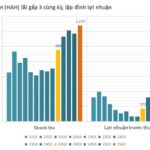

HDBank recorded remarkable performance in Q2 2025, with pre-tax profits surpassing VND 4,713 billion, and a cumulative profit of VND 10,068 billion for the first half of the year—the highest semi-annual profit in its history, crossing the VND 10,000 billion mark.

Positive credit growth and effective risk management

In the first half of 2025, HDBank’s net interest income reached VND 17,227 billion, a 16% increase compared to the previous year. Non-interest income from payment services, digital banking, and foreign exchange activities surged by over 210% year-on-year, contributing to a 30% rise in total operating income to VND 20,840 billion. Additionally, the effectiveness of digital transformation was evident, with optimized operating costs, resulting in an impressive CIR ratio of 26%.

With these outstanding results, HDBank continues to lead the industry in operational efficiency, achieving a return on equity (ROE) of 26.5% and a high return on assets (ROA) of 2.2%. The bad debt ratio, as per SBV regulations, was maintained at a low level of 1.94%. The capital adequacy ratio (CAR) remained above 13% (under Basel II norms). Other safety indicators were also well above industry standards.

As of June 30, 2025, HDBank’s total assets exceeded VND 784 trillion, a 12% increase from the beginning of the year. Deposits reached VND 664 trillion, up 7%, while outstanding loans surpassed VND 517 trillion, an 18% increase from the beginning of the year, and nearly double the industry average (9.9% growth). The bank focused on priority sectors such as infrastructure, manufacturing, and consumer lending, which are key drivers of economic growth with low risk. HDBank actively implemented large-scale programs in line with the government and State Bank of Vietnam’s directives, including lending for social housing and young homebuyers, infrastructure and digital technology credit packages, value chains, rural and high-tech agricultural lending, and green credit.

The financial group’s subsidiaries, such as HD SAISON Finance Company and Vikki Digital Bank (the only bank that did not lay off employees during the government’s banking sector restructuring program), also reported positive results for the first six months. The number of app downloads surpassed 1 million within just five months of operation. HD SAISON’s financial transaction points exceeded 27,100, serving 15.5 million customers. Pre-tax profit for the first half reached VND 709 billion, an 18% increase year-on-year.

Vikki Digital Bank, following its comprehensive transformation from Dong A Bank to a new-generation digital bank, witnessed over 1 million app downloads and opened more than 600,000 new accounts in just five months, demonstrating its strong market acceptance. The bank’s vibrant and youthful brand image has been well received.

HD Securities Company also performed well, with a profit of VND 382 billion and an ROE of 29%, ranking among the top 10 most profitable companies, mainly from service income.

Digital transformation and industry-leading governance

In Q2, digital business programs were aggressively implemented, resulting in 75% of new customers being acquired through digital channels. The number of transactions on digital platforms increased by 51%, and 94% of individual customers’ transactions were conducted through digital channels. Digital solutions for corporate customers were continuously introduced and improved, contributing to customer acquisition and business efficiency.

Other significant technology projects, such as AI and machine learning applications in governance, training, and process automation, gained momentum. HDBank is at the forefront of implementing advanced core banking technology and next-generation digital banking super-apps. These transformations not only enhance user experiences but also lay the foundation for the development of comprehensive, personalized digital financial models and expanded digital ecosystem connectivity.

Accompanying the positive business results, HDBank received numerous prestigious awards from renowned domestic and international organizations: Best Domestic Retail Bank, Best Foreign Exchange and International Payments Services, Top 50 Best Listed Companies by Forbes, and one of the five representatives from Vietnam honored at the ASEAN Corporate Governance Awards 2025 in Malaysia.

HDBank’s achievements in Q2 and the first half of 2025 have exceeded the expectations of shareholders and investors, surpassing the targets set for the 2025 financial year.

– 18:43 30/07/2025

HDBank Signs $215 Million Syndicated Loan Agreement with Three Leading International Financial Institutions

On July 31, 2025, HDBank, a leading Vietnamese joint-stock commercial bank, inked a syndicated loan agreement worth $215 million with three prestigious international financial institutions: Sumitomo Mitsui Banking Corporation (SMBC), FinDev Canada, and the Japan International Cooperation Agency (JICA).

“Insider Trading: Chairman-Linked Entity Seeks to Increase Stake in SAM as Prices Hit 2-Year High”

National Securities Incorporation (NSI) aims to strengthen its foothold in SAM Holdings Joint Stock Company (HOSE: SAM) by acquiring an additional 5 million shares from August 6 to September 4.