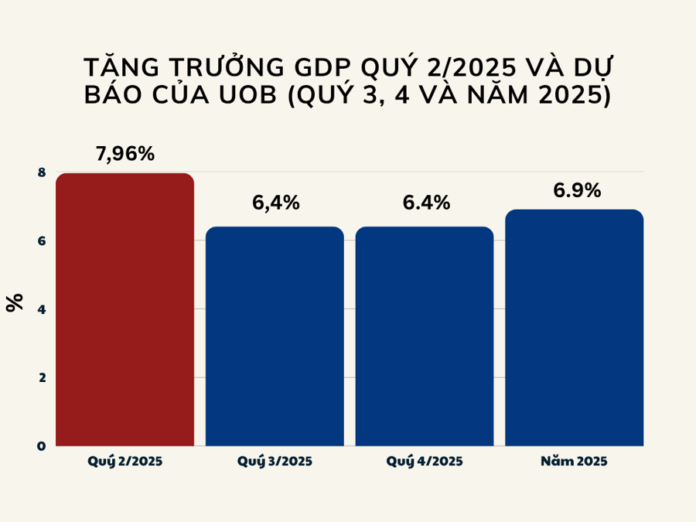

The UOB (Singapore) Market and Global Economics Research team released a report on Vietnam’s economic growth in Q2 2025, indicating a strong rebound in the country’s real GDP. The quarterly growth rate reached 7.96%, significantly outperforming Bloomberg’s forecast of 6.85% and UOB’s initial prediction of 6.1%. This also marks a notable improvement from the adjusted Q1 2025 figure of 7.05%.

Positive Export and FDI Performance Boost Q2 Economic Growth

For the first half of 2025, Vietnam’s economic growth reached 7.52% year-on-year, the highest half-year growth rate since 2011. UOB analysts attribute this robust performance primarily to businesses rushing to fulfill export orders during the 90-day period when President Trump suspended the ‘countervailing’ tariff policy, opting for a basic 10% tax rate instead.

Notably, Vietnam’s export turnover in the first half surged by 14.4% year-on-year to reach US$219 billion, while imports rose by 17.9% to US$212 billion. These figures match the full-year growth rates of 2024, with exports increasing by 14% and imports by 16%.

Computers and electronic products maintained their position as the largest export category in H1 2025, skyrocketing by 42% year-on-year to US$47.7 billion. This was followed by mobile phones, which decreased by 1.1% to US$26.9 billion, and machinery and equipment, which increased by 16.3% to US$27 billion. Together, these three categories accounted for approximately 46% of total export turnover, highlighting Vietnam’s significant reliance on these sectors.

However, according to UOB analysts, Vietnam’s manufacturing sector has yet to fully recover, as indicated by the Vietnam Manufacturing Purchasing Managers’ Index (PMI). In the past seven months, the PMI has dipped below 50 six times, signaling ongoing challenges, particularly regarding new orders.

S&P Global data reveals that Vietnam’s export orders declined in June at the sharpest rate since September 2021, matching the pace of decline observed in May 2023.

A positive economic indicator for the first half of the year was the 8.1% year-on-year increase in FDI, the highest level for this period since 2021.

The manufacturing sector continued to lead, attracting US$9.56 billion, or 81.6% of the total FDI. The real estate sector ranked second, with US$932.2 million, equivalent to 8% of the total FDI. Consequently, the total newly registered FDI capital in the first half reached US$21.52 billion, a substantial increase of 32.6% year-on-year.

“The strong momentum from this registered capital is expected to positively impact the realized capital in the coming months. However, in the context of global trade tensions and the implementation of tariff measures, FDI flows may be subject to fluctuations in the international trade environment,” UOB analysts commented.

Given the positive developments in recent trade negotiations with the US, UOB experts suggest that the worst may be over. However, they maintain that tariff policies remain a significant hurdle for Vietnam. As such, they forecast a moderate growth rate for exports in 2025.

UOB analysts estimate that Vietnam’s GDP growth for 2025 will surpass their initial baseline forecast by 0.9 percentage points, reaching 6.9% (up from the previous prediction of 6.0%).

For the remaining two quarters of the year, UOB predicts GDP growth of around 6.4% for both Q3 and Q4 2025. Under these conditions, the realized FDI capital is expected to reach approximately US$20 billion for the full year.

Monetary Policy Rates to Remain Unchanged for Now

Given that overall and core inflation remained below the official target of 4.5% in the first half of 2025 and most of 2024, UOB analysts believe that the State Bank of Vietnam (SBV) may consider loosening monetary policy.

However, foreign exchange market dynamics are also a crucial factor for the SBV to consider. The VND was Asia’s worst-performing currency in H1 2025, depreciating by 2.5% against the USD.

In contrast, regional currencies benefited from the weakening USD, with gains ranging from 12% for the TWD (Taiwan Dollar) to 2.5% for the CNH (offshore Chinese Yuan) during the same period.

“Additionally, the overall positive economic growth may have reduced the pressure to loosen monetary policy. Hence, we anticipate that the SBV will maintain the current policy rates, with the refinancing rate held at 4.50%,” UOB analysts emphasized.

However, if domestic business conditions and the labor market deteriorate significantly in the next one to two quarters, UOB experts suggest that the SBV may consider lowering the policy rate once to the COVID-19 low of 4% and subsequently cutting it by 50 basis points to 3.5%, provided that the foreign exchange market stabilizes and the US Federal Reserve initiates rate cuts.

For now, UOB’s base scenario remains that the SBV will refrain from altering its monetary policy stance.

“We forecast that the VND will remain near the lower end of its trading band against the USD until Q3 2025. However, in Q4 2025, the VND may start to recover in line with the general recovery of Asian currencies as trade uncertainties ease,” UOB stated.

UOB predicts the USD/VND exchange rate to be 26,400 VND in Q3 2025, 26,200 VND in Q4 2025, 26,000 VND in Q1 2026, and 25,800 VND in Q2 2026.

Unlocking Provincial Mergers: Bac Giang Shines on Vietnam’s FDI Landscape.

The large-scale administrative merger between Bac Ninh and Bac Giang has officially ushered in a new era for the Northern Key Economic Region’s industrial, commercial, and service landscape. This union not only creates a seamless production, industrial, and logistics hub rivaling any in the country but also serves as a powerful magnet for foreign direct investment (FDI), channeling it towards Bac Giang – the new “promised land” on Vietnam’s investment map.

Is All This Money Being Spent in the Right Places?

“Vietnam requires a more flexible and efficient mechanism to direct funds to where they are needed most. The first step is to untangle the bottleneck of public investment disbursement, followed by redirecting credit flows. Instead of fueling speculative channels, the focus should be on prioritizing manufacturing, green technology, and social housing.”

June 2025 PMI: New Export Orders Plunge at Sharpest Rate in Over Two Years

The S&P Global Vietnam Manufacturing Purchasing Managers’ Index™ (PMI), a composite indicator designed to provide a single-figure snapshot of the health of the manufacturing sector, fell to 48.9 in June from 49.8 in May. This reading signalled a third successive month below the 50.0 no-change mark and a marginal deterioration in business conditions as the second quarter drew to a close.

“A Private Sector-Led Economy: Aiming for a 51-52% Contribution to GDP by 2025.”

“Proposed Amendments to the Law on Supporting Small and Medium-sized Enterprises: Aiming High for Vietnam’s Private Sector by 2025.

We strive to enhance the private sector’s contribution to GDP, targeting a substantial increase to 51-52% by 2025. This involves boosting budget revenues from the private sector and significantly improving employment and labor productivity…”

Let me know if you would like me to continue with this tone and style for any further content creation or editing.