government’s efforts to remove legal obstacles for over 2,200 stalled projects, increasing the real estate supply; 2) Expanding infrastructure through public investment and public-private partnership (PPP) models; 3) Maintaining low-interest rates.

For the retail and tourism sector, VNDirect believes that solid growth will continue, driven by improving household income, a rapidly growing middle class, government consumption stimulus policies, and visa relaxation for international tourists.

With Expected Tariff Cuts of 10-15%, Historical Trends Suggest a Continued Bull Run for Vietnam’s Stock Market

The experts at Yuanta predict a likely scenario of a tariff regime based on a good’s origin, with rates ranging from 10% to 15%.

Market Beat July 1: Sellers Dominate, VCB Steps In to Support Index

The VN-Index witnessed a sharp drop in the afternoon session, but swiftly recovered to close above the reference level. The benchmark index of the Ho Chi Minh Stock Exchange ended today’s trading at 1,377.84 points. Meanwhile, the HNX-Index closed below the reference level, edging down 0.8 points to 228.45.