The question of “Why and how to achieve double-digit growth?” is not only relevant today but has been a topic of discussion in previous years.

WHY IS DOUBLE-DIGIT GROWTH NECESSARY?

This question arises from various perspectives. The first perspective, and the most important one, stems from our mindset. The thought of “falling further behind” was first raised during the mid-term conference of the 7th Congress (in 1993), after the country initially overcame the socio-economic crisis that had been lingering since the end of the 1970s and lasted through the 1980s, extending into the early 1990s. The First Renovation contributed to the transition from a centralized planned economy to a market-oriented one. Opening up and integrating with the global economy attracted investment and labor from various economic sectors, both domestic and foreign, which boosted economic growth and social development.

Subsequently, there have been several positive mindsets, such as transitioning to the industrialization and modernization era, shifting from an agricultural to an industrial country, and changing the growth model from quantity to quality, from breadth to depth, preventing the “risk of falling further behind,” “falling into the middle-income trap,” and “getting old before getting rich.” These mindsets imply the need to prioritize growth.

However, there are also some mindsets among people that have more or less impacted high growth. Vietnam has been affected by several crises, such as the collapse of socialist regimes in Eastern European countries, the East Asian and Southeast Asian currency crisis, and the global financial crisis and economic recession from the end of 2008.

The Covid-19 pandemic emerged in 2020 and surged in 2021; inflation has also been high in some years. In previous years, there was a large trade deficit in goods; a continuous and significant deficit in services. The budget has been in deficit for many years, while the ratio of investment to GDP is higher than that of asset accumulation, and there is a concern about the ratio of national debt to GDP. Although foreign exchange reserves have increased, there have been a few instances of stimulus packages, so the reserves are still thin.

There are many mindsets that affect growth, among which two prominent ones are worth mentioning. The first is the mindset of fearing “overheating” growth, which seems reasonable but is wrong in two aspects. Firstly, for Vietnam, a 1% increase in GDP is only a few billion USD (in 2024, it was about 4.7 billion USD); while for many countries in the world, a 1% increase in GDP can reach tens or even hundreds of billions of USD. Therefore, even if Vietnam’s growth reaches 5%, it will only increase by a few tens of billions of USD, so there is no need to worry about it being called “overheating.”

Secondly, only when there is a massive printing of money to invest and consume to increase domestic aggregate demand, or when there is a very high VND/USD exchange rate to encourage exports, restrict imports, and achieve a trade surplus to support domestic aggregate supply (GDP production), can we talk about “overheating.”

The mindset of fearing an export-oriented economy is unreasonable and negatively affects the priority of growth. In fact, high exports lead to a trade surplus, which not only affects Vietnam’s position in foreign trade relations but also contributes to GDP growth when domestic aggregate demand is weaker than domestic aggregate supply. Essentially, it is the “outlet” for domestic production.

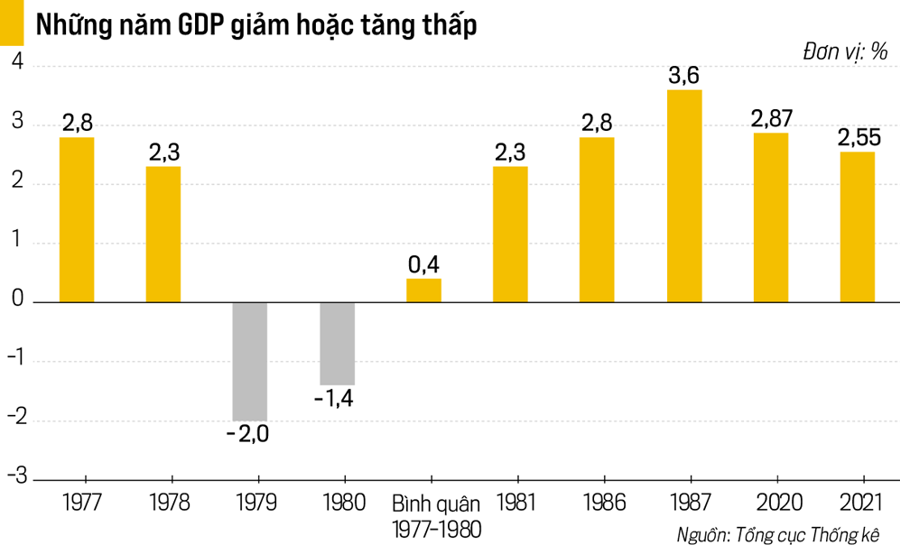

The second perspective is that Vietnam has a low starting point. This is a consequence of the socio-economic crisis that lasted from the end of the 1970s to the early 1990s. The most obvious consequence of this crisis was the reduction or low growth of GDP in some years.

