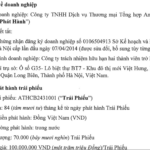

The Hanoi Stock Exchange (HNX) has just announced that August 8th will be the first trading day for the registered shares of F88 Investment Joint Stock Company (F88).

Accordingly, 8,264,612 shares of F88 Investment Joint Stock Company will officially be listed on the UPCoM exchange on August 8th, under the stock code F88, with a reference price of VND 634,900 per share in the first trading session.

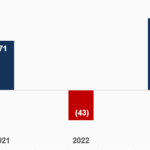

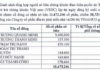

In terms of business results, in the second quarter of 2025, F88 recorded double-digit growth in most core indicators, with a 30% increase in revenue to VND 925 billion and a 220% surge in pre-tax profit to VND 189 billion compared to the second quarter of 2024. This performance resulted from the company’s increased disbursement (+47%) and loan portfolio expansion (+45%), coupled with maintained discipline in risk management.

In the first six months of 2025, F88 achieved 888 operating stores, completing 100% of its annual expansion plan. Net debt stood at VND 5,543 billion, and revenue for the period reached VND 1,745 billion, a 30% year-over-year increase. Pre-tax profit amounted to VND 321 billion, equivalent to 48% of the full-year plan.

Notably, in the past six months, the company added 20 sales points, bringing the total number of stores to 888. F88 also witnessed positive growth in customer metrics, with new customer acquisition and new loan contracts increasing by 19.5% and 76.2%, respectively, compared to the previous year. Meanwhile, the repeat customer ratio reached 50% of total customers.

Particularly, the My F88 mobile application facilitated the shift of loan contracts from offline to online, with the ratio rising from 5% in the first quarter of 2025 to 23% in the second quarter of 2025.

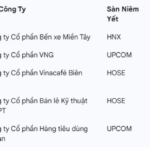

Previously, the State Securities Commission approved F88’s transition to a public company. Following the approval, F88 had 30 days to register for share trading on the UPCoM exchange. This is considered a crucial stepping stone toward the company’s goal of listing on the Ho Chi Minh City Stock Exchange (HOSE) in 2027 – three years later than initially planned.

For 2025, F88 aims to raise more than VND 700 billion (approximately $27 million) through bond issuance. The company’s ownership structure includes prominent investors such as Mekong Capital, Vietnam Oman Investment, and Granite Oak. Additionally, F88 has secured loan capital from international partners like Lending Ark Asia and Lendable.

Bond Leverage at The Maris Vung Tau Project

“As 2024 drew to a close, Allgreen Vuong Thanh Trung Duong Ltd. successfully raised an additional 535 billion VND through bond issuances, bringing their total capital raised via this route to 2,270 billion VND within just one month. This injection of funds is dedicated to expediting the development of their premium resort project, The Maris Vung Tau.”