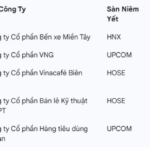

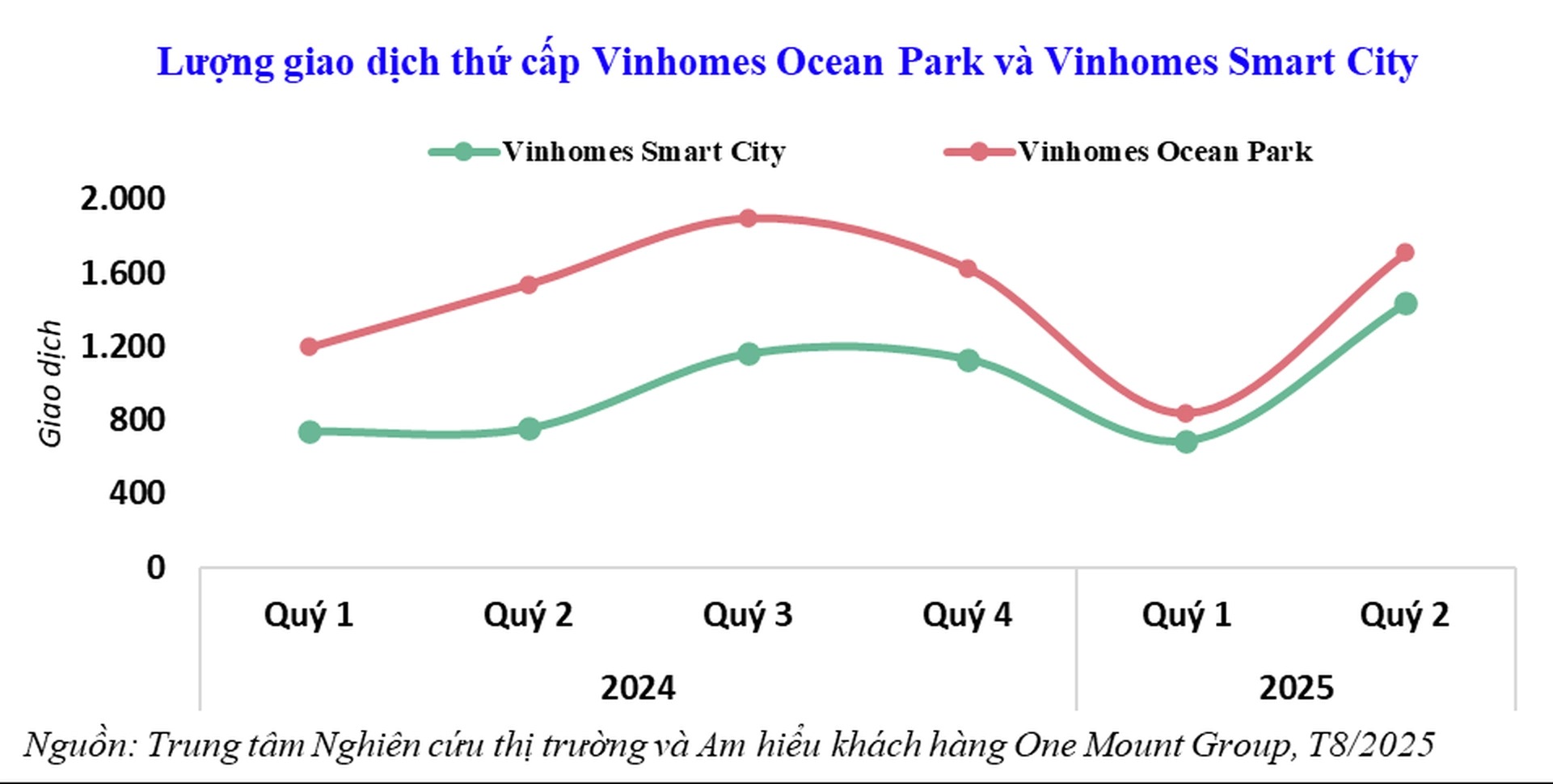

According to market research and customer insights from One Mount Group, the Hanoi high-rise real estate market witnessed a noticeable shift in the second quarter of 2025, as the absence of new mid-range supply persisted for the fifth consecutive quarter. This led to a significant shift in demand towards the secondary market.

Mr. Tran Minh Tien, Director of the Center for Market Research and Customer Insights at One Mount Group, stated that this indicates a new phase of balance between the primary and secondary markets.

According to data from the group, Hanoi recorded approximately 28,900 real estate transactions in Q2 2025, a 56% increase from the previous quarter. Of these, secondary market transactions accounted for 20,400 units, 2.4 times higher than primary market transactions (8,500 units).

High-rise apartments remained the most vibrant segment, with over 17,100 units traded (including both primary and secondary), a 107% increase from the previous quarter. While new primary supply decreased, secondary market transactions increased by 8% year-over-year and a significant 84% quarter-over-quarter, reaching 9,400 units. This surge can be attributed to a diverse range of transferable properties, as well as more affordable prices that align with the payment capabilities of many practical homebuyers.

“This shift is a result of multiple factors, including the absence of mid-range to affordable projects, rising primary market prices, and a more cautious approach from buyers,” said Mr. Tran Minh Tien.

