The VN-Index witnessed a dramatic trading session, surging to a historic high of 1,584.98 points, up nearly 57 points, before briefly dipping into negative territory.

However, a strong influx of capital towards the end of the session propelled the VN-Index to close at 1,547.15 points on August 5, an increase of almost 19 points. The HoSE matching value reached a record high of VND69,600 billion.

Despite the overall market’s positive performance, foreign transactions remained a detractor, with significant net selling of VND2,259 billion across all three exchanges. Details are as follows:

HoSE: Foreigners net sell nearly VND2,524 billion

In terms of net buying, HPG witnessed the strongest demand from foreign investors, with a net buy value of approximately VND1,080 billion. BID and MSN also attracted robust net buying, with each recording net purchases of VND141 billion. Additionally, MWG and VCB witnessed net buying ranging from VND129 billion to VND137 billion.

Conversely, VIC experienced a sudden surge in net selling, with a net sell value of VND2,891 billion, mainly through negotiated trades. SHB and VPB, two banking stocks, also witnessed substantial net selling, ranging from VND199 billion to VND227 billion. Blue-chip stocks VHM and FPT were net sold at VND153 billion and VND147 billion, respectively.

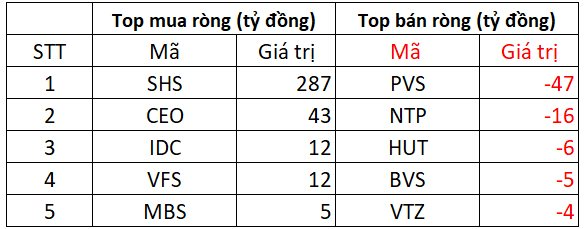

On the HNX, foreigners net bought approximately VND281 billion

SHS witnessed the strongest net buying on the HNX, with a net buy value of VND287 billion. CEO, IDC, and VFS also attracted net buying, ranging from VND12 billion to VND43 billion. MBS saw a slight net buy of VND5 billion.

On the opposite side, PVS and NTP faced net selling on the HNX, with values ranging from VND16 billion to VND47 billion. Additionally, HUT, BVS, and VTZ experienced net selling between VND4 billion and VND6 billion.

On UPCOM, foreigners net sold approximately VND16 billion

In terms of net buying, MPC attracted net purchases of around VND15 billion. QNS, SGP, and HNG followed with net buying of VND2 billion, VND1 billion, and VND1 billion, respectively. HBC also witnessed slight net buying on UPCOM during this session.

Conversely, MCH experienced robust net selling of VND28 billion. ACV and VEA faced net selling of VND4-5 billion, while CLX and RIC were net sold in the range of a few hundred million to VND1 billion.

The Youngest Chairman on the Vietnamese Stock Exchange: A Tale of Success and Ambition

Introducing the youngest chairman on the Vietnamese stock exchange. While wealth is not the sole measure of success, this individual’s achievements are undoubtedly impressive. With a sharp mind and a knack for leadership, they have risen through the ranks to become a prominent figure in the financial world. Their story serves as an inspiration to all, proving that age is just a number when it comes to pursuing your dreams.

Asset Management Strategies for Navigating Peak Margin Debt Waters

The Vietnamese stock market has been on a record-breaking rally, with margin lending at brokerage firms also reaching unprecedented heights. As the market enters a correction phase, this has resulted in forced selling as investors scramble to meet margin calls.