The average annual GDP growth rate during 1977-1980 (0.4%) was far lower than the population growth rate (2.4%). Per capita GDP increased slowly and even decreased in some years (such as 1978, 1979, and 1980). In 1988, it was only 86 USD, placing Vietnam among the lowest-income countries and territories in the world. It took 20 years (until 2008) for Vietnam to move out of the group of low-middle-income countries, with per capita GDP surpassing 1,000 USD, and in 2024, it reached 4,700 USD.

Hyperinflation caused CPI to increase by double or even triple digits in some years, such as 1986 (774.7%), 1987 (222.1%), 1988 (349.4%), 1989 (36%), 1990 (67.1%), 1992 (17.5%), 1994 (14.4%), and 1995 (12.7%). From 2007 to 2011, inflation remained in double digits.

The trade balance was in deficit for many years, with a large scale. In the past 40 years, there have been 27 years of trade deficits in goods, with 21 of those years having a deficit of over 1 billion USD, mainly during the period from 1985 to 2011. The service balance has continuously been in deficit with a significant scale: in recent years, there have been 15 years with a deficit of over 1 billion USD, especially in some years exceeding 12 billion USD.

Due to the trade balance and service balance deficits, the overall balance has been in a large deficit, not only in essential consumer goods but also in important raw materials and fuels. In recent years, although there has been a surplus, it has not been significant, and there have even been years of deficits (2015 and 2022), especially a large deficit in 2022 (22,746 million USD).

Foreign exchange reserves have improved, surpassing 100 billion USD in some years, but in many other years, they have been quite thin, especially during the two stimulus packages due to the impact of the global financial crisis and the Covid-19 pandemic. In recent years, foreign exchange reserves have decreased and are currently almost 20 billion USD lower than the peak. Unemployment has been high in some years (in 1988, it was 13%).

The third perspective is that although Vietnam has had a continuous growth for many years, ranking among the top countries and territories in the world, the growth rate has been low in many years. As a result, the total GDP and per capita GDP rankings are much lower than the population ranking (37th and 122nd compared to 14th). Therefore, Vietnam still faces the risk of “falling further behind” and “getting old before getting rich” if the GDP growth rate does not increase.

The fourth perspective is that among the five goals of the “pentagon” (high growth; low inflation; trade surplus; low unemployment; environmental protection and improvement), high growth is the first and most important goal, influencing the other four goals.

As the material foundation, high growth is the material condition for improving the relationship between domestic aggregate supply and domestic aggregate demand, between production and consumption, thereby reducing inflationary pressures. High growth creates the material conditions for increasing exports of goods and services, reducing the pressure on imports of goods and services, overcoming trade deficits in goods and services, improving the balance of payments, increasing foreign exchange reserves, and ensuring the country’s financial security.

High growth is the material basis for creating jobs and reducing unemployment. It also provides the material foundation for preventing and mitigating the negative impacts of the environment and improving the environment.

The fifth perspective is that Vietnam is currently facing many opportunities for higher growth, which must not be missed. These include foreign investment, not only in terms of quantity but also in terms of quality and technology; the establishment of international financial centers in Vietnam, with strength in both quantity and quality; and the expansion of large and favorable markets.

Opportunities also arise from attracting a large number of international visitors to Vietnam from various countries and territories, with high spending levels, creating conditions for increasing the “density” of visitors per 100 people, as well as the number of days and the average spending per day and per person, thereby increasing the total export revenue of tourism services. In addition, opportunities come from various other relationships, including countries that have signed new-generation free trade agreements (FTAs) and upgraded diplomatic relations (to strategic partners, comprehensive partners, etc.).

The sixth perspective is that the requirements of the New Era – the Era of National Rising – demand that Vietnam accelerate its growth, with a double-digit rate, over a long period (one or two decades).

