The VN-Index witnessed a nerve-wracking session today as it dipped by 7 points, despite a lengthy upward trajectory. However, it managed to close in the green, gaining 1.77 points to reach the 1,377.84 level, with negative breadth as 196 stocks declined and 117 advanced.

The market’s resilience was largely due to the sturdy performance of VCB, a pivotal stock in the banking sector. This single stock contributed 2.32 points to the overall index, surging by 2.11%. Additionally, other banking stocks such as MBB, HDB, TCB, and BID maintained their upward momentum, collectively adding over 3 points to the index.

On the flip side, most other sectors faced selling pressure as investors rushed to lock in profits. Notably, the real estate sector, including Vin stocks, experienced a volatile session. While VIC and VHM managed to recover from their intraday lows of 2.2% and 2.48%, respectively, other real estate stocks like PDR, VPI, DXG, KBC, and DIG plunged by 2-3%.

Similarly, the securities sector witnessed a broader sell-off compared to the previous day, with prominent stocks like SSI, MBS, and FTS correcting over 1%, and VND declining by 2.33%.

Sectors directly impacted by tariff announcements also reflected negative sentiment, despite expectations of relatively low tariffs of 15-20% from the US. Air transport and logistics stocks took a hit, with notable declines in ACV, SCS, NCT, HAH, and VSC. In the export sector, while ANV soared to the ceiling price, MPC, PAN, VHC, and ASM remained in the red.

Domestic consumer-focused sectors, such as food and beverages, also struggled. MSN, a prominent player, fell by 2.08%. MML and MCH followed suit, declining by 3.38% and 1.73%, respectively. The energy sector saw declines in PVS, PVD, PVC, and PVB, with losses ranging from 1-3%.

Overall, the market is awaiting the official announcement of US retaliatory tariffs, expected on July 9. Cautious investors remain on the sidelines, as evident from the day’s liquidity of VND 22.5 trillion across all three exchanges, including net foreign selling of VND 383.2 billion. However, in matched transactions, foreign investors were net buyers to the tune of VND 400.5 billion.

A deep dive into the foreign investor activity reveals that they were net buyers in the banking, tourism, and entertainment sectors. Their top net bought stocks in matched transactions included HDB, HVN, MSN, FPT, DBC, VJC, NLG, CTG, VCB, and ANV.

On the other hand, they were net sellers in the basic materials sector, offloading stocks like HPG, GEX, HDG, FRT, HAH, BAF, PC1, VPB, and SAB.

