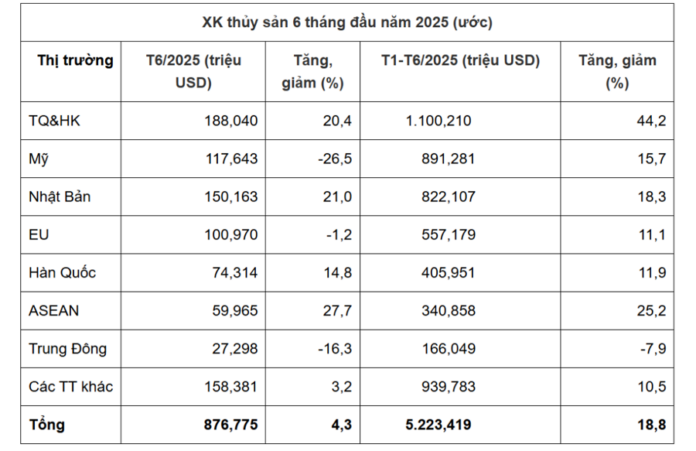

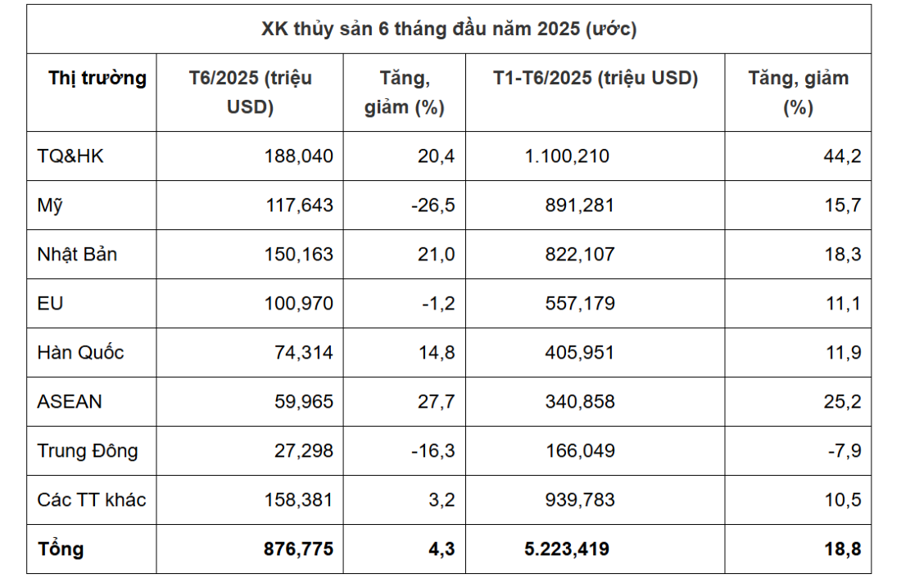

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), after a strong surge of over 20% in May, seafood export turnover in June 2025 remained higher than the same period last year, but the growth rate slowed down to 4%, reaching $876 million. In the first six months, seafood exports reached $5.2 billion, up nearly 19% over the same period last year.

EAST ASIAN MARKETS CONTINUE TO GROW

China, the US, and Japan are the three largest seafood consumer markets for Vietnam in the first half of this year, accounting for market shares of 19.6%, 18.2%, and 15%, respectively.

Seafood exports to the US market in June 2025 decreased by 26% compared to the same period last year. In the first six months, exports to the US reached $891 million, still up 16% thanks to the “acceleration” of shipments before July 9 – the date the US applies new countervailing duties. However, since June, many enterprises have proactively stopped exporting to the US to avoid the risk of high taxes.

The Chinese, Japanese, South Korean, and ASEAN markets continued to maintain good growth in June, increasing from 15% to nearly 28%. Meanwhile, exports to the EU slowed down, decreasing slightly by 1%, while the Middle East market saw a sharp decline of 16% due to the impact of the war.

Notably, exports to Israel – a major consumer market for canned tuna – decreased by more than 50%. Among the top 15 largest export markets, the export value of seafood products increased the most in the Brazilian market, with a growth rate of 71.3%.

“In the worst-case scenario, if Vietnam’s competing seafood countries, such as Ecuador, India, Thailand, and Indonesia, are subject to lower US countervailing duties than Vietnam, competition will become more intense. In that case, Vietnamese seafood will shift to neutral markets such as Japan, the EU, and ASEAN, but the potential for compensation is limited as global consumer demand has not recovered strongly.”

Ms. Le Hang, VASEP Deputy General Secretary.

In terms of products, tuna was the group that witnessed the sharpest decline in June, decreasing by more than 31% over the same period, mainly due to the impact of tariffs from the US – a market with a large proportion. In the first six months, tuna exports decreased by nearly 2%. Meanwhile, shrimp and catfish growth slowed down, also affected by US tax policies. By the end of June, shrimp exports reached $2.07 billion (up 26%) and catfish exports reached $1 billion (up 10%).

