Despite low savings deposit interest rates, the amount of money deposited in banks has increased significantly. Mr. Truong Hoang Tuan, Director of VietABank An Giang, shared his insights with the Finance and Monetary Market Magazine on the reasons behind the continued flow of capital into the banking system and provided predictions for interest rate trends in the upcoming months.

Reporter: People still choose to deposit money in banks despite low short-term interest rates, and although long-term deposits offer higher interest rates, fewer people opt for those options. From your perspective as a commercial bank manager, what are the reasons for this phenomenon?

Mr. Tuan: It’s noteworthy that idle cash flow continues to pour into the banking system in the first half of 2025, despite the low savings interest rates. In the current deposit market, although some joint-stock commercial banks and digital banks have adjusted their interest rates higher than at the beginning of the year, these adjustments are mainly for long-term deposits of 18-24 months. However, most depositors still prefer short-term deposits of 1-6 months, which offer greater flexibility.

In my opinion, this is because the average interest rates for all terms remain positive, exceeding the inflation rate (CPI for the first six months reached 3.27%). As a result, depositors not only preserve the principal value of their money but also earn a real yield. At the same time, trust in monetary policy and the safety associated with traditional savings habits play a dominant role. Even when interest rates do not increase or only increase slightly for long-term deposits, people still proactively deposit money due to a “defensive” mindset and the expectation of using capital for practical needs.

Mr. Truong Hoang Tuan, Director of VietABank An Giang

The State Bank of Vietnam (SBV) also affirmed that “household deposits… are converted into credit to the economy,” indicating that the money is not stagnant in banks but is used to support production and business activities. The continued increase in savings deposits in the banking system also demonstrates the stable and flexible liquidity of the banking system, meeting the needs of both savings and economic transactions.

Reporter: Currently, bank deposits have reached record highs. As a commercial bank executive, what are your thoughts on this matter?