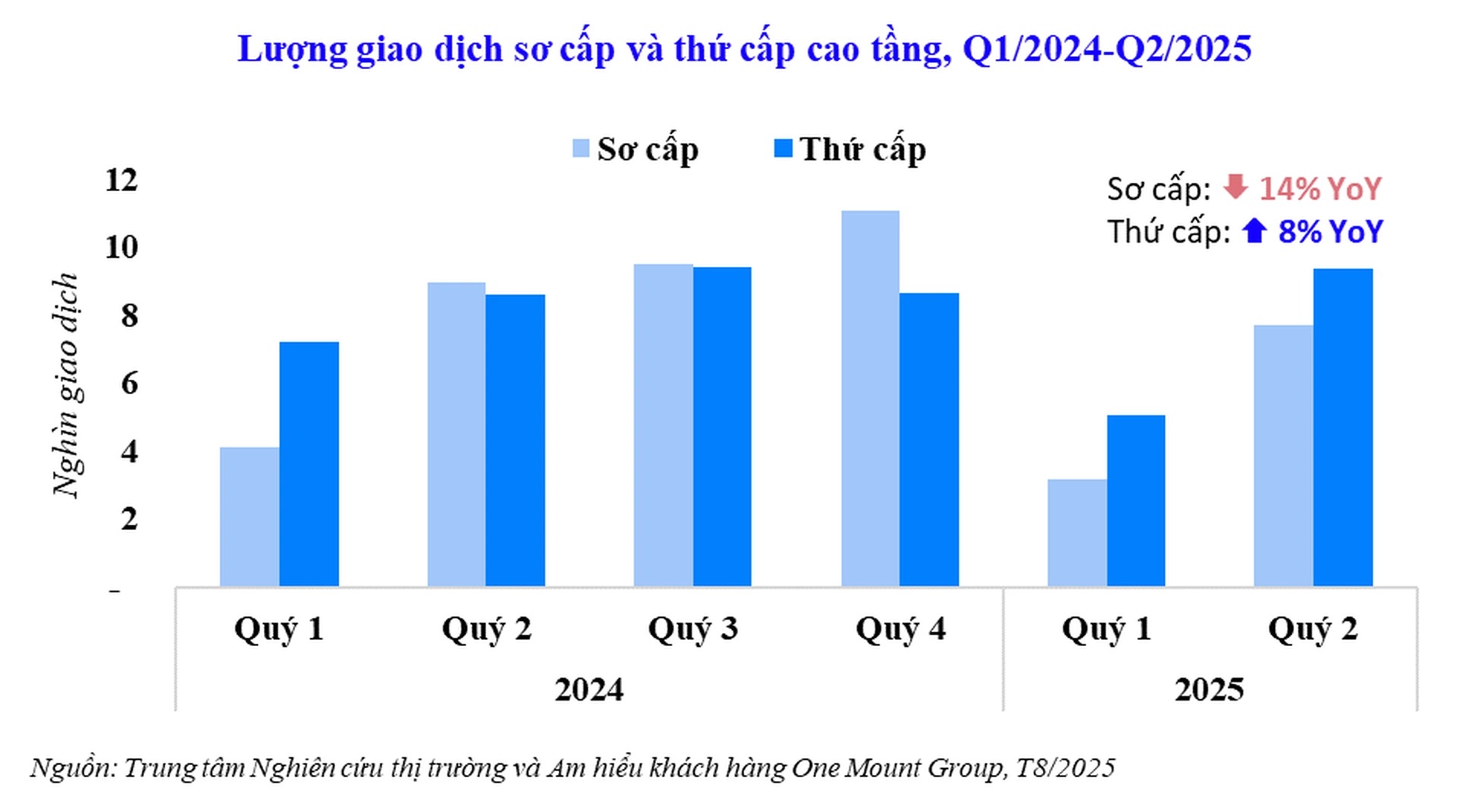

Analyzing by area, the Western region of Hanoi accounted for 50% of secondary market transactions in Q2 2025. This area is home to numerous completed projects, with Vinhomes Smart City standing out due to its abundant transferable properties and secondary market prices that are 30-40% lower than primary market prices in the same area.

In Q2 2025, Vinhomes Smart City recorded nearly 1,500 transactions, a 94% increase from the same period in 2024, partly due to an exceptional number of new deliveries—expected to exceed 3,200 units in 2025, nearly double that of Vinhomes Ocean Park. Meanwhile, Vinhomes Ocean Park maintained stable transaction volumes (up 17% year-over-year).

Notably, the Sapphire subdivision in both projects continues to lead demand, despite secondary market prices approaching those of higher-end subdivisions (Vinhomes Ocean Park: VND 55-60 million/sqm; Vinhomes Smart City: VND 70-75 million/sqm).

According to Mr. Tran Minh Tien, the shift towards the secondary market in Q2 2025 is not merely a temporary reaction to the lack of new mid-range supply, but also underscores the growing importance of the resale market in maintaining liquidity.

Thus, the secondary market is becoming a “release valve,” bringing balance to the market amid a mismatch in primary supply. With the strong recovery in Q2 and a large number of apartments expected to be delivered in the second half of the year, secondary market transactions are anticipated to continue driving the Hanoi real estate market throughout 2025.

The Capital’s Conundrum: Unraveling Hanoi’s Apartment Market Enigma

The latest report from Savills Vietnam reveals that despite a significant surge in the launch and supply of apartments in Hanoi during Q2 2025, prices continue to climb.

The Rise of Low-Rise Real Estate in West Hanoi

With unparalleled advantages in infrastructure, utilities, and development potential, low-rise real estate in the west of Hanoi is the hottest segment in the capital’s market.