Mr. Le Duc Khanh shares insights on the stock market’s performance and future prospects.

Journalist Khánh Ly: As we approach the halfway mark of 2025, what are your thoughts on the stock market’s performance so far this year?

Mr. Le Duc Khanh, Director of Analysis at VPS Securities Joint Stock Company: The first half of 2025 witnessed a remarkable recovery and breakthrough in the Vietnamese stock market. Despite international fluctuations, such as the US tariff policies, which caused significant adjustments in the VN-Index from the 1,340-point region to a low of 1,073 points, the domestic market demonstrated resilience and quickly rebounded. The VN-Index has officially surpassed the strong resistance zone of 1,350 – 1,355 points, setting a new three-year high and gradually advancing towards higher targets, such as the 1,380 – 1,400-point region in the third quarter. This reflects a significant improvement in investor confidence, especially with sustained high liquidity in the market.

One of the highlights of the first half was the strong differentiation among sectors, which simultaneously opened up numerous investment opportunities as many stock groups entered a new growth cycle. Positive-performing sectors included ports, real estate, agriculture, and finance – areas that benefited from supportive macro policies, improved cash flow, and expectations of an economic recovery. Moreover, the strong return of domestic investment capital, particularly from individual and institutional investors, also contributed significantly to the overall index’s upward momentum.

Overall, the first six months of 2025 witnessed a market that not only flourished in terms of points but also displayed positive shifts in investor sentiment and cash flow quality, paving the way for a more sustainable growth cycle in the latter half.

Mr. Le Duc Khanh provides insights into the economy and corporate performance.

Despite the challenges, the economy has maintained positive growth in the first two quarters. How do you assess the performance of businesses in the first half of this year? Can we expect positive results, in your opinion?

In the context of Vietnam’s stable economic growth in the first half of 2025, the performance of listed companies is considered quite positive and clearly differentiated across sectors. Although GDP growth has not entirely met expectations, the government’s flexible policies, especially those supporting public investment, boosting consumption, and improving the business environment, have laid a solid foundation for the production and business activities of enterprises.

Notably, foreign direct investment (FDI) continued to grow, particularly in high-tech industries, manufacturing, energy, and infrastructure. This reflects international investors’ confidence in Vietnam’s mid-to-long-term prospects.

Regarding sectors, those directly benefiting from policies and global trends include technology, AI, digital transformation, renewable energy, infrastructure, finance – insurance, logistics, and retail. These sectors witnessed improvements in both revenue and profits during the first half. Meanwhile, the real estate industry, which has faced pressures recently, is showing signs of recovery in certain segments, such as social housing, industrial real estate, and financially healthy enterprises.

Overall, the first half of 2025 marks a period of rejuvenation for businesses after a challenging time, with positive signals in their internal operations, policy environments, and investment capital. This lays an essential foundation for the business community to accelerate in the latter half.

What are your predictions for the macroeconomic landscape in the remaining quarters of 2025?

In the second half of 2025, the Vietnamese economy is expected to continue its robust recovery, supported by both domestic and international factors. Globally, uncertainties that once caused significant fluctuations in financial and commodity markets, such as the Middle East conflict and US-China trade tensions, are gradually easing. Additionally, the possibility of the US Federal Reserve lowering interest rates in the fourth quarter of 2025 is a very positive signal for global financial markets and will help reduce pressure on exchange rates and interest rates in Vietnam.

Domestically, 2025 is a pivotal year in the medium-term public investment plan for 2021–2025, with a total disbursed capital of VND 791 trillion. The government is focusing on implementing key infrastructure projects, such as the North-South Expressway and inter-regional highways, as well as programs for developing new-generation energy sources. The 2% VAT reduction policy, extended until the end of 2026, continues to play a crucial role in boosting domestic consumption and reducing operating costs for businesses. Furthermore, the adjustment of administrative units at the commune level from July 1, 2025, carries not only administrative significance but also contributes to improving state management efficiency and accelerating local public investment disbursement, which is essential for promoting substantive growth.

