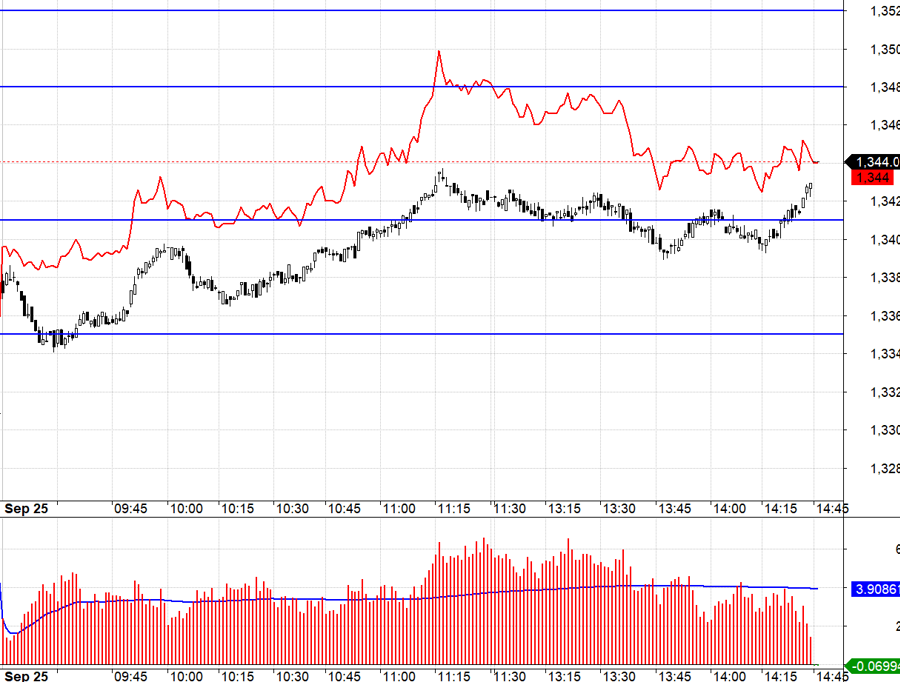

The VN-Index experienced a turbulent session, plunging over 20 points twice, but eventually recovering to close just 7.31 points lower at 1,495. The market breadth turned negative with 180 declining stocks against 141 gainers, indicating profit-taking in small-cap stocks.

In the real estate sector, residential stocks witnessed notable corrections, including DIG, PDR, CEO, and NLG, while the Vingroup stocks continued their downward trend with VIC falling by 1.42% and VHM by 0.11%. However, some stocks remained resilient, such as NVL, which climbed by 3.6%, VRE with a 1.25% gain, and KDH, which rose by 1.09% due to positive business prospects for the second quarter and the full year 2025.

The banking sector mirrored this performance, with CTG leading the decline at 3.49% and BID falling by 1.72%. Conversely, smaller bank stocks attracted buying interest, with NVB surging to its daily limit and HDB and SHB posting gains of 2.08% and 1.16%, respectively.

Securities stocks faced intense profit-taking pressure, with most of them witnessing substantial declines, although not as significant as their recent explosive gains. SHS led the drop with a 6.52% fall, followed by MBS at -3.3%, VND at -2.2%, SSI at -2.92%, and VIX at -3.66%. A surprising turnaround was seen in information technology stocks, which rebounded with FPT taking the lead, surging by 2.98%. Transport, energy, steel, and metal stocks are gradually attracting capital inflows after being neglected for a while.

