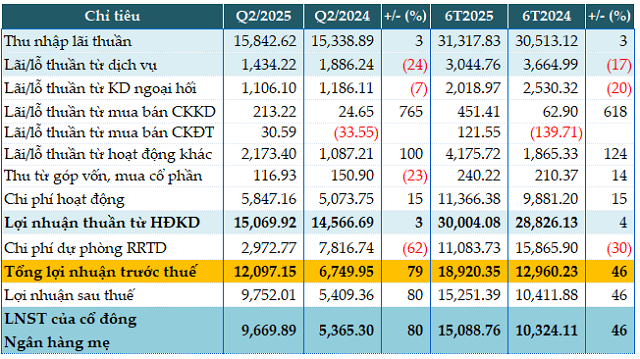

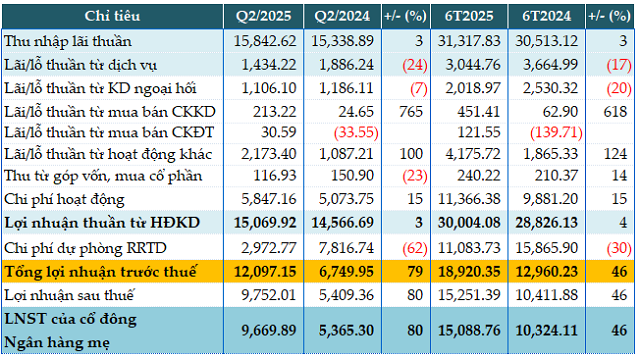

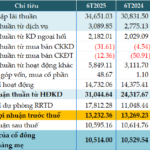

VietinBank’s net interest income for the second quarter reached nearly VND 15,843 billion, a modest 3% increase year-on-year.

There was a divergence in non-credit income sources. Service income decreased by 24%, and foreign exchange trading income fell by 7%. Conversely, proprietary trading income surged to VND 213 billion, compared to just under VND 25 billion in the same period last year. Investment securities trading activities also turned around, posting a profit of VND 31 billion. Other income sources doubled to VND 2,173 billion.

Operating expenses rose by 15% to VND 5,847 billion, resulting in a 3% increase in profit from business operations, totaling VND 15,069 billion.

In the second quarter, the bank significantly reduced its risk provisions by 62%, allocating only VND 2,973 billion. Consequently, pre-tax profit increased substantially by 79%, reaching VND 12,097 billion.

For the first half of the year, VietinBank’s pre-tax profit stood at VND 18,920 billion, a notable 46% increase year-on-year.

|

CTG’s financial results for Q2 and the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

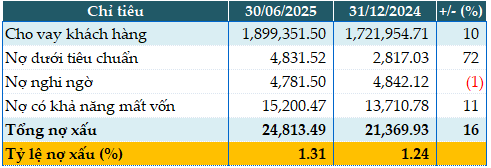

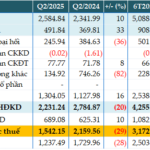

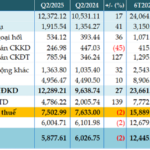

As of the end of the second quarter, total assets increased by 9% from the beginning of the year to over VND 2.6 quadrillion. Customer loans grew by 10% to nearly VND 1.9 quadrillion, while customer deposits rose by 7% to over VND 1.7 quadrillion.

The bank’s total non-performing loans as of June 30, 2025, increased by 16% from the beginning of the year, amounting to over VND 24,813 billion. However, there was an improvement in doubtful debts. As a result, the non-performing loan ratio increased from 1.24% at the beginning of the year to 1.31%.

|

CTG’s loan quality as of June 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

– 08:35, July 31, 2025

Profits Soar and Bad Debt Declines: ABBank’s Impressive First Half of the Year

The recently released Q2 2025 consolidated financial statements reveal that An Binh Joint Stock Commercial Bank (ABBank) posted a remarkable performance with a pre-tax profit of VND 1,257 billion, tripling its figure from the previous year. This outstanding result brings the bank’s half-year pre-tax profit to VND 1,672 billion, achieving 92% of its annual target.

Agribank’s Pre-Tax Profit for H1 2025 Exceeds VND 13,232 Billion, with Improved Non-Performing Loan Ratio

The consolidated financial statements for the first half of 2025 reveal that the Vietnam Bank for Agriculture and Rural Development (Agribank) recorded a pre-tax profit of over VND 13,232 billion for the period, a figure almost identical to the same period last year. Non-performing loans at the end of the second quarter showed improvement compared to the beginning of the year.

Unlocking the Mystery: CASA’s 26.78% Achievement and MSB’s Profit Plunge

The consolidated financial statements of the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) revealed a profit before tax of nearly VND 3,173 billion for the first half of 2025, a 14% decrease compared to the same period last year.

“A Surge in Semiannual Profits: CASA Rises by 37.9%, MB by 18%”

The consolidated financial statements reveal that Military Commercial Joint Stock Bank (MB, HOSE: MBB) recorded a remarkable performance in the first six months of 2025. The bank’s profit before tax stood at VND 15,889 billion, reflecting an impressive 18% year-over-year growth. This outstanding result can be attributed to the robust growth across various revenue streams.

Vingroup’s Unprecedented Wealth: Holding Over 82,000 Billion VND in Cold Hard Cash, Total Assets Nearing the 1,000 Trillion VND Milestone

Vingroup’s total assets have consistently demonstrated resilience, maintaining an upward trajectory since its listing. With its impressive performance, the conglomerate helmed by billionaire Pham Nhat Vuong is poised to become Vietnam’s second non-financial enterprise to surpass the remarkable milestone of 1 million billion dong in assets, hot on the heels of Petrovietnam.