Vietcombank Maintains Profit Crown

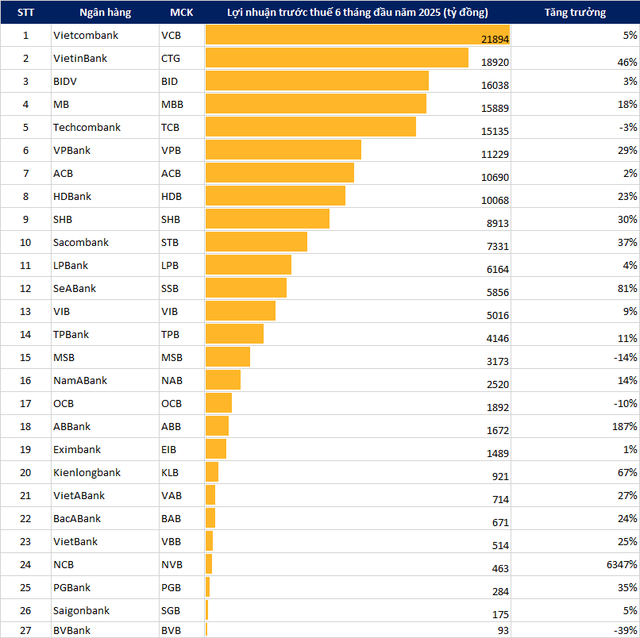

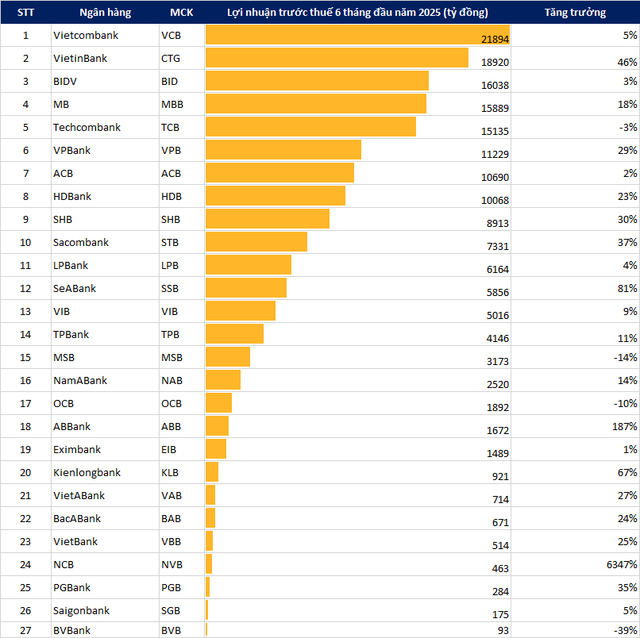

Vietcombank’s pre-tax profit for Q2 2025 reached VND 11,034 billion, a 9.2% increase year-on-year. For the first half of the year, pre-tax profit stood at VND 21,894 billion, a 5.1% increase.

Total operating income for the first six months exceeded VND 35,100 billion, a 3.2% increase. This growth was driven by strong performance in foreign exchange trading and other business activities. Meanwhile, net interest income and service income decreased by 0.5% and 43%, respectively, compared to the previous year.

Although operating expenses grew faster than total operating income, leading to a negative growth in profit from business operations compared to the previous year, Vietcombank still recorded a slight increase in pre-tax profit. This was due to a significant decrease in risk provision expenses, which stood at VND 1,562 billion in the first half of the year, a 48% decrease year-on-year.

HDBank Achieves Record Half-Year Profit

HDBank announced a pre-tax profit of over VND 4,713 billion for Q2 2025 and a record-breaking half-year pre-tax profit of VND 10,068 billion, surpassing the VND 10,000 billion mark.

