|

PLX’s Business Targets in Q2 2025

Source: VietstockFinance

|

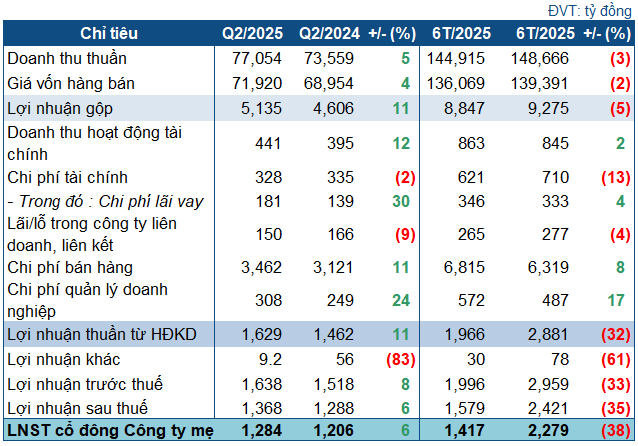

In the second quarter, the oil and gas giant generated over 77 trillion VND in net revenue, a 5% increase year-over-year. A 4% rise in cost of goods sold resulted in a gross profit of more than 5.1 trillion VND, up 11%.

Financial income increased by 12% to 441 billion VND (mainly from interest income). Financial expenses decreased by 2%, but interest expenses surged by 30% to 181 billion VND. Selling expenses climbed to nearly 3.5 trillion VND, as did administrative expenses, which rose 24% to over 308 billion VND.

Despite an 83% plunge in other income to just 9.2 billion VND, PLX still posted a net profit of nearly 1.3 trillion VND, up 6% from the previous year. This was also the company’s most profitable quarter since Q2 2021 (with a profit of over 1.4 trillion VND). The company attributed the strong results to effective cost control, optimized cost of goods sold, and improved financial performance.

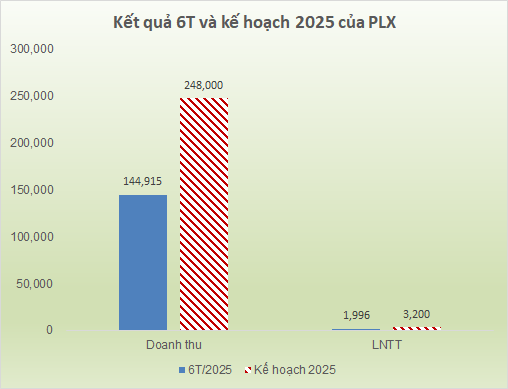

The Q2 results significantly boosted PLX’s cumulative figures for the first half. After a sharp decline in Q1, the company ended the first six months with nearly 145 trillion VND in net revenue, a 3% decrease year-over-year; and a net profit of over 1.4 trillion VND, down 38%. Compared to the targets set at the 2025 Annual General Meeting of Shareholders, the company achieved 58% of the revenue target and 62.4% of the full-year profit before tax goal.

Source: VietstockFinance

|

As of the end of Q2, PLX’s total assets stood at 87.4 trillion VND, a 7.5% increase from the beginning of the year. Of this, nearly 66.3 trillion VND was in current assets, up 11%. Cash and cash equivalents, and deposits reached 32 trillion VND, a 7% rise. Inventories amounted to nearly 16.8 trillion VND, a 7% increase.

On the capital side, short-term borrowings accounted for the majority of the company’s total liabilities, totaling more than 58 trillion VND, a 14% increase. Of this, loans amounted to approximately 20.8 trillion VND, a 20% jump. The current ratio was approximately 1.14, while the quick ratio was 0.85. However, given the fast-turning nature of the company’s inventory (oil and gas), there are no concerns about PLX’s ability to meet its debt obligations as they become due.

– 11:37 04/08/2025

“Ben Thanh TSC Announces 30% Cash Dividend, to be Paid in Two Installments”

Ben Thanh Trading & Services Joint Stock Company (Ben Thanh TSC) has announced a generous cash dividend payout of VND 40.5 billion for the fiscal year 2024, amounting to a 30% dividend ratio. This payout marks the second-highest dividend in the company’s history and is a testament to its strong financial performance and commitment to returning value to shareholders. As the company embarks on a new phase of growth, with plans to reinvest profits into a long-awaited project in the heart of Ho Chi Minh City, this dividend declaration stands as a highlight in the company’s trajectory.

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

Sacombank has been recognized by Vietnam Report and VietNamNet Newspaper as one of the Top 10 most reputable commercial banks in Vietnam for 2025. This prestigious accolade further cements Sacombank’s position as a leading private joint-stock commercial bank in the country. Additionally, Sacombank has also made significant strides, climbing into the Top 5 most reputable private banks and securing a spot in the Top 50 public companies for efficiency and reputation (VIX50).

Unprecedented: Two Vietnamese Banks Reach the 2 Million Billion Dong Deposit Milestone

Customer deposits in the banking system currently exceed 15 trillion dong. Of this, deposits at just these two banks amount to over 4 trillion dong.

KienlongBank Announces Q2 2025 Financial Results: Multiple Business Indicators Achieve Over 90% of Targets

KienlongBank (UPCoM: KLB) has announced its Q2 2025 financial results, boasting impressive performance. The bank’s consolidated pre-tax profit reached VND 565 billion, with key business indicators such as total assets, mobilized capital, and credit outstanding achieving over 90% of the year’s set plan.