Domestic Aggregate Demand

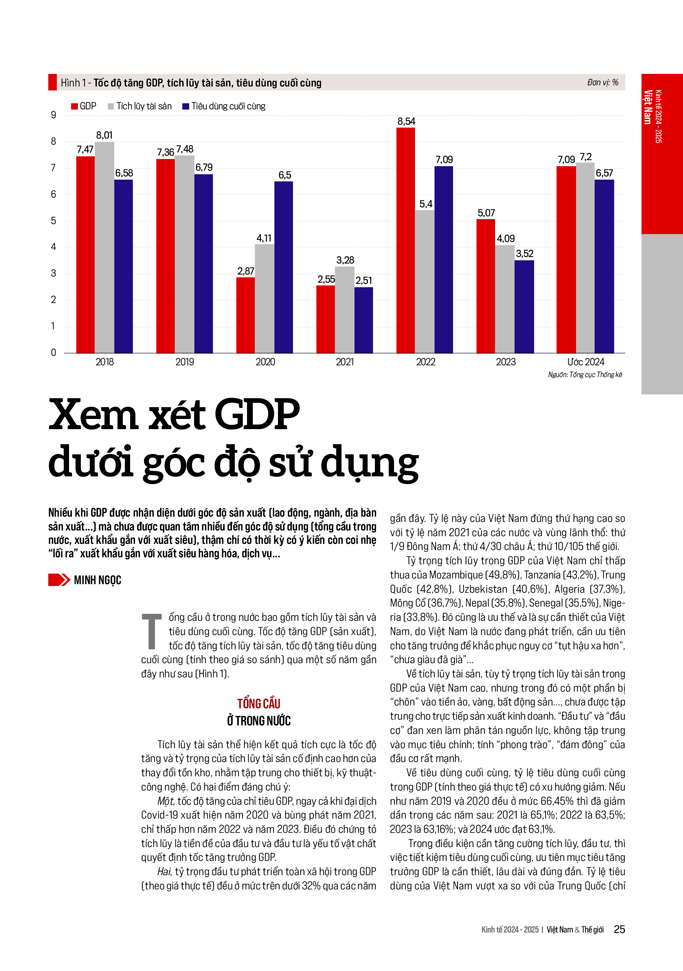

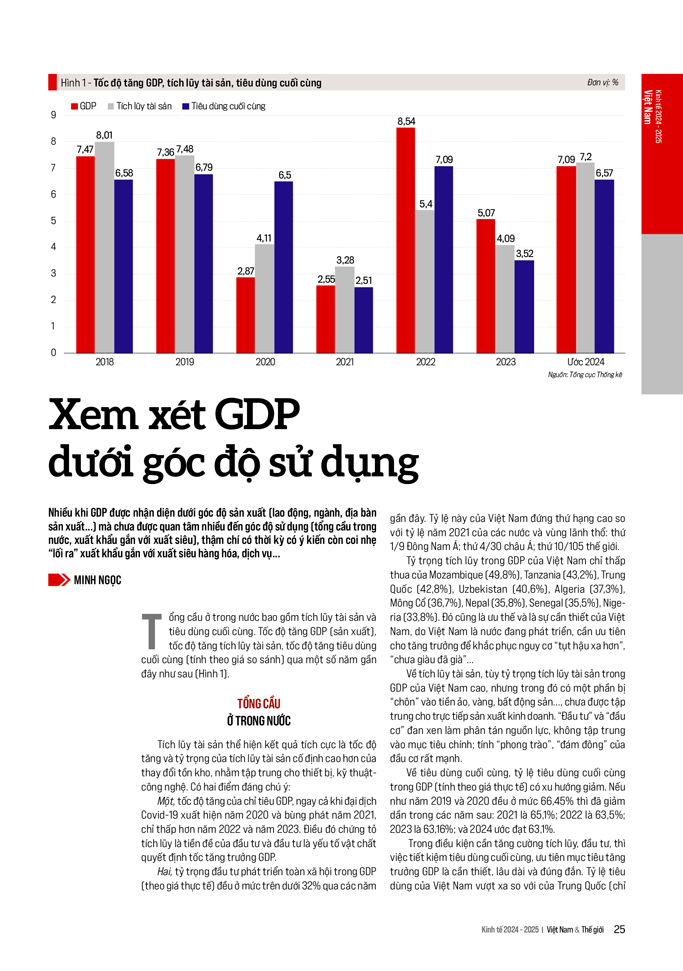

Domestic aggregate demand includes asset accumulation and final consumption. The growth rates of GDP (production), asset accumulation, and final consumption (in comparable prices) over the past few years are as follows (Figure 1):

Asset accumulation shows positive results, with a higher growth rate and proportion of fixed asset accumulation compared to inventory changes, focusing on equipment, technology, and engineering. There are two notable points:

First, the growth rate of GDP, even during the Covid-19 pandemic in 2020 and its outbreak in 2021, was only lower than in 2022 and 2023. This demonstrates that accumulation is the premise of investment, and investment is the material factor determining GDP growth.

