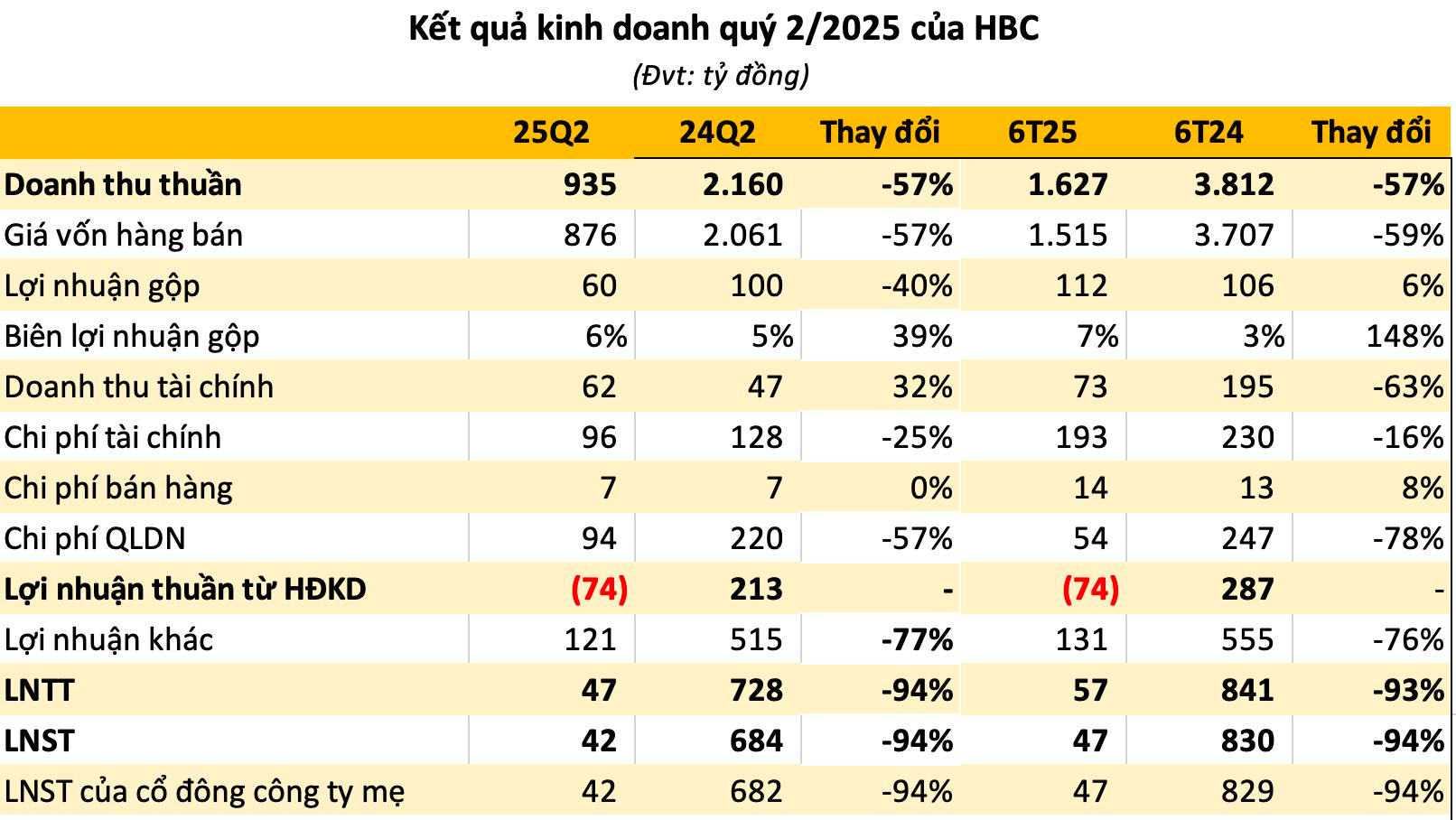

According to HBC’s Q2 2025 financial statements, revenue decreased by 57% compared to the same period last year, reaching VND 935 billion. A more significant reduction in cost of goods sold improved the gross profit margin from 4.6% in Q2 2024 to 6.4% this quarter, resulting in approximately VND 60 billion in gross profit.

Financial income increased by 35% year-over-year to VND 62 billion, of which nearly VND 57 billion came from sales on credit and late payments. Financial expenses amounted to nearly VND 96 billion, with VND 94 billion attributed to interest expenses. Consequently, HBC reported a loss of VND 74 billion from operating activities.

However, the company recognized VND 121 billion from the disposal and sale of fixed assets, resulting in a net profit of VND 42 billion, a significant decline of 94% compared to the VND 684 billion profit in the previous year.

For the first half of 2025, Hoa Binh Construction Group recorded a revenue of VND 1,627 billion and a net profit of VND 47 billion, representing a decrease of 57% and 94%, respectively, compared to the same period last year. These figures account for about 13% of the full-year profit target.

As of June 30, the company’s total assets slightly decreased to VND 15,384 billion. Short-term receivables accounted for the majority of these assets, totaling over VND 10,100 billion. Inventory increased by VND 439 billion from the beginning of the year to VND 2,850 billion.

Total liabilities at the end of the quarter were eight times the equity, amounting to nearly VND 13,600 billion. Financial debt stood at approximately VND 4,146 billion, a reduction of VND 205 billion from the beginning of the year, mainly consisting of short-term debt.

Hoa Binh Construction Group still has accumulated losses of nearly VND 2,254 billion, equivalent to 65% of its charter capital.

The Green Airport: CEO Group’s Profitable Venture into Industrial Park Development

“CEO Group reports a doubling of profits for the second quarter of 2025, attributed to successful cost-cutting measures. The Group’s quarterly profits soared to 39 billion VND. During this period, CEO Group also invested 50.5 billion VND in its newly established subsidiary, which has a charter capital of 450 billion VND.”

The Bank Stock Surprise: A Rush to Invest Before the Imminent August Cash Dividend Payout

The stock market is buzzing with excitement as share prices soar to new heights. Investors are eagerly snapping up stocks, with buy orders piling up at the ceiling price. It’s a thrilling spectacle, witnessing the fervent demand driving shares skyward.

Profiting from the Rise in Oil Prices: PV OIL’s Quarterly Earnings Double

“PV OIL (UPCoM: OIL) witnessed a positive trend in the second quarter of 2025 with domestic base prices on an upward trajectory, a stark contrast to the downward trend experienced in the same quarter of 2024. This shift has resulted in a significant boost to the company’s financial performance for the current quarter compared to the previous year.”