HOW TO ACHIEVE DOUBLE-DIGIT GROWTH?

To achieve double-digit growth, first and foremost, we need to innovate our mindset and treat it as a revolution, as the beginning of the Second Renovation. This is one of the critical contents of the New Era – the Era of National Rising.

Double-digit growth over a long period is a state that Vietnam has never achieved in the 50 years since the reunification of the country. The highest growth rate was just over 8.5% during the period of 1992-1997, after the Renovation policy and the opening and integration of the economy, overcoming the socio-economic crisis. The First Renovation did not achieve any double-digit growth. The acceleration in this era is almost double the average growth rate since the Renovation began.

Moreover, this acceleration must be achieved when the base number has already increased significantly. A 1% increase now corresponds to 4.7 billion USD, so a 10% increase means an additional 47 billion USD, which is not a small amount. Therefore, achieving this acceleration is a significant challenge, requiring a strong shift in mindset and even higher solutions.

EXAMINING THE THREE STRATEGIC BREAKTHROUGHS

The three strategic breakthroughs (institutions, human resources, and infrastructure) have been proposed and implemented, achieving many positive results, but there is still much to be done.

There are limitations in the breakthrough regarding institutions in determining their roles and specific contents. The role of this breakthrough has now been defined at a new height as the “key to the key” – understood as “pioneering,” “comprehensive,” and “continuous and uninterrupted.”

“Pioneering” means it must come first, creating a precedent and a foundation for the other two breakthroughs. When evaluating the positive results of the other breakthroughs, the impact of the institutional breakthrough must also be considered.

“Comprehensive” means it must be implemented in all aspects, from the economy and society to the organizational apparatus and personnel. After 40 years of transitioning to a market economy, the apparatus from the central to local levels is still cumbersome; the separation and integration of units often occur; the roles of the state and the market, the “visible hand” and the “invisible hand,” are not clearly defined.

The private economic sector has been recognized as a driving force, but for many years, it has only accounted for about 10% of GDP, and individual households still dominate the non-state sector. “Cross-ownership,” “backyard companies,” and the collusion between officials and business owners distort the market and permeate even the highest levels. “Continuous and uninterrupted” is hindered by “hesitation” in some periods and among some groups.

The breakthrough in human resources was also proposed early on and has achieved some positive results. The proportion of trained laborers has continuously increased from a very low level to 28% in 2024. However, this ratio is still low, and there is a gap between training quality and practical work, between jobs and creativity, between distribution and utilization, and between the structure of educational levels. The labor market has initially formed and developed but is not yet deep and extensive enough, especially in the effective utilization of talents in many units and agencies.

Infrastructure has been formed and developed, changing the face of urban and rural areas with a system of roads, airports, and seaports, but there are still limitations in transport capacity, especially seaports, ocean-going fleets, science cities, financial centers, and railways.

EXAMINING THE CONTRIBUTION OF INDUSTRY GROUPS TO OVERALL GROWTH

It can be seen that the structure and shift in the structure will inevitably lead to a decrease in the proportion of agriculture, forestry, and fisheries, an increase in the proportion of industry and construction, and a higher proportion of services in the process of industrialization, modernization, and the transition from an agricultural to an industrial country.

However, due to the advantages of land and climate and the fact that many populous countries are rapidly transitioning to industry and services, it is necessary to increase the investment ratio in the group of agricultural, forestry, and fishery industries. In terms of internal structural shift, it is crucial to increase processing to enhance value and, most importantly, to transfer labor from this group of industries (currently twice the proportion of GDP) to the industry and service sectors.

For the industrial sector, it is essential to overcome two significant limitations: the weakness of the supporting industry and the heavy reliance on assembly and processing. Developing new industries, such as semiconductors and chips, is also vital. For the service sector, it is necessary to increase the proportion of dynamic service industries such as science and technology, finance and banking, transportation and warehousing, and tourism.

EXAMINING THE GROWTH FACTORS

It is necessary to better promote traditional growth drivers and immediately improve new growth drivers.

The ratio of total social investment to GDP is still over 30%. This is a high ratio globally and has contributed to Vietnam’s continuous GDP growth over a long period, even during the Covid-19 pandemic. In the coming time, four issues need attention.