Second, the proportion of social development investment in GDP (in real terms) has been around 32% in recent years. This ratio places Vietnam in a high ranking compared to the 2021 ratios of other countries and territories: 1st out of 9 in Southeast Asia, 4th out of 30 in Asia, and 10th out of 105 globally.

Vietnam’s accumulation ratio in GDP is only lower than that of Mozambique (49.8%), Tanzania (43.2%), China (42.8%), Uzbekistan (40.6%), Algeria (37.3%), Mongolia (36.7%), Nepal (35.8%), Senegal (35.5%), and Nigeria (33.8%). This is also an advantage and a necessity for Vietnam, as it is a developing country that needs to prioritize growth to overcome the risk of “falling further behind” and “aging before getting rich.”

Regarding asset accumulation, while Vietnam’s proportion of asset accumulation in GDP is high, a portion of it is “buried” in virtual currency, gold, real estate, etc., and is not directly focused on production and business. “Investment” and “speculation” are intertwined, dispersing resources and diverting attention from the main goal. The “trend” and “herd mentality” of speculation are strong.

In terms of final consumption, the ratio of final consumption in GDP (in real terms) shows a decreasing trend. While it was 66.45% in 2019 and 2020, it gradually decreased in subsequent years: 65.1% in 2021, 63.5% in 2022, 63.16% in 2023, and an estimated 63.1% in 2024.

In the context of the need to strengthen accumulation and investment, curbing final consumption and prioritizing GDP growth targets is necessary, prudent, and appropriate in the long run. Vietnam’s consumption rate far exceeds that of China (around 55%) and many other countries.

The ratio of final consumption in GDP (in real terms) in Vietnam ranks low among comparable countries and territories: 6th out of 10 in the region, 22nd out of 35 in Asia, and 90th out of 110 globally.

Within the total final consumption (in real terms), the proportion of state consumption is below 10% of GDP and decreasing. There are two issues of concern:

Firstly, the total consumption of the state sector remains high, mainly due to a cumbersome apparatus, as the country has transitioned to a market economy for decades, yet the state still intervenes deeply in matters that the market could handle better. Meanwhile, the state’s primary responsibilities (legal framework, inspection, supervision, etc.) are not performed optimally. Currently, there is an ongoing effort to streamline the state apparatus by merging commune, district, provincial, ministerial, and other-level units.

Secondly, the average income per person for state officials and employees is low, not only causing difficulties in their living standards but also being one of the factors giving rise to corruption and negativity, including grand and petty corruption.

Regarding the final consumption of households, positive results have been achieved, such as a reduction in the number of poor households, an increase in average income, and a high proportion of income from salaries, fees from agriculture, forestry, and fisheries (79.1%, including 55.2% from salaries and 23.9% from agricultural, forestry, and fishery fees). However, the proportion of this income in GDP is decreasing, and household accumulation is low, with a small and slow-growing gap between average monthly income and expenditure.

The income gap between the highest and lowest income groups in 2022 was 7.6 times, lower than in previous years but still significant, with some urban areas showing even higher disparities.

In rural areas and some regions, such as the northern midlands, mountainous areas of the north, north-central and central coastal regions, and the Central Highlands, the gap is even lower.

Overall, domestic aggregate demand as a percentage of GDP has been lower than domestic supply in recent years and is decreasing (Figure 2).

Consequently, domestic aggregate demand has been weaker than domestic supply, emphasizing the need to enhance the role of trade surplus in goods and services (associated with exports and imports of goods and services).

Trade Surplus in Goods and Services

The trade surplus in goods and services is essentially foreign aggregate demand. This surplus, calculated in VND at real prices over the past few years, is as follows (Figure 3):

The trade surplus in goods and services is necessary and contributes significantly to the growth of domestic supply (production) while domestic aggregate demand remains weak. It is influenced by two factors: the trade surplus in goods and the trade deficit in services.

The trade surplus in goods, calculated in USD over the past few years, is illustrated in Figure 4.

In 2024, Vietnam achieved a trade surplus in goods for the ninth consecutive year, with five years of surplus exceeding 10 billion USD and two years surpassing 20 billion USD. The year 2025 is expected to be the tenth consecutive year of a trade surplus in goods, although the surplus may be lower than the previous two years.

The trade surplus in goods is attributed to outstanding export performance in terms of total scale, growth rate, proportion to GDP, main export items, export markets, and destinations, with significant contributions from free trade agreements (FTAs) and upgraded partnerships (comprehensive, strategic, and comprehensive strategic).

