In Q2 2025, many listed companies are investing hundreds to thousands of billions of dong in the stock market.

Da Nang Development Investment Corporation (NDN) , a real estate company, is allocating a significant portion of its assets to stock investments. Specifically, NDN’s trading securities portfolio is valued at over 524.3 billion VND, accounting for 42.3% of the company’s total assets (1,240 billion VND).

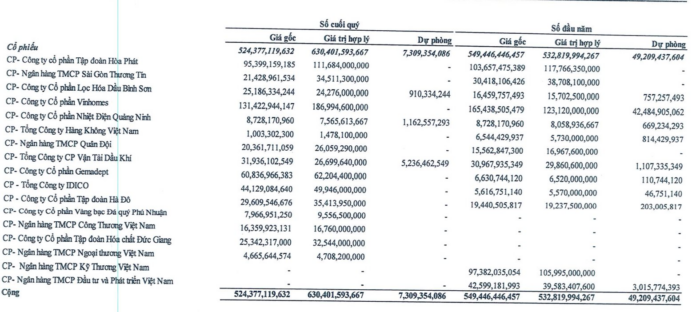

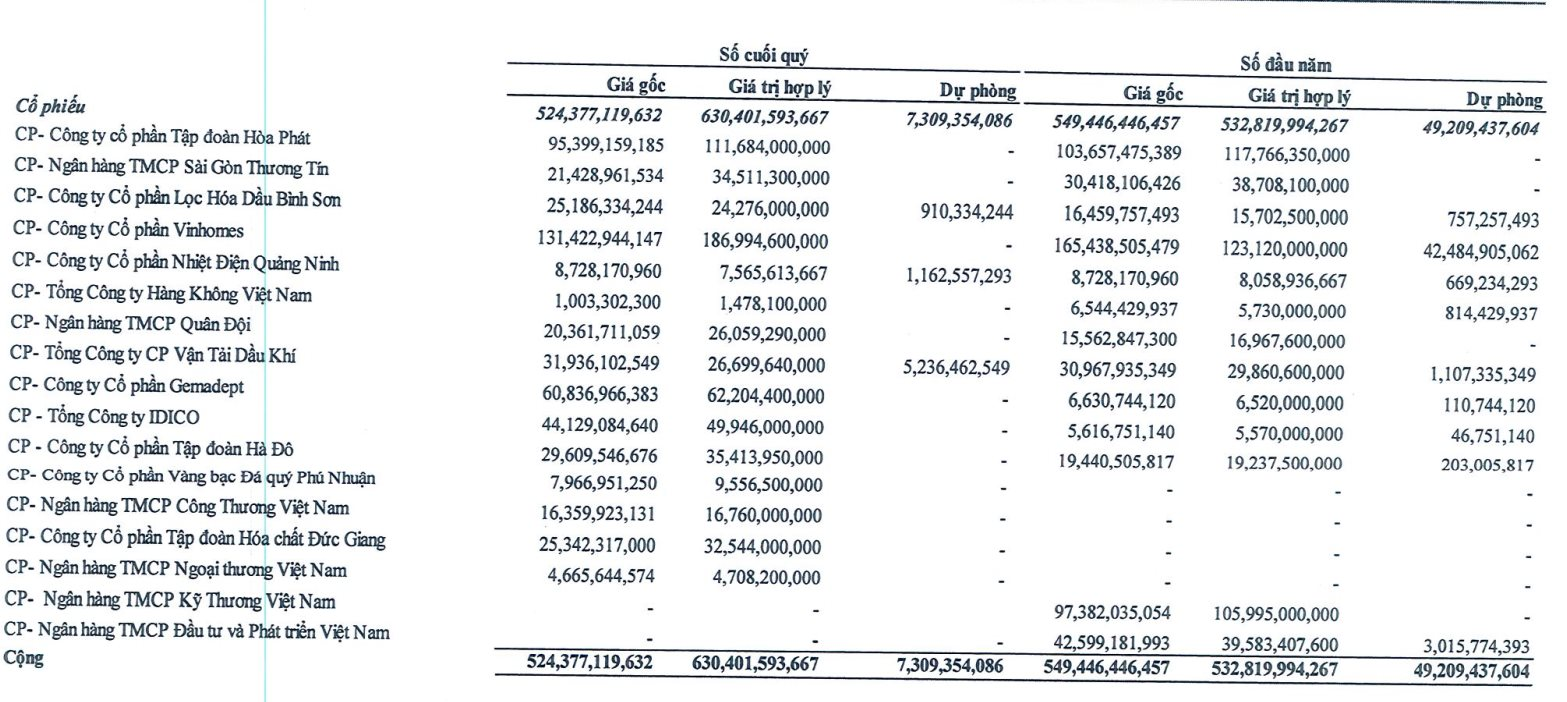

Figure 1: NDN’s investment portfolio as of Q2 2025

As of Q2 2025, NDN is investing in 15 stocks, with a fair value of over 630 billion VND, 106 billion VND higher than the original cost. NDN’s largest investments are in Vinhomes (131 billion VND), Hoa Phat (95 billion VND), Gemadept (61 billion VND), and Idico (44 billion VND), among others.