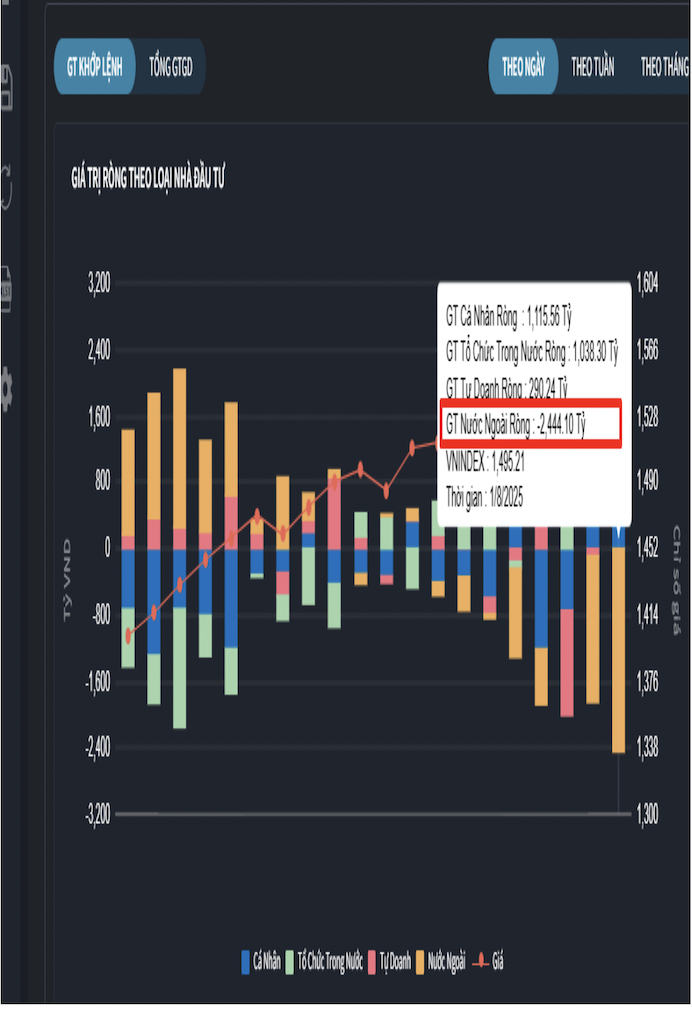

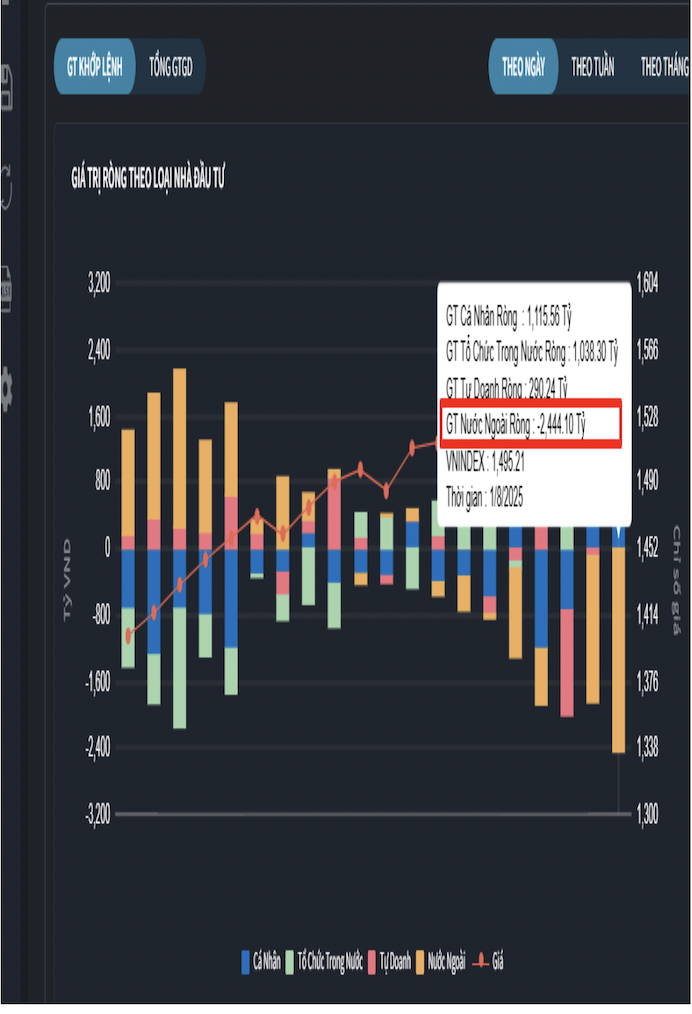

The combined trading volume of the three exchanges remained high at VND46.1 trillion, reflecting robust investor sentiment despite foreign investors’ net selling of VND2,488.5 billion. Specifically, in terms of matched orders, they net sold VND2,444.1 billion.

