New VAT Law in Vietnam: Emphasizing Transparency and Compliance

The Value-Added Tax Law of 2024 introduces significant changes to tax compliance in Vietnam. From July 1st, 2025, all purchases of goods and services, regardless of their value, will only be eligible for input VAT deduction if non-cash payment methods are used.

This regulation aims to enhance transparency in commercial transactions and ensure compliance with tax regulations, mitigating potential risks.

Specifically, according to Clause 2, Article 14 of the VAT Law 2024, taxpayers can deduct input VAT if they fulfill the following conditions:

– Possess a VAT invoice for the purchase of goods or services, or a tax payment document for import or a tax payment document on behalf of a foreign party.

– Provide non-cash payment proof for the purchased goods or services, except for specific cases stipulated by the Government.

– For exported goods and services, in addition to the above, the following are required: a contract with a foreign party for the sale, processing, or provision of services; VAT invoice for the sale of goods or services; non-cash payment proof; customs declaration for exported goods; packing slip, waybill, and goods insurance document (if applicable).

Previously, transactions below VND 20 million were eligible for VAT deduction even with cash payments. However, under the new VAT Law 2024, this threshold has been eliminated, mandating non-cash payments for all transactions to qualify for VAT deduction.

Nonetheless, the Government may specify certain exceptional cases where businesses can still claim input tax deductions when paying in cash, provided they meet the necessary conditions.

VAT Calculation Method

Clause 1, Article 11 of the VAT Law 2024 outlines the VAT calculation method as follows:

– VAT payable = Output VAT – Deductible input VAT

– Output VAT equals the total VAT of goods and services sold as recorded on the VAT invoice.

– VAT on goods and services sold = Taxable value of sold goods and services x Applicable VAT rate.

– If the invoice shows the payment amount including VAT, output VAT = Payment amount – Taxable value of VAT.

– Deductible input VAT is the total VAT amount on input VAT invoices, tax payment documents for imports, or services purchased from abroad, provided all conditions under Article 14 of the VAT Law 2024 are met.

Note that the VAT calculation method applies to businesses that fully comply with accounting, invoice, and voucher regulations as stipulated in Clause 2, Article 11 of the VAT Law 2024, including:

– Businesses with annual revenue from the sale of goods and services exceeding VND 1 billion (excluding households and individual businesses)

– Businesses that voluntarily apply the VAT deduction method (excluding households and individual businesses)

– Foreign organizations and individuals providing goods and services for oil and gas exploration, development, and exploitation activities, where tax is declared, deducted, and paid by the Vietnamese side.

“Honda Celebrates 30 Years in Vietnam: A Milestone Achievement”

Honda, the renowned Japanese automotive manufacturer, has firmly established its presence in Vietnam with an impressive network of three motorcycle factories. These state-of-the-art facilities collectively boast an annual production capacity of up to 2.5 million units, showcasing the brand’s unwavering commitment to meeting the demands of the vibrant Vietnamese market.

Tons of Frozen Meat Floods Vietnam: A 100% Surge in Imports with a Price Tag of 69,000 VND/kg, Mostly from This Country

The Vietnamese market has witnessed a significant surge in frozen pork imports during the first five months of the year compared to the same period last year.

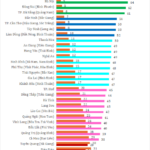

The First-Ever Economic Ranking Index for 34 Provinces and Cities: Unveiling the Latest Provincial Power Rankings

“Ho Chi Minh City, Hanoi, Haiphong, Quang Ninh, and Dong Nai continue to be the nation’s outstanding growth poles, playing a pivotal role in the country’s value chain.”