First, it is necessary to maintain this ratio and strive for a higher one because investment for development is the material factor determining GDP growth. In this regard, it is essential to encourage investment from the non-state sector to increase its proportion in total investment (to 60-70% compared to over 50% currently).

Second, guide a significant amount of capital that is currently flowing into gold, real estate, and virtual money channels into direct production and business channels.

Third, it is more important to improve investment efficiency by reducing the ICOR coefficient, which is currently high (over 5.5 times, compared to 3 times in many countries and territories worldwide). Measures to reduce the ICOR coefficient mainly include accelerating investment and construction, putting projects into operation, reducing waste and loss, etc.

Fourth, concentrate capital on improving the capacity of ocean-going fleets and seaports, railways connecting potential export areas, and enhancing the quality of FDI capital.

Regarding consumption, although the growth rate has improved, there are some issues to consider. The pressure of “saving for a rainy day” and “tightening our belts,” which appeared during the Covid-19 pandemic, still affects consumers’ psychology. Labor income remains low, significantly impacting consumers’ purchasing power and payment capacity. A significant amount of consumer goods are smuggled into the country, taking a share of the domestic market, and even disguised as Vietnamese goods to evade taxes when exported, thus taking away Vietnam’s export market share.

In terms of goods exports, 2024 set a new record with a turnover of over 405.5 billion USD. Importantly, the trade surplus reached nearly 24.8 billion USD, which is relatively high, and it was the ninth consecutive year of trade surplus. However, some issues need attention. Domestically, it is necessary to increase the export ratio of the domestic economic sector in the total export turnover of goods; reduce the trade deficit and strive for a trade balance in this sector; promote supporting industries and reduce the processing and assembly nature of industrial production.

Internationally, it is necessary to: (i) participate in more free trade agreements (FTAs); (ii) expand markets and avoid putting “all eggs in one basket”; (iii) improve the market economy nature of the domestic economy, effectively combine the “invisible hand” and the “visible hand,” and strengthen negotiations so that countries, especially the US and the EU, recognize Vietnam’s market economy. Additionally, caution should be exercised when increasing the VND/USD exchange rate.

Regarding new growth drivers, there are some issues that academic institutions, especially the Vietnam Academy of Social Sciences, need to research, propose contents and methods, and provide illustrative information.

One issue that deserves special attention is the quality of growth, which is not only unlimited in terms of resources (and almost unlimited in terms of intellectual resources) but also does not have negative side effects.

https://postenp.phaha.vn/tap-chi-kinh-te-viet-nam/detail/1262

The First-Ever Economic Ranking Index for 34 Provinces and Cities: Unveiling the Latest Provincial Power Rankings

“Ho Chi Minh City, Hanoi, Haiphong, Quang Ninh, and Dong Nai continue to be the nation’s outstanding growth poles, playing a pivotal role in the country’s value chain.”

“Reinstating Investor Confidence: Unraveling the ‘Restructuring Revolution’”

The ongoing administrative reforms post-provincial mergers are expected to unleash resources, unblock bottlenecks for the private sector, and bolster investor confidence. These strategic initiatives are designed to streamline processes, enhance operational efficiency, and foster an environment conducive to business growth and economic prosperity. With a renewed focus on ease of doing business, these reforms aim to energize the economy and unlock the region’s true potential.

The Surprising Truth About Khanh Hoa: A Single 10,000-Hectare Project Accounts for 95% of the Province’s Registered Investment Capital in the First Half of the Year

With an impressive investment of over 283,000 billion VND, the Cam Lam New Urban Area project by the Vinhomes joint venture has accounted for nearly 95% of Khanh Hoa province’s total registered investment capital in the first six months.

‘Heated’ Dialogue with the Prime Minister: The Laughter and Tears of Personal Income Tax

“In a recent development, Prime Minister Pham Minh Chinh adeptly addressed a ‘burning’ question posed by the World Economic Forum’s Chairman. This and more in today’s news roundup: the latest regional minimum wage adjustments coming into effect on July 1st; Hanoi’s continued efforts to inspect the origin and provenance of goods with specialized task forces; and an examination of the existing personal income tax structure, highlighting existing inequities.”