However, the prospects for the second half of 2025 for these two key industries depend entirely on the US countervailing duty policies. Especially, shrimp faces the risk of “tax on tax,” including countervailing duties, anti-dumping duties, and countervailing duties. The catfish industry is more optimistic as the US Department of Commerce (DOC) recently announced the final results of POR20, with seven Vietnamese enterprises enjoying a 0% anti-dumping duty rate. If the upcoming countervailing duty rate is well controlled, this could be an opportunity for Vietnamese catfish to break through.

VASEP presented two scenarios for seafood exports in the second half of 2025.

Scenario 1 – US countervailing duty after 9/7 is 10%: Total export turnover in 2025 may decrease to about $9.5 billion, a decrease of $500 million compared to the previous forecast. Other markets such as China, ASEAN, Japan, and the EU can absorb part of the regulated goods from the US.

Scenario 2 – Countervailing duty of more than 10%, exports are at risk of a deep decrease to only $9 billion or lower. The US will no longer be a stable market, especially for products with complex supply chains.

RESPONDING TO VOLATILITY IN THE MIDDLE EAST MARKET

According to VASEP, the Middle East – a region notable for its high seafood consumption and many wealthy economies such as Israel, UAE, Saudi Arabia, and Qatar – has become a strategic market for Vietnamese seafood. However, since the middle of June 2025, when the armed conflict between Israel and Iran broke out and quickly escalated, this market has also become a severe test of the adaptability of exporting enterprises.

Growing nearly twofold in five years, from $198 million (2020) to $366 million (2024), the Middle East is a bright spot for Vietnamese seafood in the journey of market diversification. In 2024, the export value to this region increased by 18% compared to the previous year, despite the challenging global context.

In the first five months of 2025, Vietnam’s seafood exports to the Middle East market reached $130 million, a decrease of 12%. The reason is partly due to the complex and prolonged conflict in the Middle East over the years, which escalated in mid-June 2025.

“Enterprises hope that authorities will strengthen market information and trade promotion in the Middle East and alternative regions. At the same time, it is proposed to establish an inter-agency working group to promptly handle emergency situations arising in the Middle East market in the context of prolonged geopolitical instability.”

Ms. Kim Thu – VASEP Industry Analyst.

Notably, the two main product groups, tuna and catfish, account for up to 70% of the total turnover to the Middle East. Of which, canned and bagged tuna, especially those soaked in oil or brine, are very popular, accounting for more than two-thirds of the value of Vietnam’s tuna exports to this region.

With a young population, a rapidly growing middle class, and the strong development of the hotel and tourism industry, the demand for seafood in countries such as the UAE, Qatar, Kuwait, and Egypt remains high. Moreover, religious factors also open up significant opportunities, as Halal-certified seafood products are highly attractive.

Israel’s military campaign, codenamed “Operation Lion’s Roar,” which began on June 13, 2025, triggered a series of military responses from Iran and regional forces, causing freight and insurance rates to surge, and severe disruptions to the Suez Canal-Red Sea shipping route.

“The escalating tension makes businesses wary of delivery and payment risks. In Egypt, Iraq, the UAE, etc., customs and logistics procedures have also been delayed, significantly affecting delivery progress. Increased input costs and narrowed profit margins: Surging oil and fuel prices have led to higher packaging, freezing, preservation, and operating costs for factories. For frozen products – which account for a large proportion – the pressure of costs is even greater. Small businesses with limited financial capacity struggle to maintain long-term orders,” shared Ms. Kim Thu, VASEP expert.

To adapt to the new fluctuations in the Middle East market, Ms. Kim Thu advised that seafood enterprises exporting to this market should approach new emerging Islamic markets such as Jordan and Libya and boost exports to the EU, Japan, and ASEAN, which have preferential trade agreements and recovering demand, instead of focusing on Israel or the UAE. Along with this, it is necessary to expand the number of factories with certifications recognized in Islamic countries such as Saudi Arabia and the UAE.

In the context of the escalating Middle East conflict, the seafood business community in Vietnam hopes for timely support policies from the authorities. Businesses also propose accessing preferential credit. In addition, it is necessary to promote Halal certification recognition and establish a Halal consulting center in Vietnam to expand exports to Islamic markets.

“No More VAT Deductions for Cash Payments Under VND 20 Million Starting Today, July 1st”

“From January 2023, tax deductions will no longer be applicable for transactions under VND 20 million if they are made in cash. This new regulation is part of the government’s efforts to encourage digital payments and reduce the amount of physical cash in circulation.”

“Honda Celebrates 30 Years in Vietnam: A Milestone Achievement”

Honda, the renowned Japanese automotive manufacturer, has firmly established its presence in Vietnam with an impressive network of three motorcycle factories. These state-of-the-art facilities collectively boast an annual production capacity of up to 2.5 million units, showcasing the brand’s unwavering commitment to meeting the demands of the vibrant Vietnamese market.