With these factors in play, Vietnam’s macroeconomic landscape in the last six months of 2025 has a solid foundation to maintain its recovery trajectory and even set the stage for a new growth cycle in 2026.

Mr. Le Duc Khanh offers insights into the stock market’s outlook for the second half of 2025.

Based on your analysis, how do you foresee the stock market performing in the latter half of 2025?

Given the positive macroeconomic backdrop, the Vietnamese stock market is predicted to maintain its upward trajectory and expand its growth potential in the coming months. After surpassing the 1,350-point mark, the VN Index is on its way towards higher targets, specifically the 1,400 – 1,450-point region.

Factors supporting this trend include the prospects of an upgrade from a frontier to an emerging market, improved economic growth, positive developments in US-Vietnam trade negotiations, and expectations of monetary policy easing from major central banks worldwide. In terms of sectors, those expected to lead the market include finance – securities, insurance, ports – logistics, construction – building materials, chemicals, textiles, and consumer retail. These sectors are benefiting from both macroeconomic tailwinds and strong intrinsic strengths.

The financial sector remains a focal point, benefiting from the recovery of the capital market, strong inflows of capital, and anticipated profit growth in the coming quarters. The ports and logistics sector also deserves attention due to the increasing role of Vietnam in the global trade landscape amid supply chain shifts. Overall, the stock market in the latter half is poised for further growth, but sector and stock differentiation will become more pronounced, requiring investors to adopt a selective and risk-managed investment strategy.

What investment strategies would you recommend for the remaining six months of 2025?

With the market presenting many favorable factors, investment strategies for the last six months of 2025 should be built on the principles of flexibility and a combination of value and growth investing. For long-term investors, it is advisable to prioritize accumulating stocks with solid fundamentals and valuations that are still attractive compared to their long-term growth potential. Sectors supported by macroeconomic policies, such as infrastructure, finance, technology, and consumer goods, are worth considering.

At the same time, investors should be prepared to restructure their portfolios when the market experiences strong upward movements to optimize their holdings and manage risks. In the short term, opportunities will arise from liquid stocks that exhibit price surges due to positive earnings reports, supportive news, or returning cash flows. Stocks in the financial, securities, construction materials, chemicals, and textiles sectors, or those showing positive shifts in production and business operations, should be monitored. Moreover, investors need to adhere to risk management principles, avoiding chasing stocks when the market becomes overheated. It is best to implement a staggered investment strategy, closely monitoring adjustment rhythms to optimize purchase timing. In a differentiated market, stock selection capabilities and trading discipline will be the keys to success in the latter half of 2025.

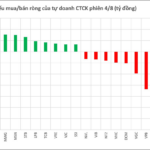

The Two Stock Symbols Unexpectedly Sold Off by Proprietary Trading Firms in Monday’s Session

The HoSE witnessed a significant development as proprietary securities firms offloaded stocks en masse, resulting in a staggering net sell value of VND 296 billion.

The Youngest Chairman on the Vietnamese Stock Exchange: A Tale of Success and Ambition

Introducing the youngest chairman on the Vietnamese stock exchange. While wealth is not the sole measure of success, this individual’s achievements are undoubtedly impressive. With a sharp mind and a knack for leadership, they have risen through the ranks to become a prominent figure in the financial world. Their story serves as an inspiration to all, proving that age is just a number when it comes to pursuing your dreams.

The Stock Market is Smashing Records: Investors Rush to Open New Accounts

As of July 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). With almost 10.5 million accounts, the market experienced a substantial increase of 226.3 thousand accounts since June and an impressive year-to-date growth of nearly 1.2 million accounts.

What Fueled the Banking Stock Boom that Took VN-Index to New Heights?

As of August 5th, bank stocks surged for the second consecutive session, propelling the index to a record high of 1570 points. However, a closer look at the statistics reveals that the group’s profits are lagging compared to the broader market.