The stock market was volatile on July 1st, with the main index falling below the reference point at times due to selling pressure from several Bluechip stocks. Buying pressure returned towards the end of the session, pushing the VN-Index up 1.77 points to close at 1,377.84. Several stocks contributed to the gain, including VCB, GVR, HVN, and BID, boosting the overall market sentiment. The trading volume on the HOSE reached nearly VND 21,000 billion.

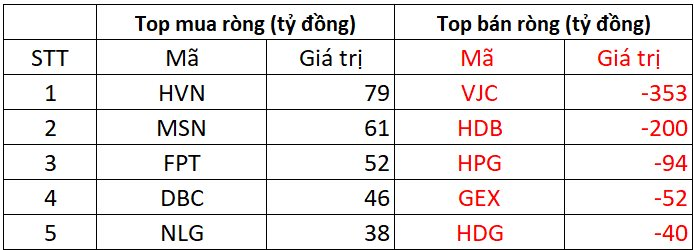

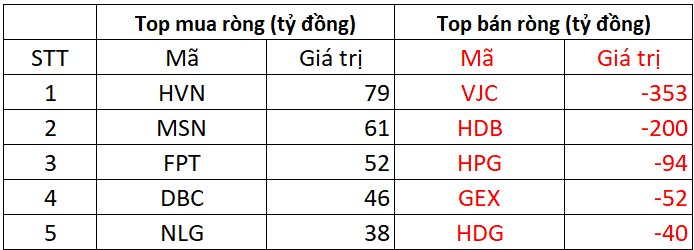

In this context, foreign investors turned to net sellers, offloading VND 349 billion across all markets. Specifically:

On HoSE, foreign investors net sold VND 331 billion.

In terms of net selling, VJC witnessed the highest net outflow, with a value of VND 353 billion. HDB and HPG also experienced net selling pressure, with net outflows of VND 200 billion and VND 94 billion, respectively. Additionally, GEX, HDG, FRT, and other stocks witnessed net selling in the range of tens of billions of VND each.

Conversely, HVN attracted the highest net buying across all markets, with a net purchase of VND 70 billion. MSN and FPT also witnessed strong net buying, with values of VND 61 billion and VND 52 billion, respectively. Stocks such as DBC, NLG, CTG, and VCB also witnessed net foreign buying.

On the HNX, foreign investors net sold VND 2 billion.

During the session, PVS witnessed the highest net selling, with a net outflow of approximately VND 53 billion. MBS also experienced net selling of VND 15 billion, while other stocks like NTP, DTD, and VFS faced net selling in the range of a few billion VND each.

On the buying side, IDC and TNG witnessed net buying of VND 59 billion and VND 4 billion, respectively. Stocks such as VC3, HUT, NVB, and TIG also witnessed modest net buying during the session.

On the UPCOM market, foreign investors net sold approximately VND 15 billion.

In terms of net buying, HBC and VEA witnessed net inflows of over VND 1 billion each, while other stocks like ABI, NCS, and QNS also experienced modest net buying from foreign investors.

Conversely, MCH continued to face net selling pressure, with a net outflow of VND 10 billion. ACV and HPD also witnessed net selling of VND 8 billion and VND 1 billion, respectively.

Stock Market Outlook for July 1st: Will the VN-Index Keep Climbing?

The VCBS Securities Company forecasts that Vietnamese stocks need more time to accumulate points and will continue to fluctuate in the July 1st session.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)