With these results, HDBank continues to lead the industry in operational efficiency, with a return on equity (ROE) of 26.5% and a high return on assets (ROA) of 2.2%. The non-performing loan ratio, as defined by the State Bank of Vietnam, remained well-controlled at 1.94%. The bank’s capital adequacy ratio (CAR) was above 13% (under Basel II norms)

As of June 30, 2025, HDBank’s total assets exceeded VND 784 trillion, a 12.4% increase from the beginning of the year. Deposits reached VND 664 trillion, a 7% increase, while outstanding loans surpassed VND 517 trillion, an 18.2% increase compared to the beginning of the year, and nearly doubled the industry average growth rate (9.9%). The bank’s lending focused on priority areas such as infrastructure, production, and consumption, which are key drivers of economic growth with low risks.

Sacombank Reports a 36% Increase in Half-Year Profit

Sacombank announced its Q2 2025 financial statements, with a consolidated pre-tax profit of VND 3,657 billion, a 36% increase year-on-year. For the first six months of the year, Sacombank’s pre-tax profit reached VND 7,331 billion, a 37% increase.

The bank’s two largest revenue streams showed positive results compared to the previous year. Net interest income for the first six months of 2025 reached VND 13,448 billion, an 11.45% increase, while net service income reached VND 1,647 billion, a 30.8% increase.

Sacombank’s operating expenses for the first six months of 2025 decreased by 5.53% year-on-year to VND 7,127 billion due to a reduction in personnel.

As of June 30, 2025, Sacombank’s total assets reached VND 807,339 billion, a 7.9% increase from the beginning of the year. Customer loan balance stood at VND 587,960 billion, a 9% increase.

In terms of loan quality, Sacombank’s non-performing loans increased by 11.7% in the first six months to VND 14,472 billion. The non-performing loan ratio also increased from 2.4% to 2.46% during this period.

OCB’s Half-Year Profit Reaches VND 1,892 Billion

OCB announced its Q2 2025 financial statements, with a pre-tax profit of VND 999 billion, an 11.2% increase year-on-year. For the first six months of the year, pre-tax profit stood at VND 1,892 billion, a 10% decrease.

As of June 30, 2025, OCB’s total assets reached VND 308,899 billion, a 10% increase from the beginning of the year. Market 1 lending reached VND 190,789 billion, an 8.4% increase from the end of the previous year, while Market 1 deposits reached VND 153,940 billion, an 8.1% increase.

SeABank’s Half-Year Pre-Tax Profit Reaches VND 5,800 Billion

SeABank’s recently published financial statements show that for the first six months of the year, the bank recorded a pre-tax profit of VND 5,856 billion, an 80.8% increase year-on-year.

As of the end of Q2 2025, the bank’s total assets reached VND 379,087 billion, a 16.4% increase from the end of 2024, equivalent to a net increase of VND 53,388 billion. Customer loan balance as of June 30, 2025, stood at VND 220,571 billion, a 5.4% increase from the beginning of the year. The non-performing loan ratio was 1.95%. Deposits and debt securities reached nearly VND 199,000 billion.

By the end of the first half of 2025, equity reached nearly VND 39,561 billion, an increase of over 13%, equivalent to a net increase of VND 4,558 billion.

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

Sacombank has been recognized by Vietnam Report and VietNamNet Newspaper as one of the Top 10 most reputable commercial banks in Vietnam for 2025. This prestigious accolade further cements Sacombank’s position as a leading private joint-stock commercial bank in the country. Additionally, Sacombank has also made significant strides, climbing into the Top 5 most reputable private banks and securing a spot in the Top 50 public companies for efficiency and reputation (VIX50).

Uncovering the Truth: The HCMC Police’s Verdict on the Money Laundering Case Involving the Owners of Duc Long Jewelry

The Ho Chi Minh City Police have concluded their investigation into a money laundering case involving the owners of Duc Long jewelry store and their employees.

“Celebrating National Pride: SHB’s ‘Happiness is Being Vietnamese’ Campaign”

Celebrating 80 years of the August Revolution (August 19, 1945 – August 19, 2025) and the National Day of the Socialist Republic of Vietnam (September 2, 1945 – September 2, 2025), SHB introduces a series of activities themed “Happiness is Being Vietnamese.” The highlight of these activities is a customer gift set designed to spread happiness and national pride to our customers and the public.