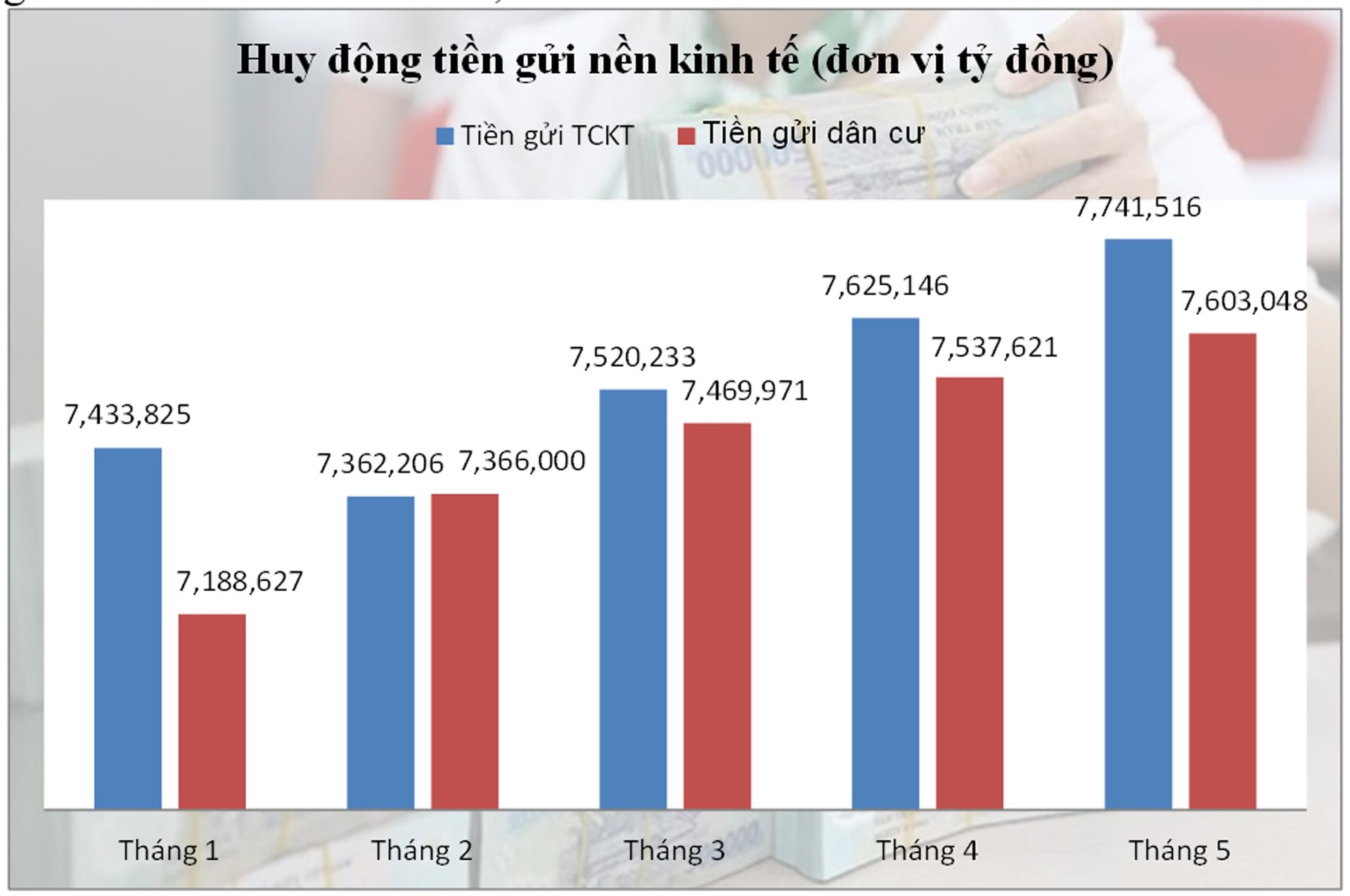

Mr. Tuan: According to data released by the SBV, as of the end of May 2025, deposits from both individual and economic organization customers in credit institutions (CIs) exceeded 15.34 million billion VND, an increase of nearly 1% compared to the previous month. Notably, after a decrease in the first two months of the year, organizational deposits have increased for three consecutive months, although the increase is still very slight. As of the end of May 2025, business deposits reached more than 7.7 million billion VND, an increase of 0.97% compared to the end of 2024.

Household deposits continue to increase significantly (up 7.61% compared to the beginning of the year), reaching more than 7.6 million billion VND at the end of May 2025. In May 2025 alone, household deposits increased by approximately 65,427 billion VND.

From my observations, deposits into banks have continued to increase despite commercial banks’ rush to lower interest rates in May 2025. After a period of banks offering deposit interest rates above 6%/year, higher than the general level for many previous months, this rate has almost “disappeared” since April.

Currently, the market only has a few banks offering interest rates of 6%/year for 12-month terms, with the prevalent rate for this term being 4.5% – 5.5%/year. The group of state-owned banks listed the interest rate for the 12-month term at 4.6% – 4.8%/year.

For the 6-month term, the average interest rate is only 3% – 5%/year. The group of state-owned banks and a few other banks offer around 3%/year, while most units in the market offer 4%/year or higher, with the highest rate being 5%/year.

This shows that, in the past time, the SBV has flexibly operated the open market operation in accordance with the supply and demand situation in the monetary market. The SBV maintains daily offerings of bills with appropriate volumes to meet the capital needs of credit institutions; at the same time, diversifies and extends the maturity of the offerings, contributing to supporting medium and long-term capital sources for the banking system, thereby supporting economic growth and maintaining macroeconomic stability.

In addition, the SBV continues to maintain the operating interest rate level at a low level to orient the reduction of lending interest rates. At the same time, it directs credit institutions to cut operating costs, promote the application of information technology, digital transformation, and implement other solutions to reduce lending interest rates. Thanks to the synchronous implementation of solutions, the lending interest rate continues to decrease. Currently, the average lending interest rate is only 6.23%/year, a decrease of 0.7%/year compared to the end of 2024, thereby supporting businesses and individuals in production and business development.

Reporter: In the context of monetary policy being oriented towards supporting economic recovery, is there a possibility of a significant increase in savings deposit interest rates by the end of this year?

Mr. Tuan: In my opinion, with monetary policy oriented towards supporting economic recovery, the possibility of a significant increase in savings deposit interest rates is not high. Instead, banks may continue to make slight adjustments to long-term terms to restructure their capital sources, but this is unlikely to create a strong attraction without substantial encouraging solutions.

It is predicted that in the second half of the year, savings deposits will continue to increase. However, the rate of increase will depend on the recovery of other investment channels and the development of operating interest rates by the SBV. Interest rate trends from now until the end of 2025 will remain at a reasonably low level, provided that macroeconomic conditions such as inflation, exchange rates, and banking system liquidity remain under control. With the current average lending interest rate at around 6.23%/year, the lowest in many years, the policy space has been exploited quite thoroughly. Therefore, there is limited room for further reduction in the remaining months of the year, and caution is needed as the interest rate differential between USD-VND is narrowing, which can put pressure on exchange rates. In the current phase, interest rate policy needs to be managed towards stability, flexibility, and caution.

According to assessments by international financial institutions, Vietnam’s overall and core inflation remaining below the official target of 4.5% in the first half of 2025 is an important factor in their belief that the SBV will keep the current policy interest rate unchanged, with the refinancing rate maintained at 4.5%.

Reporter: Thank you very much for your valuable insights, Mr. Tuan!

“Vietnam’s Central Bank Meets With Commercial Banks to Discuss Interest Rates”

The State Bank of Vietnam (SBV) has instructed credit institutions to follow the directives of the Government, the Prime Minister, and the SBV itself, with a key focus on maintaining stability in deposit interest rates. Institutions are also encouraged to further reduce operating expenses, embrace digital transformation, and be prepared to share a portion of their profits to lower lending rates.

The Bank’s Endeavor to Lower Interest Rates

The Central Bank, in a bid to heed the Government and Prime Minister’s directive on enhancing measures to reduce interest rates, convened a meeting with the credit institution system on August 4, 2025. The primary focus of this gathering was to discuss strategies for stabilizing deposit rates and reducing lending rates.

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

Stock Market Blog: Bide Your Time

The market witnessed bottom-fishing funds below the 1500-point mark of VNI, marking the third session hovering around this level, albeit with waning momentum. The ability to sustain this level remains uncertain, and liquidity signals are weakening.