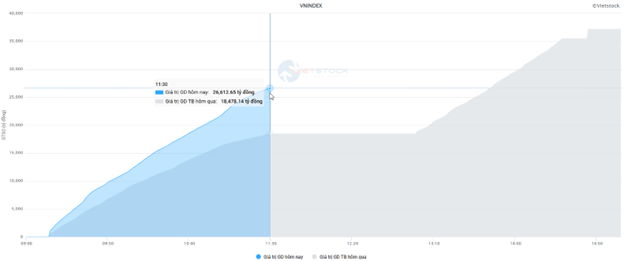

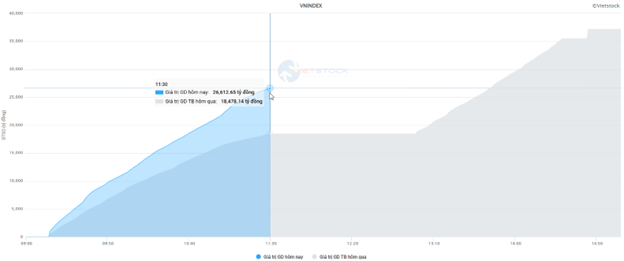

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 1.74 billion shares, equivalent to a value of more than 42.9 trillion VND; HNX-Index reached over 194 million shares, equivalent to a value of more than 3.9 trillion VND.

VN-Index opened the afternoon session positively as buying power continuously overwhelmed selling pressure, causing the index to surge. Although sellers reappeared, the VN-Index only experienced slight fluctuations and closed in optimistic green. In terms of impact, VPB, VHM, VCB, and VIC were the most positive influences on the VN-Index, contributing 6.7 points. On the other hand, VRE, PLX, FRT, and BMP were still under selling pressure, but their impact was not significant.

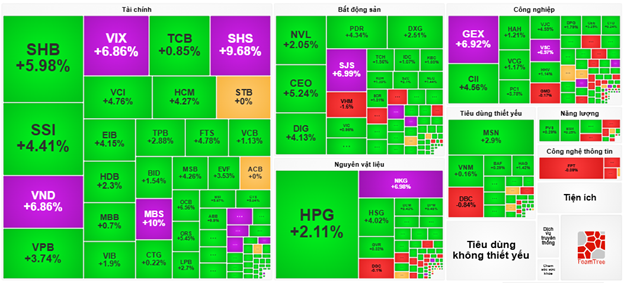

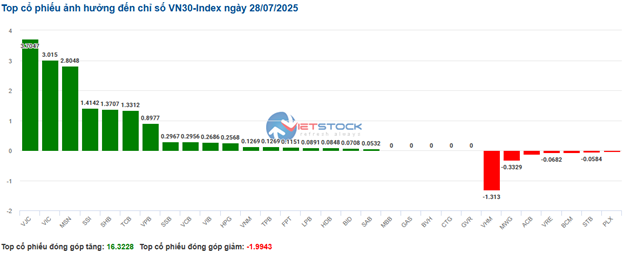

| Top 10 stocks with the most significant impact on the VN-Index on July 28, 2025 (in points) |

Similarly, the HNX-Index also witnessed a positive performance, influenced by the gains in MBS (+10%), SHS (+9.68%), CEO (+9.61%), and BAB (+9.45%)…

|

Source: VietstockFinance

|

The market rose with green dominating most industry groups. The financial sector led the market with a 2.47% gain, mainly driven by VCB (+1.29%), BID (+1.42%), TCB (+1.14%), and VPB (+4.37%). The recovery was followed by the industrial and real estate sectors, with increases of 1.85% and 1.84%, respectively. On the other hand, the energy and healthcare sectors were the only two groups that recorded losses, with decreases of 0.12% and 0.01%, respectively, mainly due to PVS (-0.29%), PVT (-0.27%), PLX (-0.66%), DHT (-1.91%), DVN (-0.43%), and DCL (-0.22%).