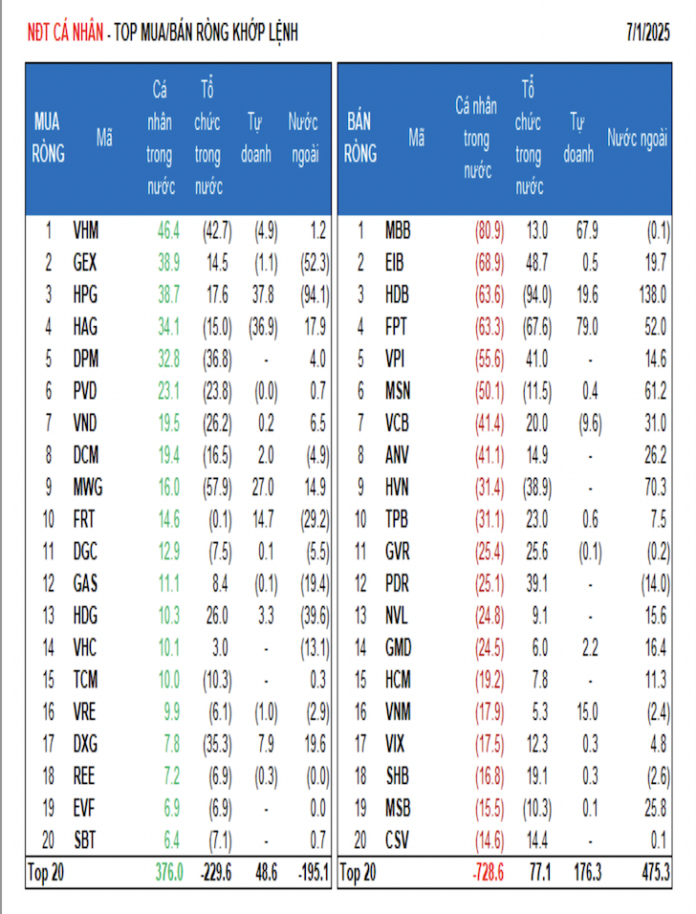

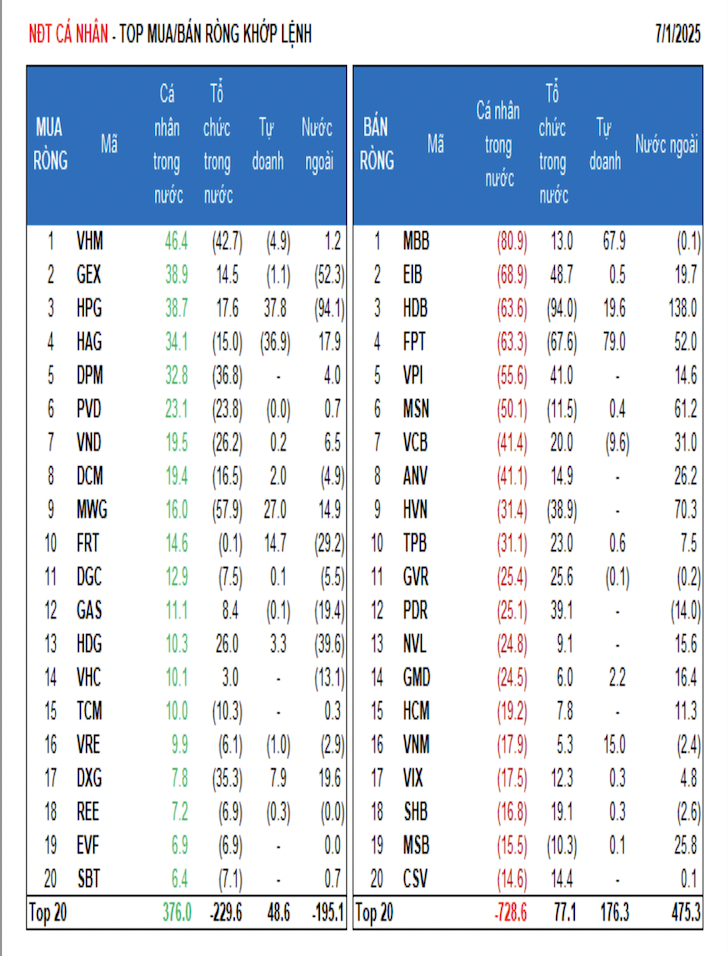

Retail investors were net buyers to the tune of VND 327.8 billion, although they offloaded stocks worth VND 515.4 billion in matched transactions. A sector-wise breakdown reveals that they were net buyers in 7 out of 18 sectors, primarily in chemicals. Their top net bought stocks included VHM, GEX, HPG, HAG, DPM, PVD, VND, DCM, MWG, and FRT.

On the selling side, they offloaded stocks in 11 out of 18 sectors, mainly in banking and real estate. Their top net sold stocks included MBB, EIB, HDB, FPT, VPI, MSN, ANV, HVN, and TPB.

Proprietary trading accounts were net sellers to the tune of VND 985.7 billion, although they were net buyers in matched transactions, purchasing stocks worth VND 283.9 billion. A sector-wise breakdown of their activity in matched transactions reveals that they were net buyers in 11 out of 18 sectors, with information technology and banking being the top sectors. Their top net bought stocks included FPT, MBB, HPG, PNJ, MWG, SSI, HDB, VNM, FRT, and E1VFVN30. On the selling side, they offloaded stocks in the food and beverage sector, with HAG, VCB, VPB, VCI, VHM, VCG, STB, CTI, VIC, and CTG being among the top sold stocks.

Local institutional investors were net buyers, purchasing stocks worth VND 1,023.2 billion. However, in matched transactions, they were net sellers to the tune of VND 169 billion. A sector-wise breakdown of their activity in matched transactions reveals that they were net sellers in 9 out of 18 sectors, primarily in information technology. Their top net sold stocks included HDB, FPT, MWG, VHM, HVN, DPM, DBC, VJC, DXG, and CTG. On the buying side, they were net buyers in industrial goods & services. Their top net bought stocks included EIB, VPI, PDR, HDG, GVR, TPB, BAF, HAH, VCB, and VCI.

The value of negotiated transactions stood at VND 3,273.2 billion, a substantial increase of 30.6% from the previous session, contributing 14.3% to the total trading value. Notably, proprietary trading accounts of domestic institutions sold over 7.5 million FPT shares (worth VND 872.7 billion) and 11 million TCB shares (worth VND 374.7 billion) to local institutions in negotiated deals.

Additionally, foreign institutions sold nearly 4.4 million VJC shares (worth VND 409.6 billion) and over 15.3 million HDB shares (worth VND 357.5 billion) to retail investors in negotiated transactions.

A sector-wise breakdown of fund flow reveals an increase in allocation to real estate, banking, construction, steel, electrical equipment, aviation, rubber & plastics, and a decrease in allocation to securities, chemicals, agricultural & seafood products, food & beverages, oil & gas, software, and warehousing.

Focusing on matched transactions, fund allocation increased for large-cap stocks (VN30) and decreased for mid-cap (VNMID) and small-cap (VNSML) stocks.