Foreign investors’ net buying on a matched order basis was focused on the Media and Healthcare sectors. The top stocks they net bought were SHB, NVL, HAH, VIX, NLG, VND, HDB, HDC, and VGC. On the selling side, their net selling was concentrated in the Banking sector, with top stocks including SSI, CTG, FPT, HPG, VHM, GMD, VSC, GEX, and BID.

Individual investors net bought VND2,072.9 billion, of which VND1,115.6 billion was on a matched order basis. In terms of matched orders, they net bought 14 out of 18 sectors, mainly in the Real Estate sector. Their top net bought stocks included SSI, HPG, VHM, CTG, VIB, FPT, GMD, MSB, VCG, and STB.

On the net selling side, they sold 4 out of 18 sectors, mainly in the Personal & Household Goods and Media sectors. The top net sold stocks were SHB, VIX, CII, VPB, HAH, VND, VCI, TPB, and VPI.

Proprietary trading accounts net bought VND360.5 billion, of which VND290.2 billion was on a matched order basis. In terms of matched orders, they net bought 9 out of 18 sectors, with the strongest purchases in the Banking and Financial Services sectors. The top net bought stocks by proprietary trading accounts today were VPB, PNJ, FUEVFVND, FPT, TPB, HDB, GEX, STB, CTG, and DGC.

The top net sold sector was Food & Beverage. The top net sold stocks included VIB, MWG, BSR, NVL, HAH, PVT, VNM, VHC, VHM, and PAC.

Domestic institutional investors net sold VND128.6 billion, but on a matched order basis, they net bought VND1,038.3 billion. In terms of matched orders, domestic institutions net sold 6 out of 18 sectors, with the largest value in the Real Estate sector. The top net sold stocks were NVL, VHM, NLG, MSB, HDB, VTP, DXG, VGC, EVF, and EIB. On the buying side, their largest net buying was in the Financial Services sector, with top stocks including CTG, SSI, FPT, VSC, VCI, VIB, GEX, MWG, STB, and VNM.

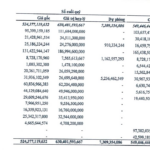

Today’s matched order trading value reached VND5,256.8 billion, up 208.1% compared to the previous session, contributing 11.2% of the total trading value. Notably, there was a significant transaction in VJC, with over 5 million shares worth VND630.3 billion traded as a domestic institution sold to an individual investor.

The money flow allocation ratio increased in Securities, Construction, Software, Warehousing, and Water Transport sectors, while it decreased in Real Estate, Banking, Steel, Food, Agro-Forestry-Fishery, and Automobile Production sectors. Specifically, in terms of matched orders, the money flow allocation ratio increased in the mid-cap VNMID and small-cap VNSML groups but decreased in the large-cap VN30 group.

The July Record of VN-Index: Retail Investors Cash Out with 11,000 Billion Profit

Individual investors recorded a net sell-off of VND 7,324.1 billion, including a substantial VND 11,260.5 billion sold through matched orders in the past July.

“Blue-Chip Stocks Surge: VN-Index Recaptures the 1,500-Point Milestone”

Despite a significant decline in liquidity, today’s session witnessed an exuberant market performance. The largest blue-chip stocks witnessed a robust surge, propelling the VN-Index not only to reclaim the 1500-point mark lost last week but also to surpass 1528.19 points, reigniting hopes of testing the historical peak once again.

The Flow of Capital: The Rhythm of Adjustment Endures

The market has experienced its most significant correction since the April lows, following a remarkable 42% surge in the VN-Index. The abrupt 4.1% decline on July 29, accompanied by record-breaking trading volumes, signaled the conclusion of a short-term cycle. It’s essential for the market to cool off and consolidate before embarking on the next upward trajectory.

“Foreigners net-sell $10 billion, mostly in matched deals.”

Today, foreign investors net-sold $4.3 million, with gross selling of $43.5 million and gross buying of $39.2 million. On the matching side, they net-sold $11.6 million.