NDN has had to set aside over 7.3 billion VND in provisions for BSR, QTP, and PVT stocks.

With 42% of its total assets invested in stocks, NDN’s financial performance has been significantly impacted by its stock investments.

NDN’s revenue from sales and services in the first half of the year was nearly 11 billion VND, and when offset by gains/losses from stock investments, the company’s profit was nearly 30 billion VND for the first six months of 2025. They also reversed provisions for trading securities and other investments of nearly 52 billion VND.

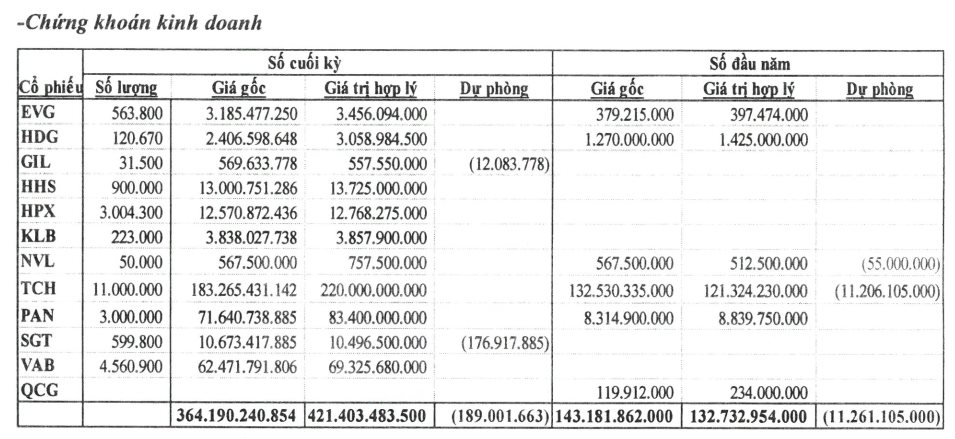

Another real estate company, Tu Liem Urban Development Joint Stock Company (LIDECO, stock code: NTL) , recorded an original investment cost of 364.1 billion VND in trading securities, equivalent to 18.6% of total assets (1,958 billion VND). NTL’s portfolio mainly invests in TCH, PAN, and VAB stocks. As of June 30, the fair value of the portfolio was 421 billion VND, 57 billion VND higher than the original cost.

Figure 2: NTL’s investment portfolio as of Q2 2025

In terms of financial performance, NDN’s revenue in Q2 decreased by 99.6% to just over 6 billion VND, and profit after tax decreased by 99.7% to nearly 2 billion VND. The company attributed this to the fact that there was no revenue from real estate activities in Q2 as projects are in the process of completing investment procedures. The only revenue generated during the quarter came from financial activities, including interest from bank deposits and investments in securities on the Vietnamese stock market.

TVC, a company that previously invested significant amounts in stocks, sold off almost 95% of its portfolio in Q2.