In terms of foreign trading, they continued to sell a net amount of more than 1,078 billion VND on the HOSE exchange, focusing on HPG (417.73 billion VND), FPT (149.73 billion VND), GVR (106 billion VND), and VIX (104.85 billion VND). On the HNX exchange, foreigners bought a net amount of more than 107 billion VND, focusing on SHS (53.37 billion VND), MBS (45.1 billion VND), LAS (7.74 billion VND), and VGS (5.05 billion VND).

| Foreign Trading Buy-Sell Dynamics |

Morning Session: Maintaining Broad-Based Gains

The market maintained its upward momentum until the end of the morning session. At the midday break, the VN-Index rose nearly 19 points (+1.24%), reaching 1,550.06 points; the HNX-Index also surged 2.77%, reaching 261.6 points. The market breadth was positive, with 475 gainers, 47 losers, and 836 unchanged stocks.

Increased trading in large-cap stocks improved market liquidity compared to the previous week. The value of HOSE this morning reached over 26 trillion VND, up 44% from the previous session. HNX also recorded a volume of 124 million units, equivalent to 2.5 trillion VND.

Thus, the market not only grew strongly in terms of index points but also witnessed a significant breakthrough in liquidity.

Source: VietstockFinance

|

Banking stocks accounted for 7 out of the top 10 stocks with the most positive contributions to the VN-Index, with VPB and VCB being the main pillars, contributing more than 3 points to the index’s gain. Following were HPG, VIC, and BID, which added nearly 3 points to the overall index. In contrast, VHM exerted the most significant negative pressure, taking away 1.4 points from the index.

Considering industry groups, green dominated most stock sectors. The financial sector temporarily led the market in the morning session, with strong performances from stocks such as VCB (+1.13%), BID (+1.54%), VPB (+3.74%), HDB (+2.3%), SSI (+4.41%), along with many stocks hitting the ceiling price, including VIX, VND, MBS, SHS, VAB, AGR, and SBS. The media and communications sector followed suit, with notable performances from VGI (+2.09%), FOX (+1.23%), FOC (+1.16%), and ICT (+2.26%).

Additionally, the real estate, materials, and industrial sectors also traded positively as buying interest concentrated on stocks like SJS, ACG, TIG, NKG, GEX, VSC (hitting the ceiling price), NVL (+2.05%), CEO (+5.24%), DIG (+4.13%), HPG (+2.11%), HSG (+4.02%), CII (+4.56%), PC1 (+3.78%), and VJC (+4.59%).

On the other hand, the information technology sector continued to struggle as selling pressure dominated the large-cap stocks in the industry, including FPT (-0.09%), CMG (-0.35%), and ELC (-0.83%).

Source: VietstockFinance

|

Foreigners continued to be net sellers, offloading a total of 686 billion VND across the three exchanges. The selling pressure was concentrated in HPG, with a net sell value of 294.49 billion VND, far exceeding the net sell value of other stocks. In contrast, SHB led the net buy list with a value of 223.86 billion VND.

| Top 10 stocks bought and sold by foreigners in the morning session of July 28, 2025 |

10:30 AM: Securities stocks hit ceiling prices, VN-Index remains positive

As of 10:30 AM, the market continued to be dominated by green, with the VN-Index gaining over 14 points and trading at 1,545 points. The HNX-Index rose over 6.3 points to 260 points. The positive contributions to the market’s upward momentum came mainly from the financial, real estate, and industrial sectors.

The breadth within the VN30-Index basket was somewhat mixed. Notably, on the positive side, VJC, VIC, MSN, and SSI contributed 3.7 points, 3 points, 2.8 points, and 1.4 points to the VN30 index, respectively. Conversely, only a few stocks, including VHM, MWG, ACB, and VRE, faced selling pressure, resulting in a loss of more than 1.8 points from the overall index.

Source: VietstockFinance

|

The financial sector continued to attract investment interest, with most stocks in this group posting strong gains. Notably, VIX (+6.86%), SSI (+4.71%), SHS (+9.68%), VND (+6.86%), HCM (+5.63%), VCI (+6.74%), and MBS (+10%) recorded impressive performances…

Additionally, stocks in the real estate sector also contributed significantly to the index’s gain, including CEO (+6.55%), DIG (+4.36%), PDR (+4.82%), and DXG (+2.51%)…

The industrial sector also witnessed a positive performance, with leading stocks in the industry recording gains. Specifically, VSC hit the ceiling price, followed by CII, GEX, and PC1, which increased by 5.47%, 5.79%, and 4.37%, respectively.