The trade deficit in services has initially shown positive signs of improvement. The scale of the deficit has decreased in recent years, although it increased in 2024, remaining lower than in the previous three years (2020-2022) (Figure 5). Postal and telecommunications services shifted from a previous deficit to a surplus in 2022…

However, the entire service sector still faces a significant trade deficit. The proportion of service exports in total exports of goods and services is low, and the ratio of service exports to GDP in the service sector is considerably lower than that of service imports (11.1% versus 15.9% in 2023 and 11.8% versus 17.9% in 2024). The ratio of the service trade deficit to service exports remains high (298.9% in 2021, decreasing to 96.8% in 2022 and 43.6% in 2023) but increased to 51.7% in 2024, a substantial figure.

The trade deficit in transport services is significant, reaching 5,495 million USD in 2020, 8,141 million USD in 2021, 7,376 million USD in 2022, 6,390 million USD in 2023, and 8,080 million USD in 2024. In 2024, some service sectors still experienced a trade deficit, including financial services (-98 million USD), insurance services (-920 million USD), and other services (-2,934 million USD). Notably, the tourism sector also faced a trade deficit (-380 million USD) despite a significant increase in international arrivals to Vietnam.

The service trade deficit is partly due to the later opening of service sectors compared to the manufacturing sector, with only a few decades of operation. However, a crucial factor is the weakness of many domestic service industries, especially transport, insurance, and other services, which contribute significantly to the trade deficit.

Forecast for 2025

Regarding domestic supply in 2025, GDP at comparable prices is expected to increase by 8%. Considering the GDP deflator (estimated at 4.2%, higher than the 4.12% in 2024), the real GDP in 2025 is projected to reach approximately 12.9 million billion VND, a 12% increase compared to 2024.

Assuming the ratio of asset accumulation to GDP reaches about 32%, slightly higher than the corresponding ratio of 31.7% in 2024, the scale of asset accumulation in 2025 will be 4.13 million billion VND. With the ratio of total social investment in asset accumulation at around 96% (slightly higher than the corresponding ratio of 95.5% in 2024), the total social investment in 2025 will be 4 million billion VND, an increase of nearly 7% compared to 2024. The ratio of total social investment to GDP will be approximately 32.2%, higher than the corresponding ratio of 32.07% in 2024.

If the ratio of final consumption to GDP reaches about 62.5%, slightly lower than the corresponding ratio of 63% in 2024, final consumption in 2025 will increase by 6% compared to 2024.

In summary, the total asset accumulation and final consumption (domestic aggregate demand) in 2025 will be 12.1 million billion VND, or 94% of total GDP, lower than the corresponding ratio of 95.5% in 2024.

The forecast for 2025 suggests that due to a lower ratio of total domestic consumption (including asset accumulation and final consumption) to GDP compared to the previous year, the trade surplus in goods and services will be higher than in 2024.

The trade surplus in goods will continue for the tenth consecutive year, estimated at around 25 billion USD, higher than the 24.768 billion USD in 2024, mainly due to a lower growth rate of goods exports compared to the previous year (14% versus 14.3%) and a larger scale, reaching about 462.3 billion USD compared to 405.5 billion USD.

The trade deficit in services in 2025 will be higher than in 2024 (12.3 billion USD) and is expected to exceed 13 billion USD.

As the trade surplus in goods and services in 2025 is projected to be lower than in 2024, its impact on GDP growth in 2025, when viewed from the perspective of GDP utilization, will not be significant. Therefore, to achieve the GDP growth target, it is necessary to continue stimulating domestic aggregate demand, i.e., increasing asset accumulation, mainly through investment in fixed assets, and promoting final consumption.

This article was published in a special edition of the magazine “Economy 2024-2025: Vietnam & The World” in February 2025. Please refer to the following link for more details: https://postenp.phaha.vn/tap-chi-kinh-te-viet-nam/detail/1262

Unlocking Provincial Mergers: Bac Giang Shines on Vietnam’s FDI Landscape.

The large-scale administrative merger between Bac Ninh and Bac Giang has officially ushered in a new era for the Northern Key Economic Region’s industrial, commercial, and service landscape. This union not only creates a seamless production, industrial, and logistics hub rivaling any in the country but also serves as a powerful magnet for foreign direct investment (FDI), channeling it towards Bac Giang – the new “promised land” on Vietnam’s investment map.

Revolutionizing Travel: Private Sector Steps Up for High-Speed Rail

The legal framework has paved the way for private enterprises to embark on the ambitious North-South high-speed rail project.

What’s in the $16 Billion Dong Nai Free Trade Area?

This is the first free trade zone to fully integrate a production ecosystem with airport-seaport logistics, trade finance, and high-tech industries. With direct access to Long Thanh Airport and Phuoc An Port, this zone offers unparalleled advantages for businesses looking to thrive in an efficient and well-connected environment.