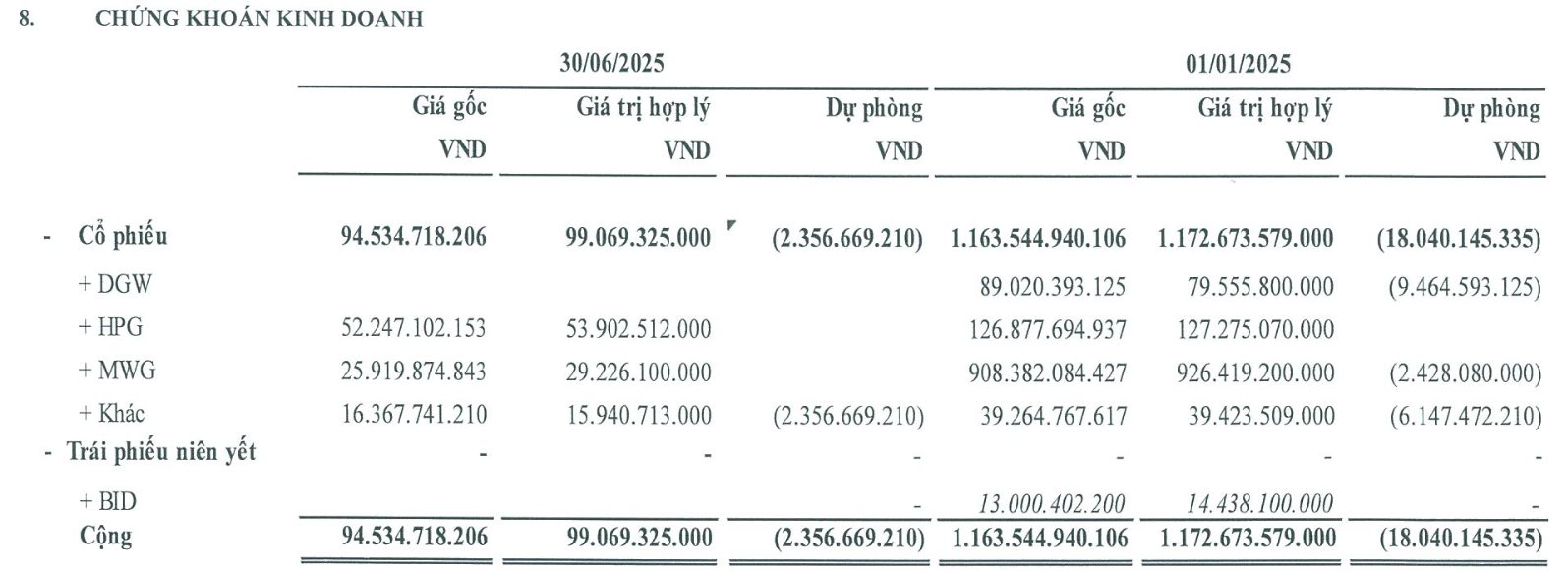

Q2/2025 Financial Statement

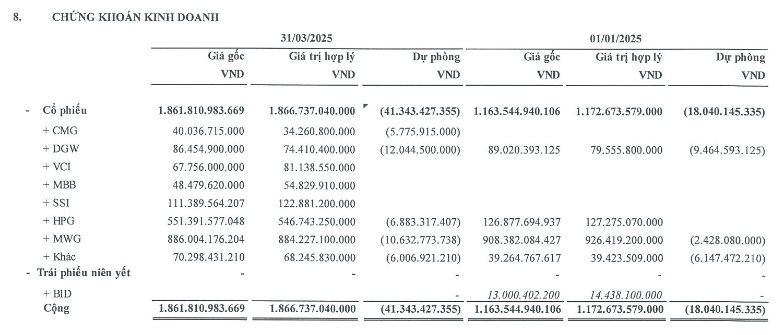

Q1/2025 Financial Statement

As of Q1, TVC invested 1,862 billion VND in stocks such as CMG, DGW, VCI, MBB, SSI, HPG, and MWG. By the end of Q2, TVC had reduced its investments to just under 95 billion VND in HPG, MWG, and other stocks.

GELEX Group (GEX) is currently allocating 5,012 billion VND to securities investments, accounting for approximately 8.5% of the Group’s total assets. GEX’s investment portfolio consists mostly of stocks, with an original cost of nearly 4,622 billion VND, and the remainder in bonds with an original cost of over 390 billion VND.

The Q2/2025 financial report does not provide a detailed breakdown of the individual stocks held by GEX. However, according to the 2024 financial report, GEX invested more than 3,297 billion VND in EIB stocks. GEX is also a major shareholder, holding nearly 187 million EIB shares, equivalent to 10% of charter capital.

Vietnam Container Shipping Joint Stock Company (Viconship – HOSE: VSC) has increased its stock investments by 2.5 times since the beginning of the year, from 546 billion to 1,404 billion VND as of June 30, accounting for about 16% of total assets. The detailed portfolio as of June 30 is not disclosed, but as of the beginning of the year, the company mainly invested in GEX, EIB, and PET stocks.

In terms of financial performance, VSC’s pre-tax profit in Q2/2025 was 177 billion VND, up 57% from the same period last year, and after-tax profit increased by 62.45% compared to Q2/2024.

Refrigeration Electrical Engineering Corporation (REE) is investing over 933 billion VND in trading securities, mainly in the International Commercial Joint Stock Bank (VIB) with 696 billion VND. REE has been investing in VIB since the end of 2022.

The Great Unloading: Corporate Leaders Race to Sell Shares, HIG Bids Farewell to the Stock Exchange

“In a recent development, four top executives at Petrosetco have signaled their intent to offload nearly 1 million PET shares between August 6 and September 4, through matching and negotiated transactions. This move comes as Hà Đức Hiếu, a member of the Board of Management at Dat Xanh Group, also registers to sell 6.355 million DXG shares to reduce his equity holdings.”

What to Do When the VN-Index Takes a Nosedive and Foreign Investors Start Selling?

The VN-Index has witnessed a consecutive two-day decline, with intense selling pressure from foreign investors – often deemed as ‘smart money’. Is this a telling sign for investors?