In contrast, the energy sector was the only group that recorded losses, with a somewhat mixed performance and selling pressure slightly outweighing buying interest. In particular, selling pressure was concentrated in PVS, which declined by 0.58%, PVT decreased by 0.53%, PLX fell by 0.39%, and TMB dropped by 0.15%…

Compared to the beginning of the session, buyers continued to dominate the market. There were 434 advancing stocks and 227 declining stocks.

9:30 AM: Green Dominates the Market at the Opening

At the beginning of the July 28 session, as of 9:30 AM, the VN-Index slightly increased by over 9.5 points to 1,540 points. Similarly, the HNX-Index rose by 3.27 points to 257 points. Additionally, the VN30-Index basket also witnessed a dominant green tone, with more than 18 stocks advancing positively.

Green prevailed across all industry groups, indicating a strong and positive market momentum. Notably, the financial and real estate sectors, which have the largest market capitalization, played a leading role in driving the overall market.

Within the financial sector, securities stocks continued to shine as VIX hit the ceiling price, VND rose by 4.02%, SHS climbed by 3.76%, and SSI gained 1.47%… However, the banking group exhibited a slightly mixed performance as green appeared in SHB, which increased by 1.33%, TCB, up by 0.14%, and VIB, rising by 0.82%… Meanwhile, selling pressure persisted in STB, which fell by 0.2%, HDB, down by 0.71%, and ACB, declining by 0.21%…

In the real estate sector, large-cap stocks such as NVL rose by 2.63%, PDR climbed by 2.41%, CEO increased by 3.06%, and DIG advanced by 2.75%…

Moreover, industrial stocks continued to trade stably in positive territory as most stocks maintained their gains. Notably, VSC hit the ceiling price, while GEX and CII rose by 5.42% and 3.04%, respectively…

Market Pulse for July 21: Foreign Investors Turn Net Buyers, VN-Index Hovers Near 1,500 Points

The market closed with the VN-Index down 12.23 points (-0.82%), settling at 1,485.05. The HNX-Index also witnessed a decline of 1.98 points (-0.8%), ending the day at 245.79. The market breadth inclined towards the bears with 435 declining stocks against 331 advancing stocks. Within the VN30 basket, 17 stocks lost ground, 12 advanced, and 1 remained unchanged, reflecting a similar bearish sentiment.

Vietstock Daily: Embracing Challenges, August 1st, 2025

The VN-Index retreated after a volatile session, relinquishing early gains. Despite this pullback, the index remains above the middle Bollinger Band, a critical support level to sustain its upward trajectory. Meanwhile, the Stochastic Oscillator has begun to descend from overbought territory, indicating that the short-term outlook may encounter challenges ahead.

Market Beat: VN-Index Makes a Dramatic U-Turn, Soaring Nearly 9 Points at the Close

The market opened the afternoon session on a shaky note, with the index dropping more than 9 points at one point and flirting with the 1,500-point threshold. However, the latter half of the afternoon painted a different picture, as the index staged a steady recovery, erasing the losses from earlier in the day.

“Market Mayhem: The Wild Ride”

The VN-Index witnessed a volatile session, forming a Doji candlestick pattern, which indicates a tug-of-war between buyers and sellers at higher levels. Trading volume continued to set new records, reflecting the vibrant participation of cash flow. Currently, the Stochastic Oscillator has provided a fresh buy signal, while the MACD is narrowing its gap with the Signal line. If the buy signal is validated in the upcoming sessions, the positive outlook in the short term is likely to prevail.

Market Beat July 29: Profit-taking Pressure Mounts, VN-Index Down 64 Points

The selling pressure intensified during the afternoon session, driving the market deeper into negative territory. The downward trend gained momentum towards the closing bell, with the VN-Index plunging 64 points to close at 1,493.41. The HNX-Index also witnessed a sharp decline, falling over 8 points to end the day at 255.36.